Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The balance sheets of Prima Ltd. and Donna Corp. on December 31, Year 5, are shown below: Cash Accounts receivable Inventory Plant Patents Current

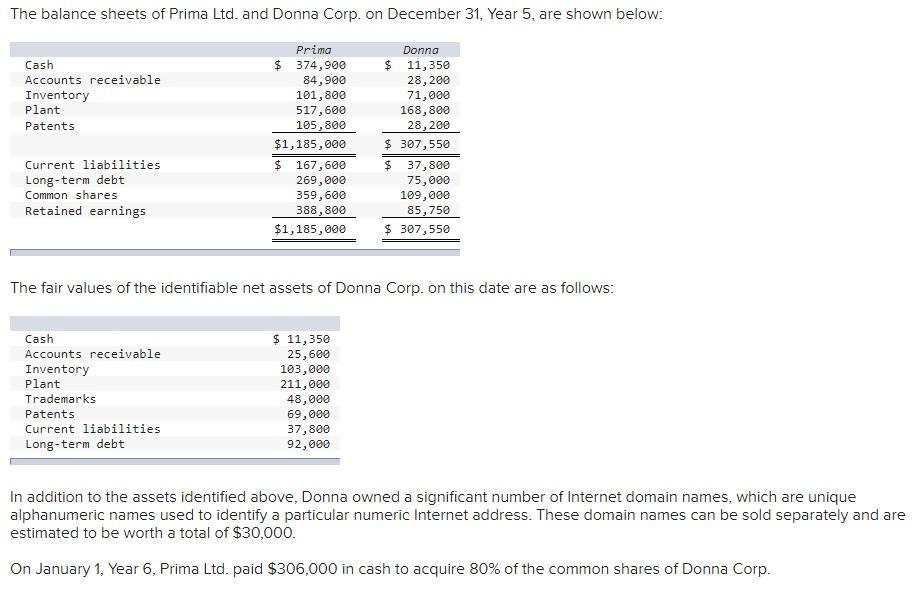

The balance sheets of Prima Ltd. and Donna Corp. on December 31, Year 5, are shown below: Cash Accounts receivable Inventory Plant Patents Current liabilities Long-term debt Common shares Retained earnings Cash Accounts receivable Inventory Plant Prima $ 374,900 84,900 101,800 517,600 105,800 $1,185,000 Trademarks Patents Current liabilities Long-term debt $ 167,600 269,000 359,600 388,800 $1,185,000 The fair values of the identifiable net assets of Donna Corp. on this date are as follows: $ 11,350 25,600 103,000 211,000 48,000 69,000 Donna $ 11,350 28, 200 71,000 168,800 28, 200 37,800 92,000 $ 307,550 $ 37,800 75,000 109,000 85,750 $ 307,550 In addition to the assets identified above, Donna owned a significant number of Internet domain names, which are unique alphanumeric names used to identify a particular numeric Internet address. These domain names can be sold separately and are estimated to be worth a total of $30,000. On January 1, Year 6, Prima Ltd. paid $306,000 in cash to acquire 80% of the common shares of Donna Corp. Required: (a) Prepare the consolidated balance sheet on January 1, Year 6, under the fair value enterprise method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the acquisition of Donna Corp by Prima Ltd we need to determine the purchase price alloca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started