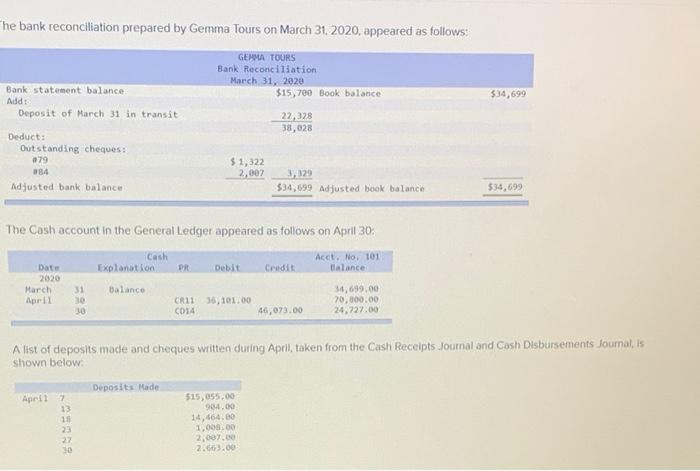

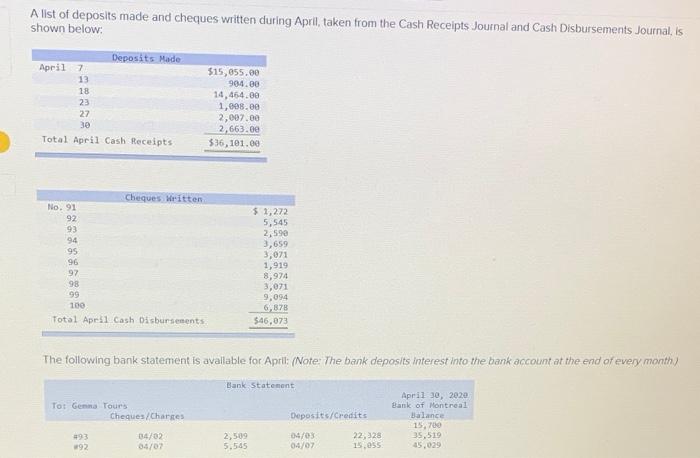

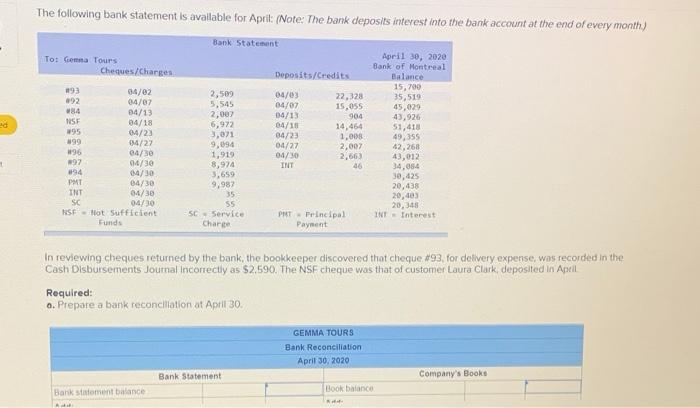

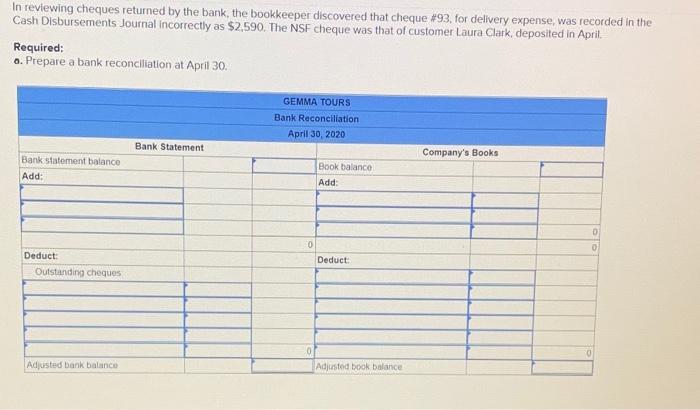

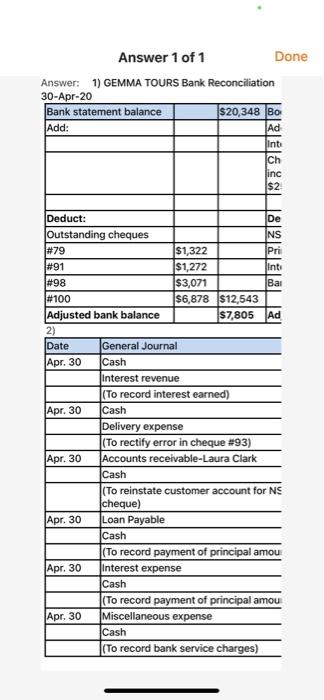

The bank reconciliation prepared by Gemma Tours on March 31, 2020, appeared as follows: GEMMA TOURS Bank Reconciliation March 31, 2020 $15,700 Book balance $34,699 22, 328 38,028 Bank statement balance Add: Deposit of March 31 in transit Deduct: Outstanding cheques : 079 84 Adjusted bank balance $ 1,322 2,007 3,129 $34,699 Adjusted book balance $34,699 The Cash account in the General Ledger appeared as follows on April 30: Cash Explanation PR Acct. No. 101 Balance Debit Credit Date 2020 March April Balance 31 30 30 36,101.00 CR11 C014 34,699.00 70,000.00 24,727.00 46,073.00 A list of deposits made and cheques written during April, token from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 2 13 18 23 27 10 515,055.00 900.00 14,464.00 1,000.00 2,007.00 2.663.00 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 13 18 23 27 30 Total April Cash Receipts $15,655.00 904.00 14,464.00 1,608.00 2,007.00 2,663.00 $36, 101.00 Cheques written No. 91 92 93 94 95 96 92 98 99 100 Total April Cash Disbursements $ 1,272 5,545 2,590 3,659 3,071 1,919 8,974 3,071 9,094 6,878 $46,073 The following bank statement is available for April (Note: The bank deposits interest into the bank account at the end of every month) Bank Statement Tot Gemma Tours Cheques/Charges Deposits/Credits April 30, 2020 Bank of Montreal Balance 15,700 35,519 45.029 04/02 04/07 2,509 5.545 04/03 04/07 22,928 15.055 w92 The following bank statement is available for Aprik: (Note: The bank deposits interest into the bank account at the end of every month) Bank Statement 092 Tot Gonna Tours Cheques/Charges 93 04/02 04/07 W4 04/13 NSF 04/18 w95 04/23 199 94/27 w96 04/30 292 04/30 94 04/30 PMT 04/30 INT 04/30 SC 04/30 NSE - Not sufficient Funds 2,509 5,545 2,007 6,972 3,071 9,094 1,919 8,974 3,659 9,982 35 55 SC-Service Charte Deposits/Credits 04/03 22,328 04/07 15,055 04/13 904 04/18 14,464 04/23 1,008 04/27 2,007 04/30 2,663 INT April 30, 2020 Bank of Montreal Balance 15,700 35,519 45,029 43,926 51,418 49,355 42,268 43,012 34,054 30,425 20,438 20,403 20,348 INT = Interest PRT - Principal Payment In reviewing cheques returned by the bank the bookkeeper discovered that cheque #93, for delivery expense, was recorded in the Cash Disbursements Journal Incorrectly as $2,590. The NSF cheque was that of customer Laura Clark, deposited in Apell. Required: o. Prepare a bank reconciliation at April 30. GEMMA TOURS Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank soment balance Book balance In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #93. for delivery expense, was recorded in the Cash Disbursements Journal incorrectly as $2.590. The NSF cheque was that of customer Laura Clark, deposited in April Required: o. Prepare a bank reconciliation at April 30. GEMMA TOURS Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank statement balance Add: Book balance Add: 0 0 0 Deduct Deduct: Outstanding cheques 0 0 Adjusted bank balance Adjusted book balance b. Prepare the necessary Journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation View transaction list Journal entry worksheet Record interest eamed. Note: Enter debits before credits Date General Journal Debit Credit Apr 30 Record entry Clear entry View general Journal Answer 1 of 1 Done Answer: 1) GEMMA TOURS Bank Reconciliation 30-Apr-20 Bank statement balance $20,348 Bo Add: int Ad inc $2 16182818 Deduct: De Outstanding cheques NS #79 $1,322 Pri #91 $1,272 Int #98 $3,071 Bai #100 $6,878 $12,543 Adjusted bank balance $7,805 Ad 2) Date General Journal Apr. 30 Cash Interest revenue (To record interest earned) Apr. 30 Cash Delivery expense (To rectify error in cheque #93) Apr. 30 Accounts receivable-Laura Clark Cash (To reinstate customer account for NS cheque) Apr. 30 Loan Payable Cash (To record payment of principal amou Apr. 30 Interest expense Cash (To record payment of principal amou Apr. 30 Miscellaneous expense Cash (To record bank service charges)