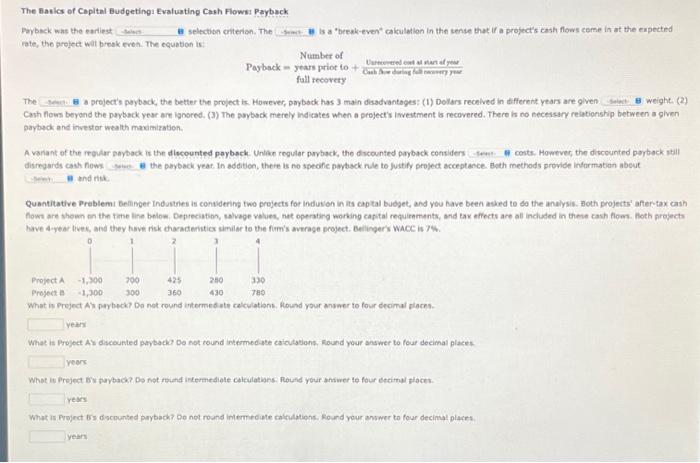

The Basks of Capital Budgeting Evaluating Cash Flowsi Payback Parback was the earliest selection criterion. The is a "beexk-ever" calculation in the sense that if a project's cash flows ceme in at the expected rate, the project wat break erea. The equation is: Paybackyearspriottofullrecovery The a projects payback, the better the project is. However, payback has 3 main disadvantages: (1) Dellars recolved in different years are glven weight: (2) Cosh flows beyend the payback year are ignored. (3) The sayback merely indicates when a projects i westment is recovered. There is no necessary rebiationship between a given paybeck and investor wealth maximiration. A varant of the reoular payback is the discounted payback. Unilike regular parback, the dincounted payback coesiders costs. However, the discounted portack itill disregands cash news. the payback yeat. In additen, theie is no specife payback nle to justify project acceptance. Bath mechods provide infarmatian abeut and its. Quantitative Problemt Bellinger Indastres is convidering fwo projects for indusion in its captal budget, and you have been asked to do the analysis. Doth projects' affer-tax cash have 4-year lives, and they have rik characteristics similar to the form's average project. Bellimpers wacc is 7%. What is Preject As parbeck? Do net round intermes ath calculations, hound your answer to four decimal plachs. years years vears What is Project 6s docounted payback? oo not round intermedute caltulations. Round your answer to four decimal placrs. years The Basks of Capital Budgeting Evaluating Cash Flowsi Payback Parback was the earliest selection criterion. The is a "beexk-ever" calculation in the sense that if a project's cash flows ceme in at the expected rate, the project wat break erea. The equation is: Paybackyearspriottofullrecovery The a projects payback, the better the project is. However, payback has 3 main disadvantages: (1) Dellars recolved in different years are glven weight: (2) Cosh flows beyend the payback year are ignored. (3) The sayback merely indicates when a projects i westment is recovered. There is no necessary rebiationship between a given paybeck and investor wealth maximiration. A varant of the reoular payback is the discounted payback. Unilike regular parback, the dincounted payback coesiders costs. However, the discounted portack itill disregands cash news. the payback yeat. In additen, theie is no specife payback nle to justify project acceptance. Bath mechods provide infarmatian abeut and its. Quantitative Problemt Bellinger Indastres is convidering fwo projects for indusion in its captal budget, and you have been asked to do the analysis. Doth projects' affer-tax cash have 4-year lives, and they have rik characteristics similar to the form's average project. Bellimpers wacc is 7%. What is Preject As parbeck? Do net round intermes ath calculations, hound your answer to four decimal plachs. years years vears What is Project 6s docounted payback? oo not round intermedute caltulations. Round your answer to four decimal placrs. years