Answered step by step

Verified Expert Solution

Question

1 Approved Answer

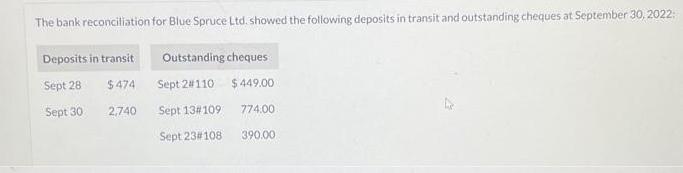

The bank reconciliation for Blue Spruce Ltd. showed the following deposits in transit and outstanding cheques at September 30, 2022: Outstanding cheques Sept 2#110

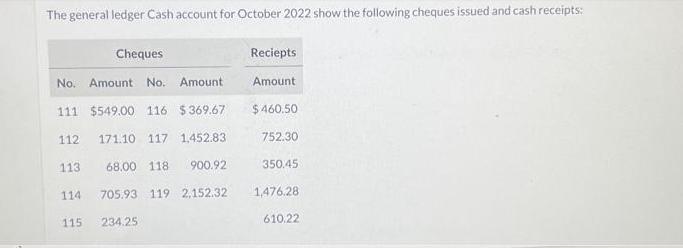

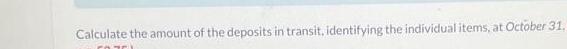

The bank reconciliation for Blue Spruce Ltd. showed the following deposits in transit and outstanding cheques at September 30, 2022: Outstanding cheques Sept 2#110 $449.00 Sept 13#109 Sept 23#108 Deposits in transit Sept 28 Sept 30 $474 2,740 774.00 390.00 The general ledger Cash account for October 2022 show the following cheques issued and cash receipts: Cheques No. Amount No. Amount 111 $549.00 116 $369.67 112 171.10 117 1.452.83 113 68.00 118 900.92 114 705.93 119 2.152.32 115 234.25 Reciepts Amount $460.50 752.30 350.45 1,476.28 610.22 In addition, the deposits and cheques that cleared the bank during the month of October is presented below: Cheque and other debits No. Amount No. Amount No. Amount 109 774.00 111 549.00 116 369.67 110 449.00 117 1,452.83 113 86.00 119 2.152.32 114 705.93 115 234.25 Deposits 2.740.00 474,00 460.50 752.30 350.45 Calculate the amount of the deposits in transit, identifying the individual items, at October 31. FOTEL

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

On the reconciliation of receipts in cash account in the books and deposits in bank statement we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started