Answered step by step

Verified Expert Solution

Question

1 Approved Answer

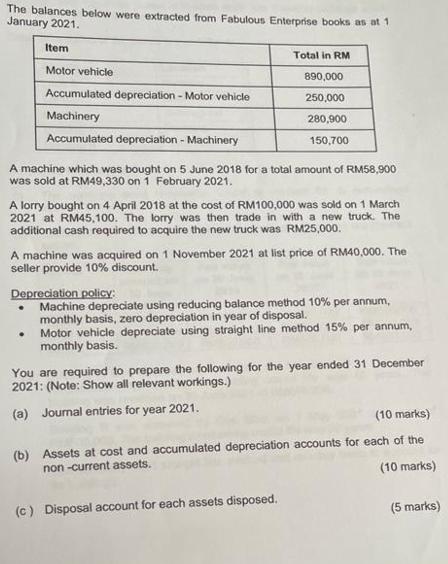

The balances below were extracted from Fabulous Enterprise books as at 1 January 2021. Item Motor vehicle Accumulated depreciation - Motor vehicle Machinery Accumulated

The balances below were extracted from Fabulous Enterprise books as at 1 January 2021. Item Motor vehicle Accumulated depreciation - Motor vehicle Machinery Accumulated depreciation - Machinery Total in RM 890,000 250,000 280,900 150,700 A machine which was bought on 5 June 2018 for a total amount of RM58,900 was sold at RM49,330 on 1 February 2021. A lorry bought on 4 April 2018 at the cost of RM100,000 was sold on 1 March 2021 at RM45,100. The lorry was then trade in with a new truck. The additional cash required to acquire the new truck was RM25,000. A machine was acquired on 1 November 2021 at list price of RM40,000. The seller provide 10% discount. Depreciation policy: Machine depreciate using reducing balance method 10% per annum, monthly basis, zero depreciation in year of disposal. Motor vehicle depreciate using straight line method 15% per annum, monthly basis. You are required to prepare the following for the year ended 31 December 2021: (Note: Show all relevant workings.) (a) Journal entries for year 2021. (10 marks) (b) Assets at cost and accumulated depreciation accounts for each of the non-current assets. (10 marks) (c) Disposal account for each assets disposed. (5 marks)

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

01Feb21 Particulars Machine sold for Less Book Value Purchase Cost Depreciation for 2018 7 months 58...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started