Answered step by step

Verified Expert Solution

Question

1 Approved Answer

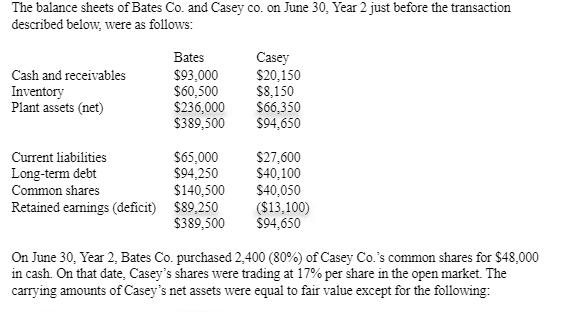

The balance sheets of Bates Co. and Casey co. on June 30, Year 2 just before the transaction described below, were as follows: Bates

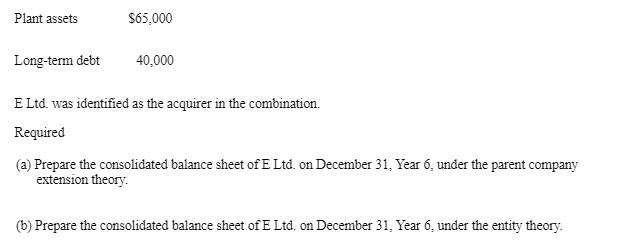

The balance sheets of Bates Co. and Casey co. on June 30, Year 2 just before the transaction described below, were as follows: Bates Cash and receivables Inventory Plant assets (net) $93.000 $60,500 $236,000 $389,500 Casey $20,150 $8,150 S66,350 $94,650 $65,000 $94,250 $140,500 Retained eamings (deficit) $89,250 $389,500 Current liabilities $27,600 $40,100 $40,050 ($13,100) $94,650 Long-term debt Common shares On June 30, Year 2, Bates Co. purchased 2,400 (80%) of Casey Co.'s common shares for $48,000 in cash. On that date, Casey's shares were trading at 17% per share in the open market. The carrying amounts of Casey's net assets were equal to fair value except for the following: Plant assets S65,000 Long-term debt 40,000 E Ltd. was identified as the acquirer in the combination. Required (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the parent company extension theory. (b) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the entity theory.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Part A Parent company extension the ory 1 calculate acquisation d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started