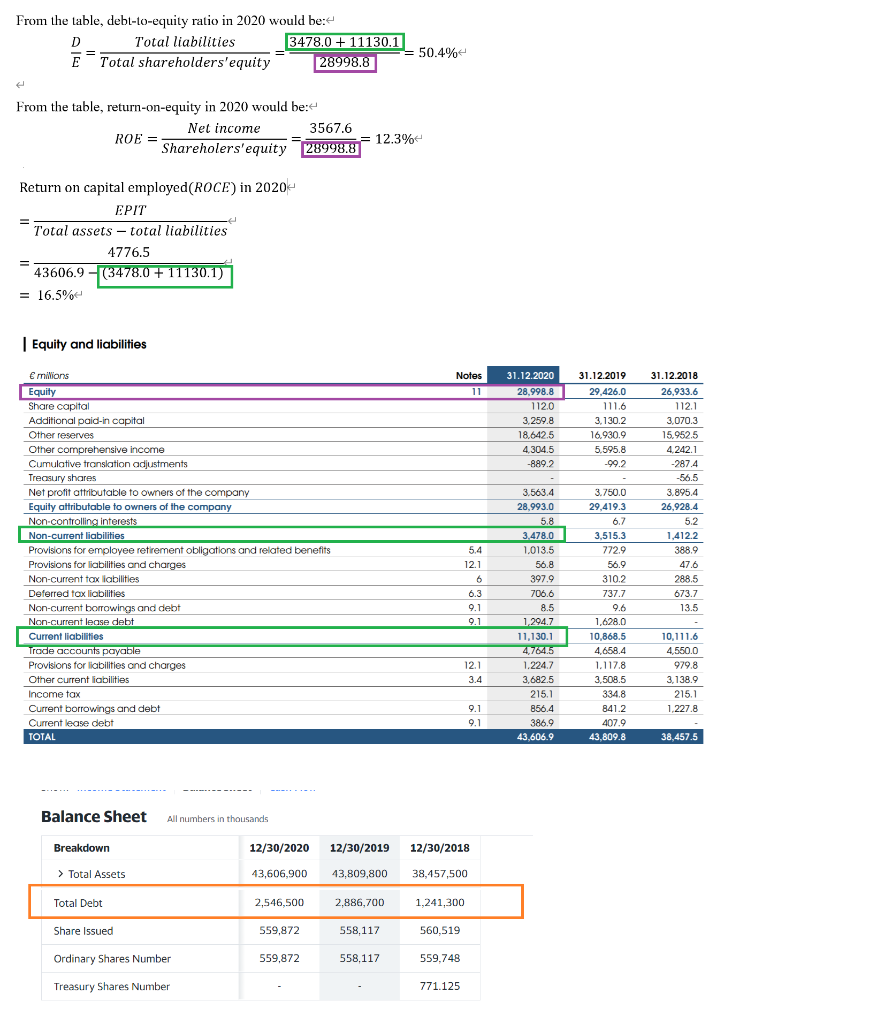

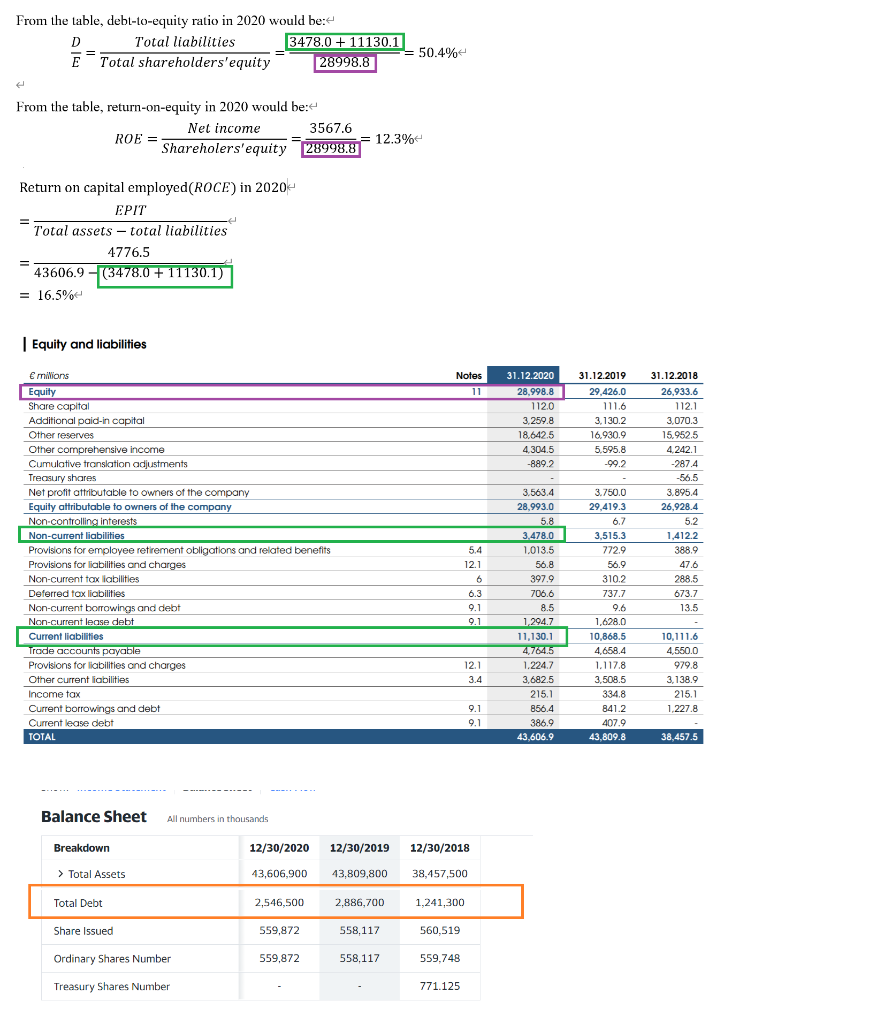

The below are the calculations of debt-to-equity, return-on-equity and return on capital employed of Loreal company, would you please help me check if the calculations are correct?

For the debt part calculated in D/E, I chose to add up current and non-current liabilities found in the annual financial report, however, when I search the company in yahoo finance, there is a column for total debt, I wonder which value should be used. Same problem with the calculation on ROCE.

Also, am I substituting the value correctly for shareholders' equity?

THANKS!!!

From the table, debt-to-equity ratio in 2020 would be: D Total liabilities 3478.0 + 11130.1 E Total shareholders'equity 28998.8 50.4% From the table, return-on-equity in 2020 would be: Net income 3567.6 ROE = Shareholers'equity 28998.8 12.3% = Return on capital employed(ROCE) in 2020 EPIT Total assets - total liabilities 4776.5 43606.9 (3478.0 + 11130.1) = 16.5% Equity and liabilities Notes 11 31.12.2020 28,998.8 1120 3,259.8 18,642.5 4,304.5 -889.2 31.12.2019 29.426,0 111.6 3.130.2 16.930.9 5,595.8 -99.2 milions Equity Share capital Additional paid-in capital Other reserves Other comprehensive income Cumulative translation adjustments Treasury shares Net profit attributable to owners of the company Equity attributable to owners of the company Non-controlling interests Non-current liabilities Provisions for employee retirement obligations and related benefits Provisions for liabilities and charges Non-current tax liabilities Deferred tax liabilities Non-current borrowings and debt Non-current lease debt Current liabilities Trade accounts payable Provisions for liabilities and charges Other current liabilities Income tax Current borrowings and debt Current lease debt TOTAL 3.750.0 29,419.3 6.7 3,515.3 7729 56.9 310.2 31.12.2018 26,933.6 112.1 3,070.3 15.952.5 4.242.1 -287.4 -56.5 3.895.4 26,928.4 5.2 1,412.2 388.9 47.6 288.5 673.7 13.5 5.4 12.1 6 6.3 9.1 9.1 3.563.4 28.993.0 5.8 3.478.0 1.013.5 56.8 397.9 706.6 8.5 1,294.7 11.130.1 2.7655 1.224.7 3,682.5 215.1 856.4 386.9 43,606.9 12.1 3.4 737.7 9.6 1.628.0 10,868.5 4.658.4 1.117.8 3,508.5 334.8 841.2 407.9 43,809.8 10.111.6 4,550.0 979.8 3,138.9 215.1 1.227.8 9.1 9.1 38.457.5 Balance Sheet All numbers in thousands Breakdown 12/30/2020 12/30/2019 12/30/2018 > Total Assets 43,606,900 43.809,800 38,457,500 Total Debt 2,546,500 2.886,700 1,241,300 Share Issued 559,872 558,117 560.519 Ordinary Shares Number 559,872 558,117 559.748 Treasury Shares Number 771.125