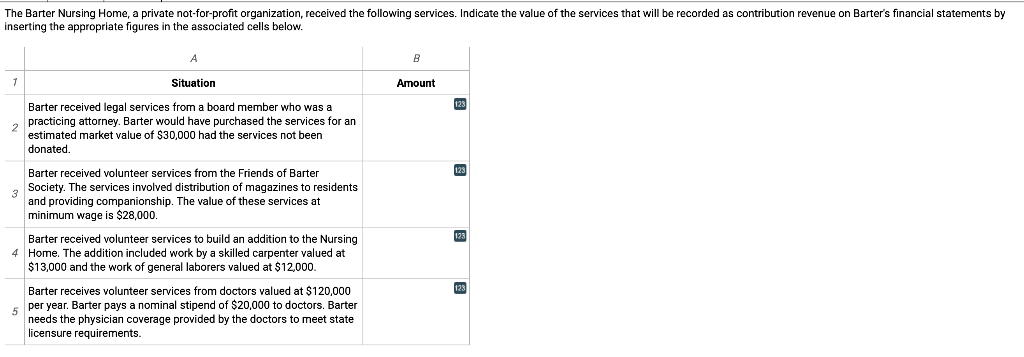

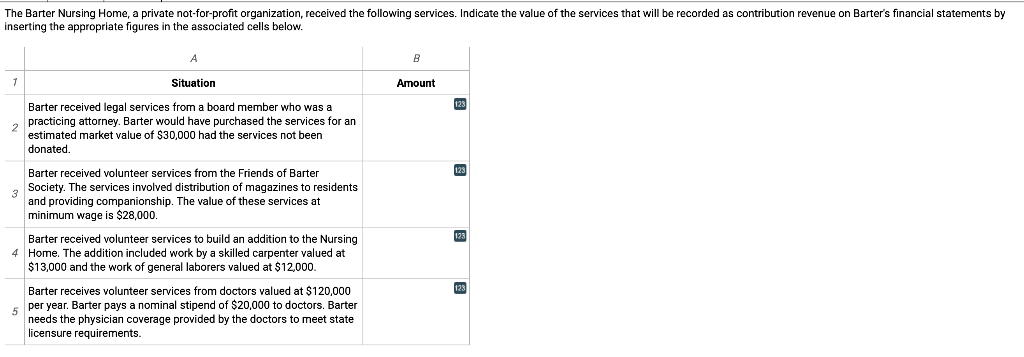

The Barter Nursing Home, a private not-for-profit organization, received the following services. Indicate the value of the services that will be recorded as contribution revenue on Barter's financial statements by inserting the appropriate figures in the associated cells below. 4 1 Situation Amount 123 Barter received legal services from a board member who was a practicing attorney. Barter would have purchased the services for an estimated market value of $30,000 had the services not been donated. 123 Barter received volunteer services from the Friends of Barte Society. The services involved distribution of magazines to residents and providing companionship. The value of these services at minimum wage is $28,000. 123 Barter received volunteer services to build an addition to the Nursing 4 Home. The addition included work by a skilled carpenter valued at $13,000 and the work general laborers valued at $12,000 123 Barter receives volunteer services from doctors valued at $120,000 per year. Barter pays a nominal stipend of $20,000 to doctors. Barter needs the physician coverage provided by the doctors to meet state licensure requirements. The Barter Nursing Home, a private not-for-profit organization, received the following services. Indicate the value of the services that will be recorded as contribution revenue on Barter's financial statements by inserting the appropriate figures in the associated cells below. 4 1 Situation Amount 123 Barter received legal services from a board member who was a practicing attorney. Barter would have purchased the services for an estimated market value of $30,000 had the services not been donated. 123 Barter received volunteer services from the Friends of Barte Society. The services involved distribution of magazines to residents and providing companionship. The value of these services at minimum wage is $28,000. 123 Barter received volunteer services to build an addition to the Nursing 4 Home. The addition included work by a skilled carpenter valued at $13,000 and the work general laborers valued at $12,000 123 Barter receives volunteer services from doctors valued at $120,000 per year. Barter pays a nominal stipend of $20,000 to doctors. Barter needs the physician coverage provided by the doctors to meet state licensure requirements