Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at

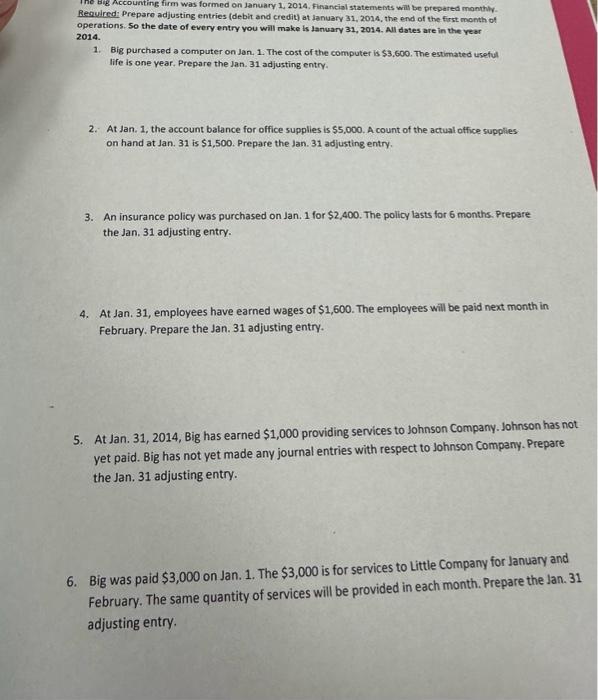

The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry. The Big Accounting firm was formed on January 1, 2014. Financial statements will be prepared monthly Required: Prepare adjusting entries (debit and credit) at January 31, 2014, the end of the first month of operations. So the date of every entry you will make is January 31, 2014. All dates are in the year 2014. 1. Big purchased a computer on Jan. 1. The cost of the computer is $3,600. The estimated useful life is one year. Prepare the Jan. 31 adjusting entry. 2. At Jan. 1, the account balance for office supplies is $5,000. A count of the actual office supplies on hand at Jan. 31 is $1,500. Prepare the Jan. 31 adjusting entry. 3. An insurance policy was purchased on Jan. 1 for $2,400. The policy lasts for 6 months. Prepare the Jan. 31 adjusting entry. 4. At Jan. 31, employees have earned wages of $1,600. The employees will be paid next month in February. Prepare the Jan. 31 adjusting entry. 5. At Jan. 31, 2014, Big has earned $1,000 providing services to Johnson Company. Johnson has not yet paid. Big has not yet made any journal entries with respect to Johnson Company. Prepare the Jan. 31 adjusting entry. 6. Big was paid $3,000 on Jan. 1. The $3,000 is for services to Little Company for January and February. The same quantity of services will be provided in each month. Prepare the Jan. 31 adjusting entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Depreciation Expense 300 Accumulated Depreciation Computer Equipmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started