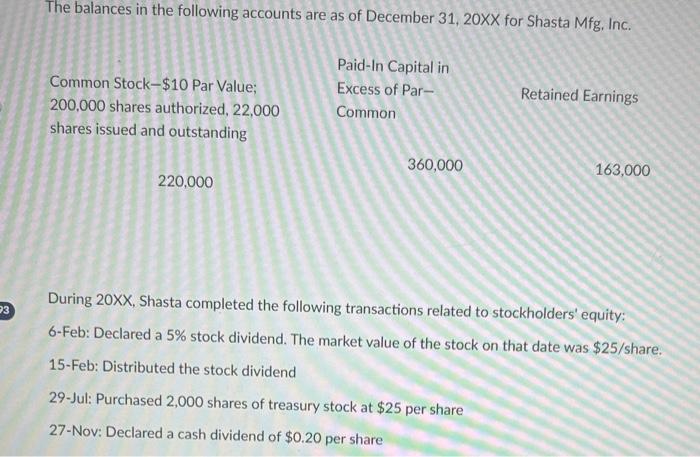

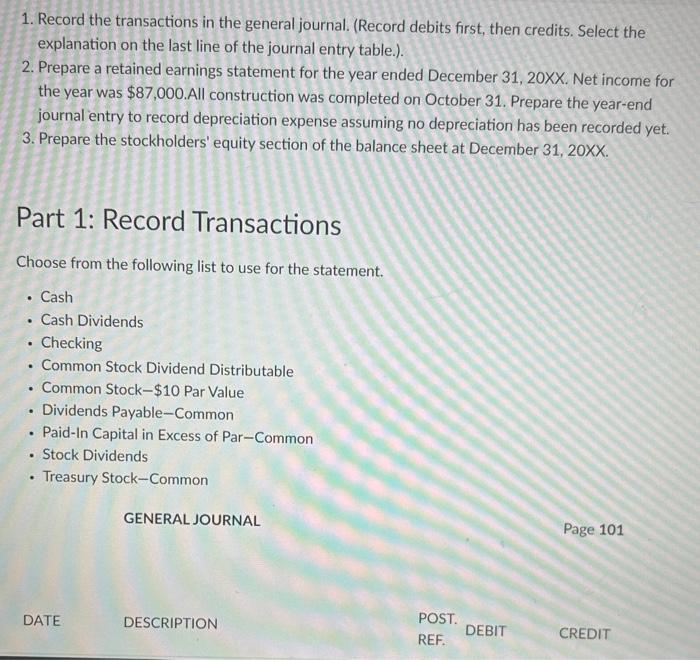

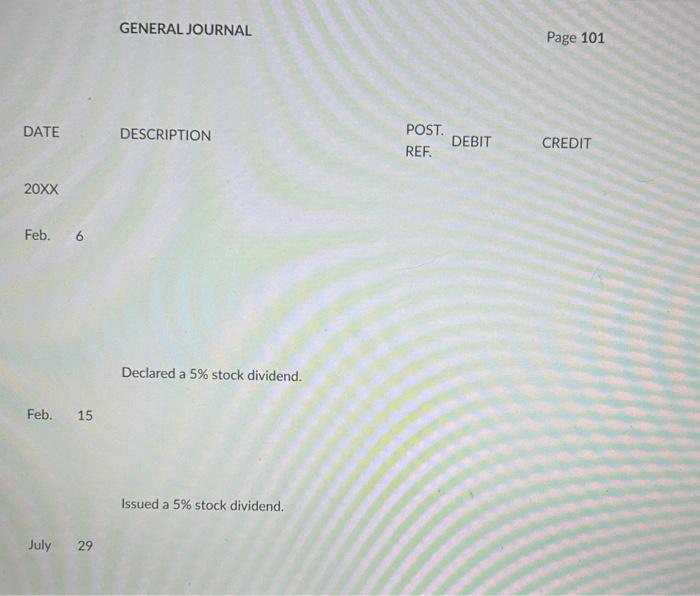

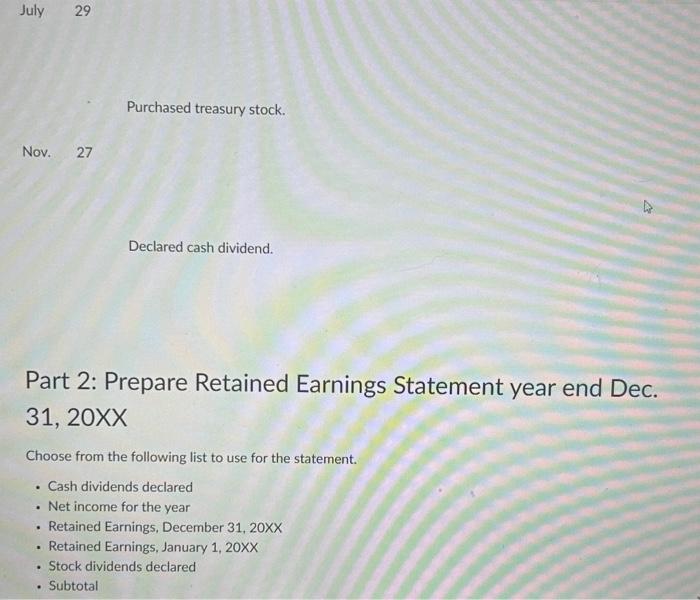

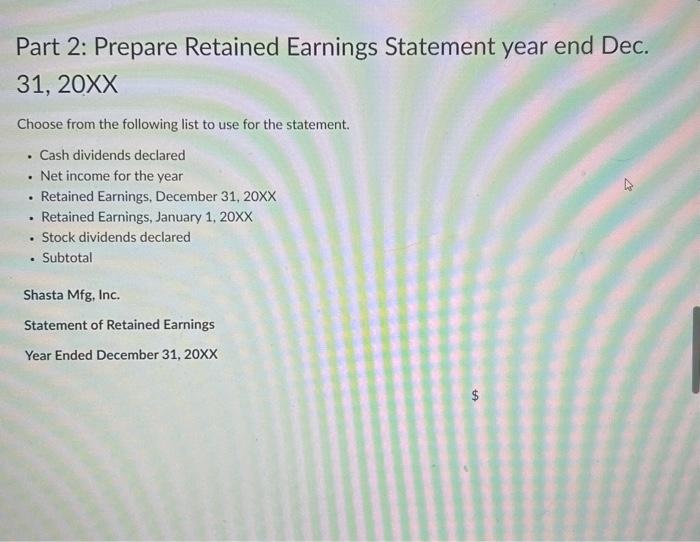

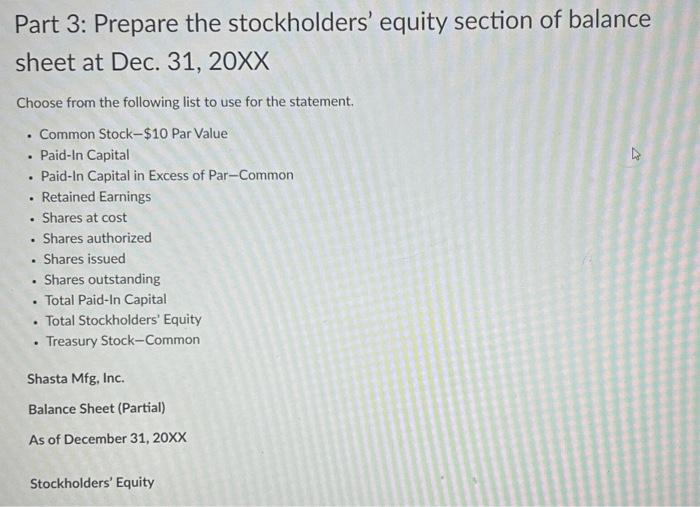

The balances in the following accounts are as of December 31, 20XX for Shasta Mfg, Inc. During 20XX, Shasta completed the following transactions related to stockholders' equity: 6-Feb: Declared a 5% stock dividend. The market value of the stock on that date was $25/ share. 15-Feb: Distributed the stock dividend 29-Jul: Purchased 2,000 shares of treasury stock at $25 per share 27-Nov: Declared a cash dividend of $0.20 per share 1. Record the transactions in the general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.). 2. Prepare a retained earnings statement for the year ended December 31, 20XX. Net income for the year was $87,000.All construction was completed on October 31. Prepare the year-end journal entry to record depreciation expense assuming no depreciation has been recorded yet. 3. Prepare the stockholders' equity section of the balance sheet at December 31,20XX. GENERAL JOURNAL Declared cash dividend. Part 2: Prepare Retained Earnings Statement year end Dec. 31, 20XX Choose from the following list to use for the statement. - Cash dividends declared - Net income for the year - Retained Earnings, December 31, 20XX - Retained Earnings, January 1,20XX - Stock dividends declared - Subtotal Part 2: Prepare Retained Earnings Statement year end Dec. 31, 20XX Choose from the following list to use for the statement. - Cash dividends declared - Net income for the year - Retained Earnings, December 31, 20XX - Retained Earnings, January 1, 20XX - Stock dividends declared - Subtotal Shasta Mfg, Inc. Statement of Retained Earnings Year Ended December 31, 20XX Part 3: Prepare the stockholders' equity section of balance sheet at Dec. 31, 20XX Choose from the following list to use for the statement. - Common Stock-\$10 Par Value - Paid-In Capital - Paid-In Capital in Excess of Par-Common - Retained Earnings - Shares at cost - Shares authorized - Shares issued - Shares outstanding - Total Paid-In Capital - Total Stockholders' Equity - Treasury Stock-Common Shasta Mfg, Inc. Balance Sheet (Partial) As of December 31, 20XX Stockholders' Equity