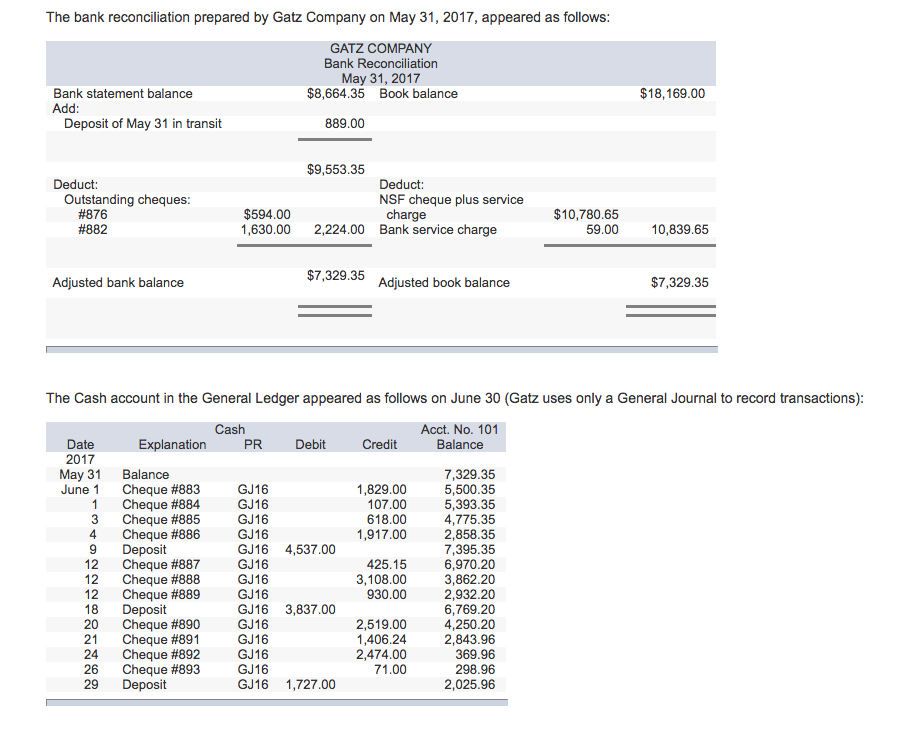

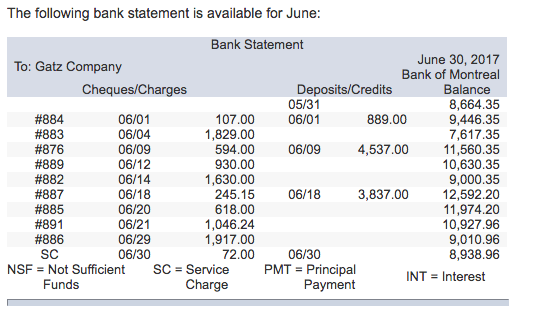

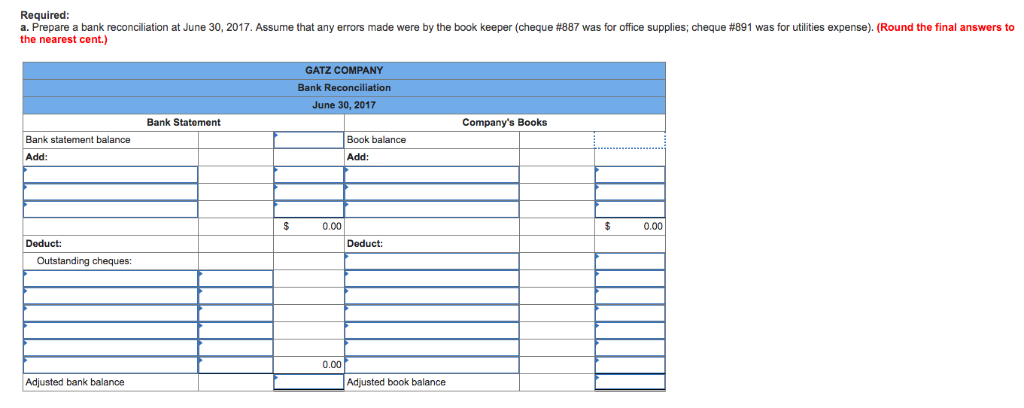

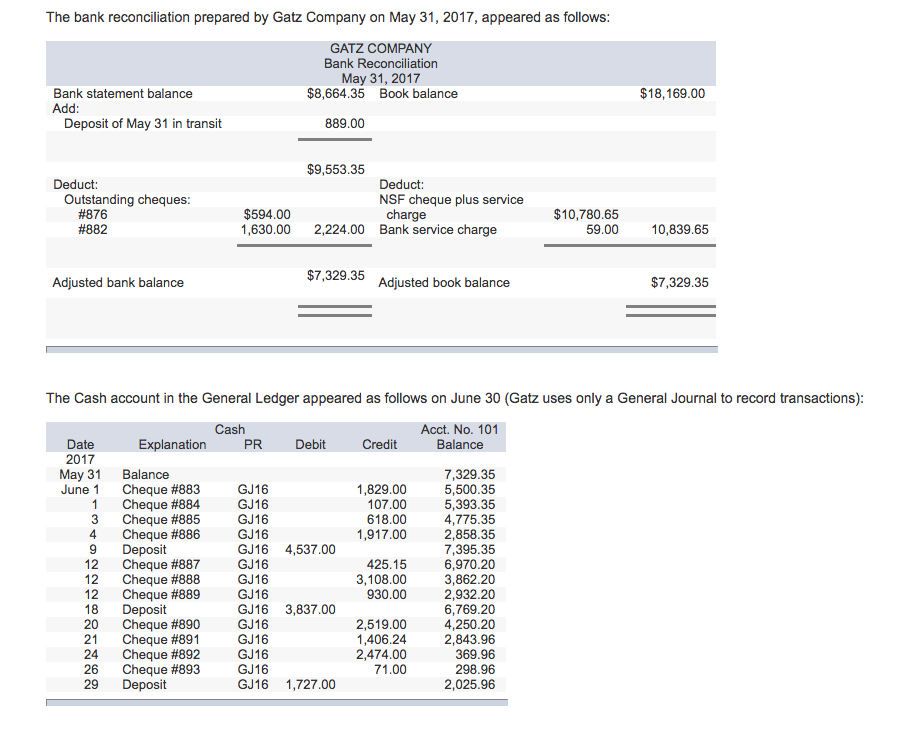

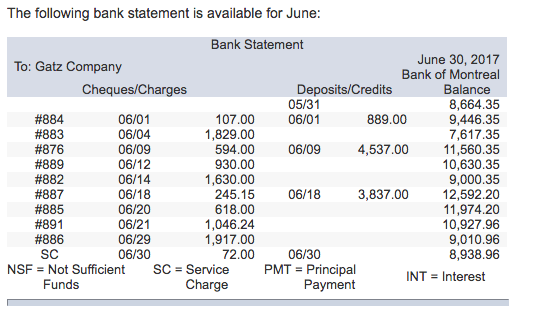

The bank reconciliation prepared by Gatz Company on May 31, 2017, appeared as follows: GATZ COMPANY Bank Reconciliation May 31, 2017 $8,664.35 Book balance Bank statement balance Add: $18,169.00 Deposit of May 31 in transit 889.00 $9,553.35 Deduct Deduct: NSF cheque plus service charge Bank service charge Outstanding cheques #876 $594.00 1,630.00 $10,780.65 59.00 # 882 2,224.00 10,839.65 $7,329.35 Adiusted book balance Adjusted bank balance $7,329.35 The Cash account in the General Ledger appeared as follows on June 30 (Gatz uses only a General Journal to record transactions): Cash PR Acct. No. 101 Date 2017 Explanation Debit Credit Balance May 31 June 1 Balance 7,329.35 5,500.35 5,393.35 4,775.35 2,858.35 7,395.35 6,970.20 3,862.20 2,932.20 6,769.20 4,250.20 2,843.96 369.96 298.96 Cheque #883 Cheque #884 3 GJ16 GJ16 GJ16 GJ16 GJ16 4,537.00 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 1,829.00 107.00 618.00 Cheque #885 Cheque #886 9 4 1,917.00 Deposit Cheque #887 Cheque #888 Cheque #889 Deposit Cheque #890 Cheque #891 Cheque #892 Cheque #893 Deposit 425.15 12 12 12 18 20 21 24 26 29 3,108.00 930.00 3,837.00 2,519.00 1,406.24 2,474.00 71.00 1,727.00 2,025.96 The following bank statement is available for June: Bank Statement June 30, 2017 Bank of Montreal To: Gatz Company Deposits/Credits 05/31 06/01 Cheques/Charges Balance 8,664.35 9,446.35 7,617.35 11,560.35 10,630.35 9,000.35 12,592.20 11,974.20 10,927.96 9,010.96 8,938.96 # 884 # 883 # 876 #889 # 882 #887 # 885 # 891 # 886 SC NSF Not Sufficient Funds 06/01 06/04 06/09 06/12 06/14 06/18 06/20 06/21 06/29 06/30 107.00 889.00 1,829.00 594.00 930.00 06/09 4,537.00 1,630.00 245.15 618.00 06/18 3,837.00 1,046.24 1,917.00 72.00 SC Service 06/30 PMT Principal Payment = INT Interest Charge Required: a. Prepare a bank reconciliation at June 30, 2017. Assume that any errors made were the nearest cent.) ythe book keeper (cheque # 887 was for office supplies; cheque # 891 was for utilities expense). (Round the final answers to GATZ COMPANY Bank Reconciliation June 30, 2017 Company's Books Bank Statement Book balance Bank statement balance Add: Add: S 0.00 0.00 Deduct Deduct: Outstanding cheques: 0.00 Adjusted book balance Adjusted bank balance b. Prepare the necessary entries resulting from the bank reconciliation. nearest cent.) f no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the View transaction list View Journal entry worksheet General Journal Credit No Date Debit