Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Blanchett Company manufactures fishing rods. Last year, direct materials costing $516,000 were put into production. Direct labor of $430,000 was incurred and overhead

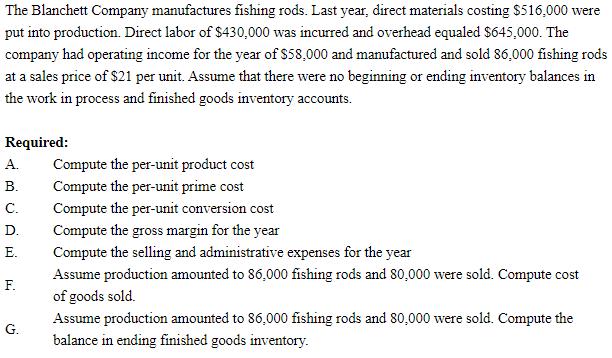

The Blanchett Company manufactures fishing rods. Last year, direct materials costing $516,000 were put into production. Direct labor of $430,000 was incurred and overhead equaled $645,000. The company had operating income for the year of $58,000 and manufactured and sold 86,000 fishing rods at a sales price of $21 per unit. Assume that there were no beginning or ending inventory balances in the work in process and finished goods inventory accounts. Required: A. Compute the per-unit product cost B. A MUAH C. D. E. F. G. Compute the per-unit prime cost Compute the per-unit conversion cost Compute the gross margin for the year Compute the selling and administrative expenses for the year Assume production amounted to 86,000 fishing rods and 80,000 were sold. Compute cost of goods sold. Assume production amounted to 86,000 fishing rods and 80,000 were sold. Compute the balance in ending finished goods inventory.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer A 1850 Workings Product CostDirect MaterialDirect LabourFactory OH51600043000064500015...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started