Answered step by step

Verified Expert Solution

Question

1 Approved Answer

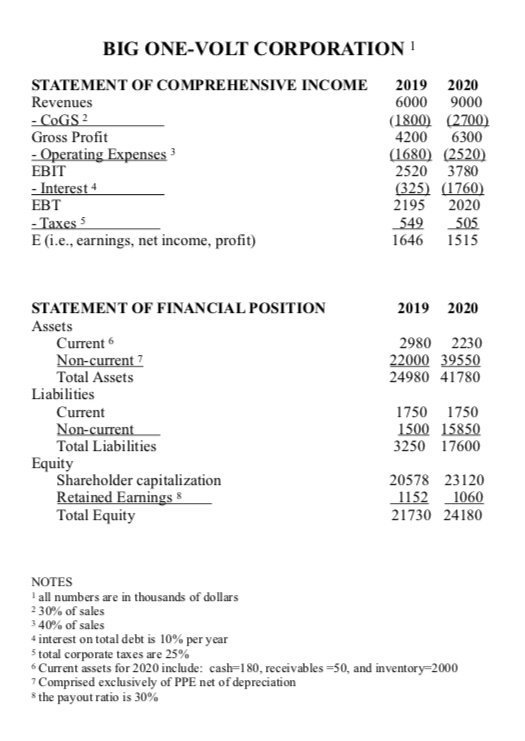

The Big One-Volt Company makes really large one-volt batteries. Its highly simplified financial statements for 2019 and 2020 appear at the end of this assignment.

The Big One-Volt Company makes really large one-volt batteries. Its highly simplified financial statements for 2019 and 2020 appear at the end of this assignment. The Big Volt guys are putting to use the Percentage of Sales Model, and are wondering what their various accounts would look like in 2023 if they manage to increase sales by 45% over 2020s sales.

a) What were dividends for 2020?

b) If the dividend policy is changed so that the payout ratio for 2020 is 50%, how will the asset expansion (of $1,600) be financed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started