Answered step by step

Verified Expert Solution

Question

1 Approved Answer

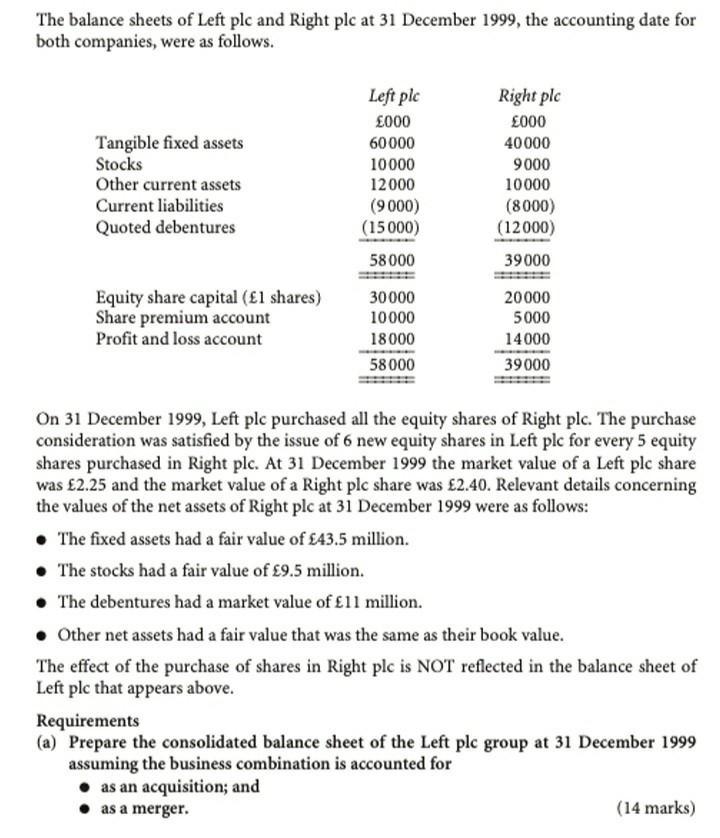

The balance sheets of Left plc and Right plc at 31 December 1999, the accounting date for both companies, were as follows. Tangible fixed

The balance sheets of Left plc and Right plc at 31 December 1999, the accounting date for both companies, were as follows. Tangible fixed assets Stocks Other current assets Current liabilities Quoted debentures Equity share capital (1 shares) Share premium account Profit and loss account Left ple 000 60000 10000 12000 (9000) (15000) 58000 30000 10000 18000 58000 as a merger. Right plc 000 40000 9000 10000 (8000) (12000) 39000 20000 5000 14000 39000 On 31 December 1999, Left plc purchased all the equity shares of Right plc. The purchase consideration was satisfied by the issue of 6 new equity shares in Left plc for every 5 equity shares purchased in Right plc. At 31 December 1999 the market value of a Left plc share was 2.25 and the market value of a Right plc share was 2.40. Relevant details concerning the values of the net assets of Right plc at 31 December 1999 were as follows: The fixed assets had a fair value of 43.5 million. The stocks had a fair value of 9.5 million. The debentures had a market value of 11 million. Other net assets had a fair value that was the same as their book value. The effect of the purchase of shares in Right plc is NOT reflected in the balance sheet of Left plc that appears above. Requirements (a) Prepare the consolidated balance sheet of the Left plc group at 31 December 1999 assuming the business combination is accounted for as an acquisition; and (14 marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Acquisition Accounting Assets Tangible Fixed Assets Stocks Oth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started