Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Beyes plan to purchase a house for $285,000. They will pay 20% down, and finance the remainder for 30 years at 6.9% interest

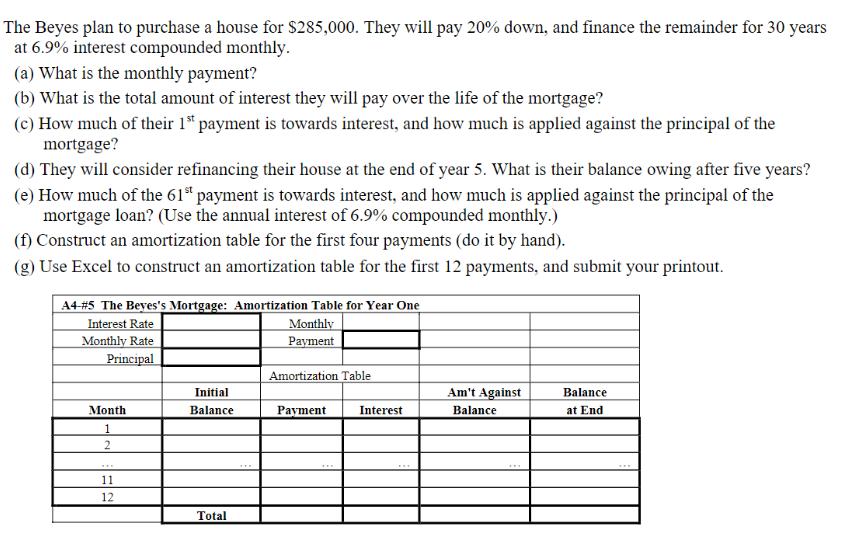

The Beyes plan to purchase a house for $285,000. They will pay 20% down, and finance the remainder for 30 years at 6.9% interest compounded monthly. (a) What is the monthly payment? (b) What is the total amount of interest they will pay over the life of the mortgage? (c) How much of their 1st payment is towards interest, and how much is applied against the principal of the mortgage? (d) They will consider refinancing their house at the end of year 5. What is their balance owing after five years? (e) How much of the 61st payment is towards interest, and how much is applied against the principal of the mortgage loan? (Use the annual interest of 6.9% compounded monthly.) (f) Construct an amortization table for the first four payments (do it by hand). (g) Use Excel to construct an amortization table for the first 12 payments, and submit your printout. A4 #5 The Beyes's Mortgage: Amortization Table for Year One Interest Rate Monthly Rate Principal Month 1 2 11 12 Initial Balance Total Monthly Payment Amortization Table Payment Interest Am't Against Balance Balance at End

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

I can guide you through the steps to solve these problems but due to the nature of the questions Ill ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started