Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Bank of Canada governor, Tiff Macklem, recently stated annual inflation rates are forecasted to increase to nearly five per cent by the end

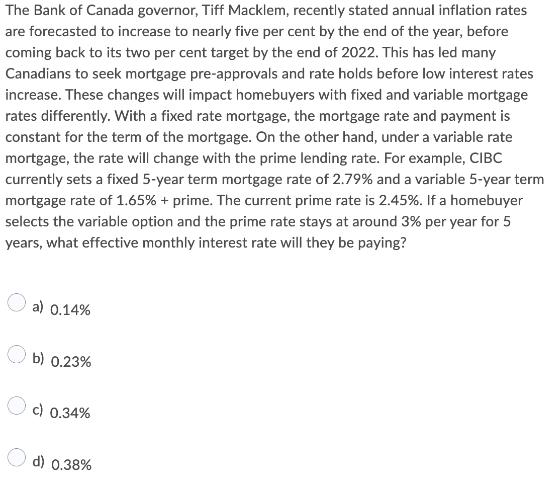

The Bank of Canada governor, Tiff Macklem, recently stated annual inflation rates are forecasted to increase to nearly five per cent by the end of the year, before coming back to its two per cent target by the end of 2022. This has led many Canadians to seek mortgage pre-approvals and rate holds before low interest rates increase. These changes will impact homebuyers with fixed and variable mortgage rates differently. With a fixed rate mortgage, the mortgage rate and payment is constant for the term of the mortgage. On the other hand, under a variable rate mortgage, the rate will change with the prime lending rate. For example, CIBC currently sets a fixed 5-year term mortgage rate of 2.79% and a variable 5-year term mortgage rate of 1.65% + prime. The current prime rate is 2.45%. If a homebuyer selects the variable option and the prime rate stays at around 3% per year for 5 years, what effective monthly interest rate will they be paying? a) 0.14% b) 0.23% c) 0.34% d) 0.38%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided bel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started