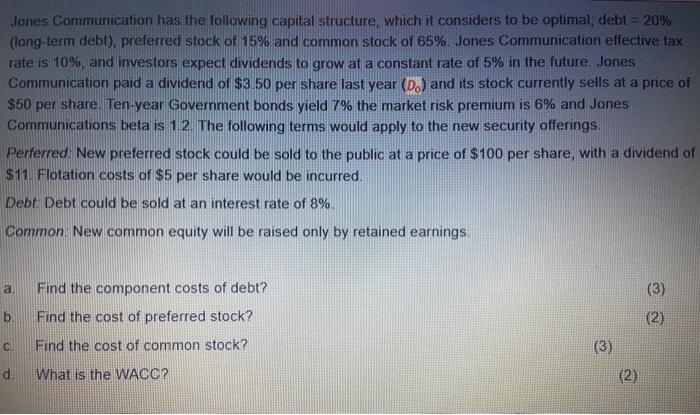

The Blue Hill Company is a large manufacturer of capital goods. (The demand for capital goods typically swings up and down a great deal between good and bad economic times.) Business has been good lately and is expected to remain so in the foreseeable future. The firm is currently relatively labor intensive in its processes. The chief engineer, Mike Smith, has suggested a major project to modernize and automate the plant. At the output level planned for next year, the project will reduce total cost by 10%. Mike has presented the idea to the management team in a totally positive light. The other executives are caught up in Mike's enthusiasm and are ready to proceed. You are Blue Hill CFO and feel Chat all sides of an issue should be discussed before it is approved. What concerns do you have? How vould you present them in a way that keeps you from appearing to be overly negative? You are a financial analyst for the Ajax Company, which uses about $1M of inventory per month. The purchasing manager has come to you for help with a buying decision. He can get a big discount on $15M of inventory by buying it all at once. However, there is some risk of obsolescence when buying that far in advance. He understands that large purchases are frequently analyzed by means of capital budgeting techniques and asks for your help in deciding whether or not to buy the specially priced inventory. How would you advise him? Is capital budgeting appropriate? Whitefish Inc operates a fleet of 15 fishing boats in the North Andros Marine Blue Hole area. Fishing has been good in the last few years, as has the market for product, so the firm can sell all the fish it can catch. Charlie Bass, the vice president for operations, has worked up a capital budgeting proposal for the acquisition of new boats. Each boat is viewed as an individual project identical to the others and shows an IRR of 22%. The firm's cost of capital has been correctly calculated at 14% before the retained earnings break and 15% after that point. Charlie argues that the capital budgeting figures show that the firm should acquire as many new boats as it possibly can, financing them with whatever means it finds available. You are Whitefish's CFO. Support or criticize Charlie's position. How should the appropriate number of new boats be determined? Does acquiring many new boats present any problems or risks that are not immediately apparent from the financial figures? Creighton Inc. is preparing a bid to sell a large telephone communications system to a major business customer. It is characteristic of the telephone business that the vendor selling a system gets substantial follow-on business in later years by making changes and alterations to that system. The marketing department wants to take an incremental approach to the bid, basically treating it as a capital budgeting project. They propose selling the system at or below its direct cost in labor and materials (the incremental cost) to ensure getting the follow-on business. They have projected the value of that business by treating future sales less direct costs as cash inflows. They maintain that the initial outlay is the direct cost to install the system, which is almost immediately paid back by the price. Future cash flows are then the net inflows from the follow-on sales. These calculations have led to an enormous NPV and IRR for the sale viewed as a project. Both support and criticize this approach. (Hint what would happen if Creighton did most of its business this way?) Jones Communication has the following capital structure, which it considers to be optimal; debt = 20% (long-term debt), preferred stock of 15% and common stock of 65%. Jones Communication effective tax rate is 10%, and investors expect dividends to grow at a constant rate of 5% in the future Jones Communication paid a dividend of $3.50 per share last year (D) and its stock currently sells at a price of $50 per share. Ten-year Government bonds yield 7% the market risk premium is 6% and Jones Communications beta is 1.2. The following terms would apply to the new security offerings. Perferred: New preferred stock could be sold to the public at a price of $100 per share, with a dividend of $11. Flotation costs of $5 per share would be incurred. Debt Debt could be sold at an interest rate of 8%. Common: New common equity will be raised only by retained earnings. a. Find the component costs of debt? (3) (2) b. Find the cost of preferred stock? C. Find the cost of common stock? d What is the WACC? (3) (2)