Answered step by step

Verified Expert Solution

Question

1 Approved Answer

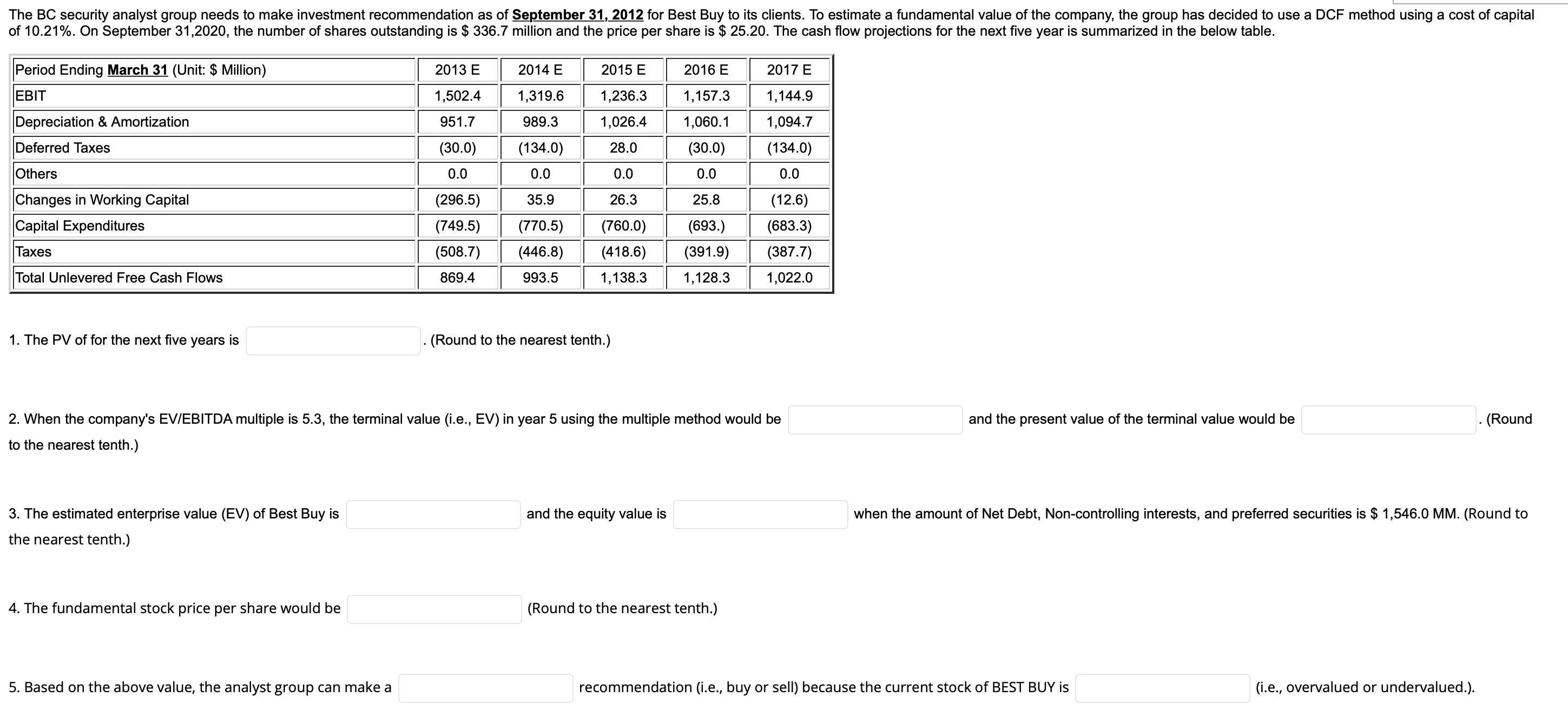

The BC security analyst group needs to make investment recommendation as of September 31, 2012 for Best Buy to its clients. To estimate a

The BC security analyst group needs to make investment recommendation as of September 31, 2012 for Best Buy to its clients. To estimate a fundamental value of the company, the group has decided to use a DCF method using a cost of capital of 10.21%. On September 31,2020, the number of shares outstanding is $ 336.7 million and the price per share is $25.20. The cash flow projections for the next five year is summarized in the below table. Period Ending March 31 (Unit: $ Million) EBIT Depreciation & Amortization Deferred Taxes Others Changes in Working Capital Capital Expenditures Taxes Total Unlevered Free Cash Flows 1. The PV of for the next five years is 3. The estimated enterprise value (EV) of Best Buy is the nearest tenth.) 4. The fundamental stock price per share would be 2013 E 1,502.4 951.7 (30.0) 0.0 (296.5) (749.5) (508.7) 869.4 5. Based on the above value, the analyst group can make a 2014 E 1,319.6 989.3 (134.0) 0.0 35.9 26.3 (770.5) (760.0) 2015 E 1,236.3 1,026.4 28.0 0.0 (446.8) (418.6) 993.5 1,138.3 . (Round to the nearest tenth.) 2. When the company's EV/EBITDA multiple is 5.3, the terminal value (i.e., EV) in year 5 using the multiple method would be to the nearest tenth.) 2016 E 1,157.3 1,060.1 (30.0) 0.0 25.8 (693.) (391.9) 1,128.3 and the equity value is 2017 E 1,144.9 1,094.7 (134.0) 0.0 (Round to the nearest tenth.) (12.6) (683.3) (387.7) 1,022.0 and the present value of the terminal value would be when the amount of Net Debt, Non-controlling interests, and preferred securities is $ 1,546.0 MM. (Round to recommendation (i.e., buy or sell) because the current stock of BEST BUY is (Round (i.e., overvalued or undervalued.).

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value PV of the cash flows we will discount each cash flow using the cost of capital of 1021 The table below shows the calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started