Question

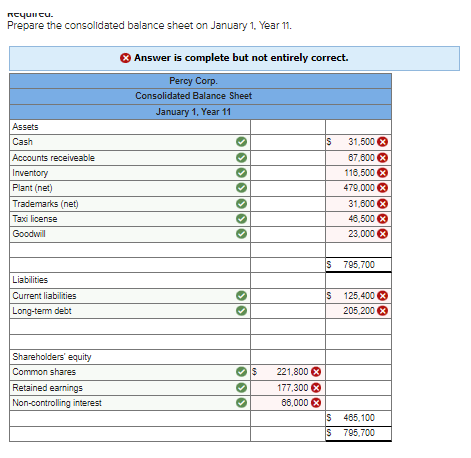

The balance sheets of Percy Corp. and Saltz Ltd. on December 31, Year 10, are shown below: Percy Saltz Cash $ 203,400 $ 4,850 Accounts

The balance sheets of Percy Corp. and Saltz Ltd. on December 31, Year 10, are shown below:

| Percy | Saltz | |||||||

| Cash | $ | 203,400 | $ | 4,850 | ||||

| Accounts receivable | 51,700 | 15,700 | ||||||

| Inventory | 62,550 | 45,400 | ||||||

| Plant | 483,500 | 197,100 | ||||||

| Accumulated amortization | (133,500 | ) | (91,700 | ) | ||||

| Trademarks(net) | 15,700 | |||||||

| $ | 667,650 | $ | 187,050 | |||||

| Current liabilities | $ | 103,400 | $ | 21,700 | ||||

| Long-term debt | 165,100 | 43,400 | ||||||

| Common shares | 221,700 | 61,700 | ||||||

| Retained earnings | 177,450 | 60,250 | ||||||

| $ | 667,650 | $ | 187,050 | |||||

The fair values of the identifiable net assets of Saltz Ltd. on December 31, Year 10, were as follows:

| Cash | $ | 4,850 | |||

| Accounts receivable | 15,700 | ||||

| Inventory | 53,700 | ||||

| Plant | 128,500 | ||||

| Trademarks | 31,400 | ||||

| 234,150 | |||||

| Current liabilities | $ | 21,700 | |||

| Long-term debt | 39,700 | 61,400 | |||

| Net assets | $ | 172,750 | |||

In addition to the assets identified above, Saltz owned a taxi licence in the City of Moose Jaw. This licence expires in nine years. These licences are selling in the open market at approximately $37,250.

On January 1, Year 11, Percy Corp paid $176,000 in cash to acquire 7,000 (70%) of the common shares of Saltz Ltd. Saltzs shares were trading for $21 per share just after the acquisition by Percy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started