Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The balances of select accounts of the dexter company on December 31, 2019 are given below accounts receivable 770000 allowance for doubtful accounts credit 2200

The balances of select accounts of the dexter company on December 31, 2019 are given below accounts receivable 770000 allowance for doubtful accounts credit 2200 total sales 9,870,000 Sales returns and allowances total 232000

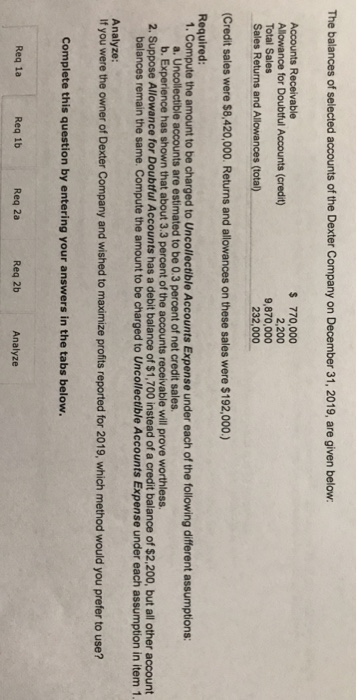

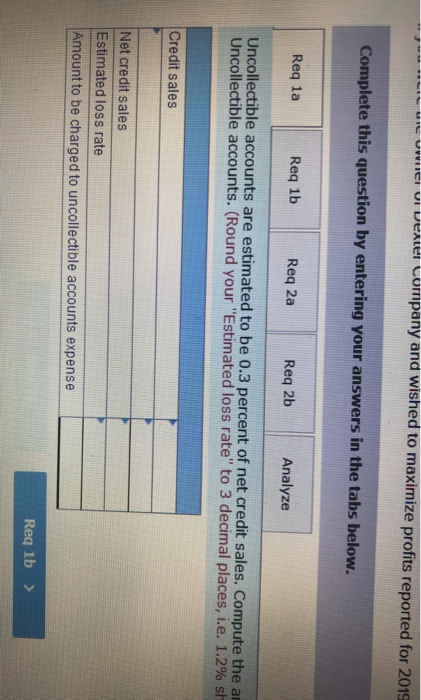

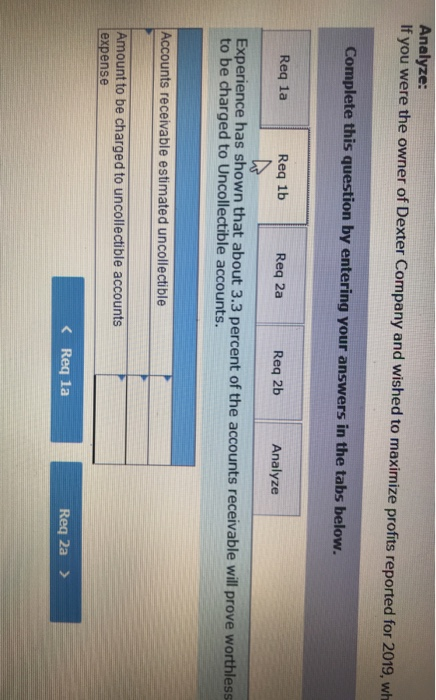

The balances of selected accounts of the Dexter Company on December 31, 2019, are given below: Accounts Receivable Allowance for Doubtful Accounts (credit) Total Sales Sales Returns and Allowances (total) $ 770,000 2,200 9,870,000 232,000 (Credit sales were $8,420,000. Returns and allowances on these sales were $192,000.) Required: 1. Compute the amount to be charged to Uncollectible Accounts Expense under each of the following different assumptions: a. Uncollectible accounts are estimated to be 0.3 percent of net credit sales. b. Experience has shown that about 3.3 percent of the accounts receivable will prove worthless 2. Suppose Allowance for Doubtful Accounts has a debit balance of $1,700 instead of a credit balance of $2,200, but all other account balances remain the same. Compute the amount to be charged to Uncollectible Accounts Expense under each assumption in item 1. Analyze: If you were the owner of Dexter Company and wished to maximize profits reported for 2019, which method would you prefer to use? Complete this question by entering your answers in the tabs below. Req la Req 1b Req za Reg 2b Analyze MIL WWIICI VI venter company and wished to maximize profits reported for 2019 Complete this question by entering your answers in the tabs below. Req la Req 1b Req 2a Reg 2b Analyze Uncollectible accounts are estimated to be 0.3 percent of net credit sales. Compute the an Uncollectible accounts. (Round your "Estimated loss rate" to 3 decimal places, i.e. 1.2% sh Credit sales Net credit sales Estimated loss rate Amount to be charged to uncollectible accounts expense Reg 1b > Analyze: If you were the owner of Dexter Company and wished to maximize profits reported for 2019, wh Complete this question by entering your answers in the tabs below. Req la Reg 1b Reg 2a Req 2b Analyze Experience has shown that about 3.3 percent of the accounts receivable will prove worthless to be charged to Uncollectible accounts. Accounts receivable estimated uncollectible Amount to be charged to uncollectible accounts expense Analyze: If you were the owner of Dexter Company and wished to maximize profits reported for 2019, which method would you Complete this question by entering your answers in the tabs below. Reg la Reg 1b Reg 2a Reg 2b Analyze Uncollectible accounts are estimated to be 0.3 percent of net credit sales. Compute the amount to be charged to Uncollectible accounts. (Round your "Estimated loss rate" to 3 decimal places, i.e. 1.2% should be entered as 0.012.) Credit sales Net credit sales Estimated loss rate Amount to be charged to uncollectible accounts expense Reg lb Req 2b > Analyze! If you were the owner of Dexter Company and wished to maximize profits reported for 2019, Complete this question by entering your answers in the tabs below. Req la Reg 1b Reg 2a Reg 2b Analyze Experience has shown that about 3.3 percent of the accounts receivable will prove worthle to be charged to Uncollectible accounts. Accounts Receivable estimated uncollectible Amount to be charged to uncollectible accounts expense Analyze: If you were the owner of Dexter Company and wished to maximize profits reported for 20 Complete this question by entering your answers in the tabs below. Req la Req 1b Req 2a Reg 2b Analyze If you were the owner of Dexter Company and wished to maximize profits reported for a you prefer to use? Using the would give highest income this year. Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started