Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Better Butter Corp. balance sheet as of December 31, 20x0 is as follows: Assets $100,000 Common Stock, $2 Par $100,000 The company intends

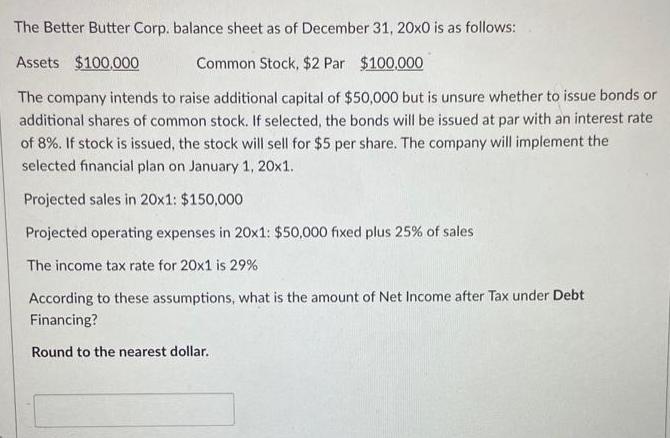

The Better Butter Corp. balance sheet as of December 31, 20x0 is as follows: Assets $100,000 Common Stock, $2 Par $100,000 The company intends to raise additional capital of $50,000 but is unsure whether to issue bonds or additional shares of common stock. If selected, the bonds will be issued at par with an interest rate of 8%. If stock is issued, the stock will sell for $5 per share. The company will implement the selected financial plan on January 1, 20x1. Projected sales in 20x1: $150,000 Projected operating expenses in 20x1: $50,000 fixed plus 25% of sales The income tax rate for 20x1 is 29% According to these assumptions, what is the amount of Net Income after Tax under Debt Financing? Round to the nearest dollar.

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net income after tax under debt financing we need to determine the interest expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started