Answered step by step

Verified Expert Solution

Question

1 Approved Answer

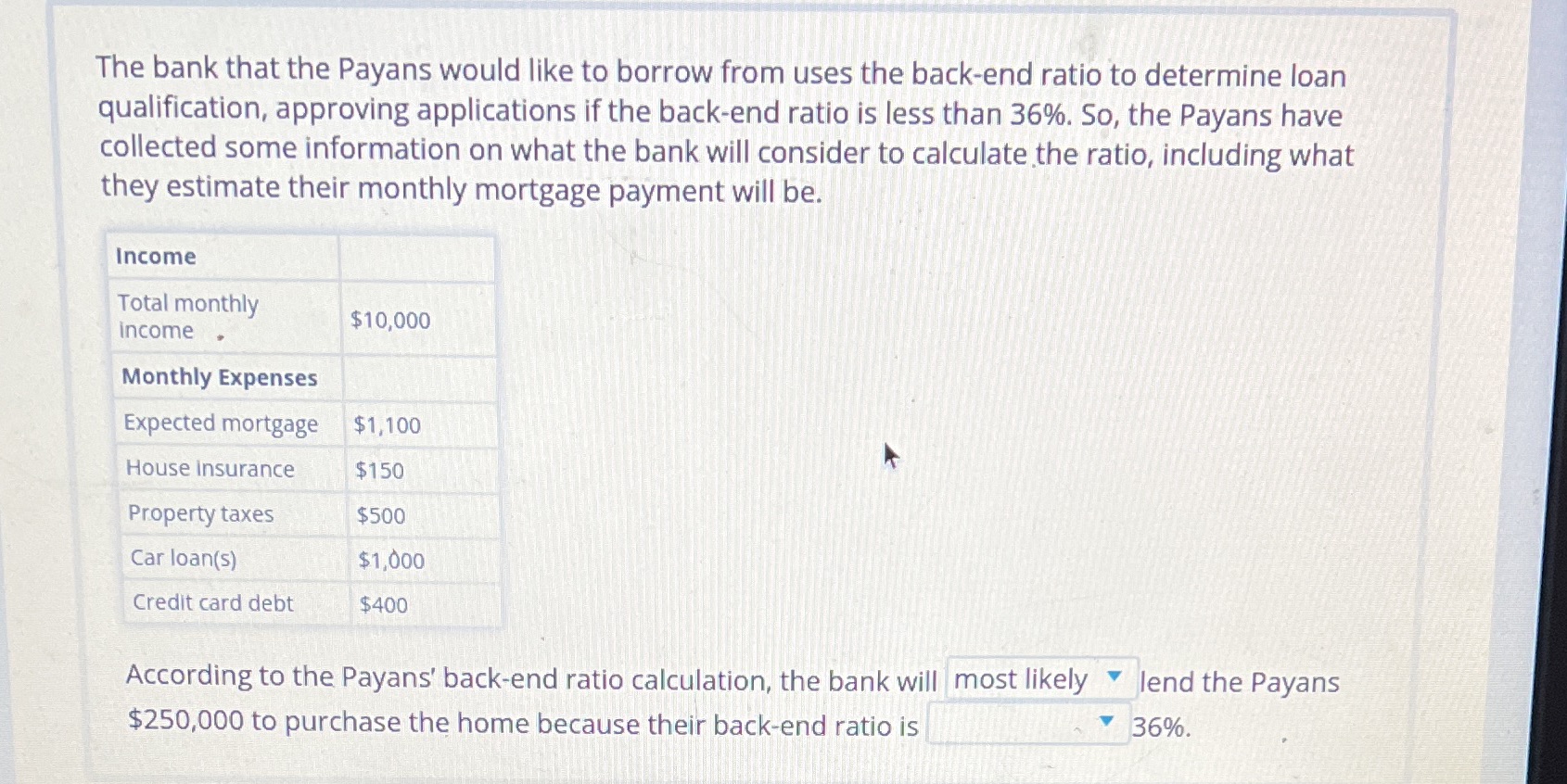

The bank that the Payans would like to borrow from uses the back-end ratio to determine loan qualification, approving applications if the back-end ratio

The bank that the Payans would like to borrow from uses the back-end ratio to determine loan qualification, approving applications if the back-end ratio is less than 36%. So, the Payans have collected some information on what the bank will consider to calculate the ratio, including what they estimate their monthly mortgage payment will be. Income Total monthly $10,000 income Monthly Expenses Expected mortgage $1,100 House Insurance $150 Property taxes $500 Car loan(s) $1,000 Credit card debt $400 According to the Payans' back-end ratio calculation, the bank will most likely $250,000 to purchase the home because their back-end ratio is lend the Payans 36%.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to assess the Payans loan qualification based on the backend ratio Calculate Total Monthly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started