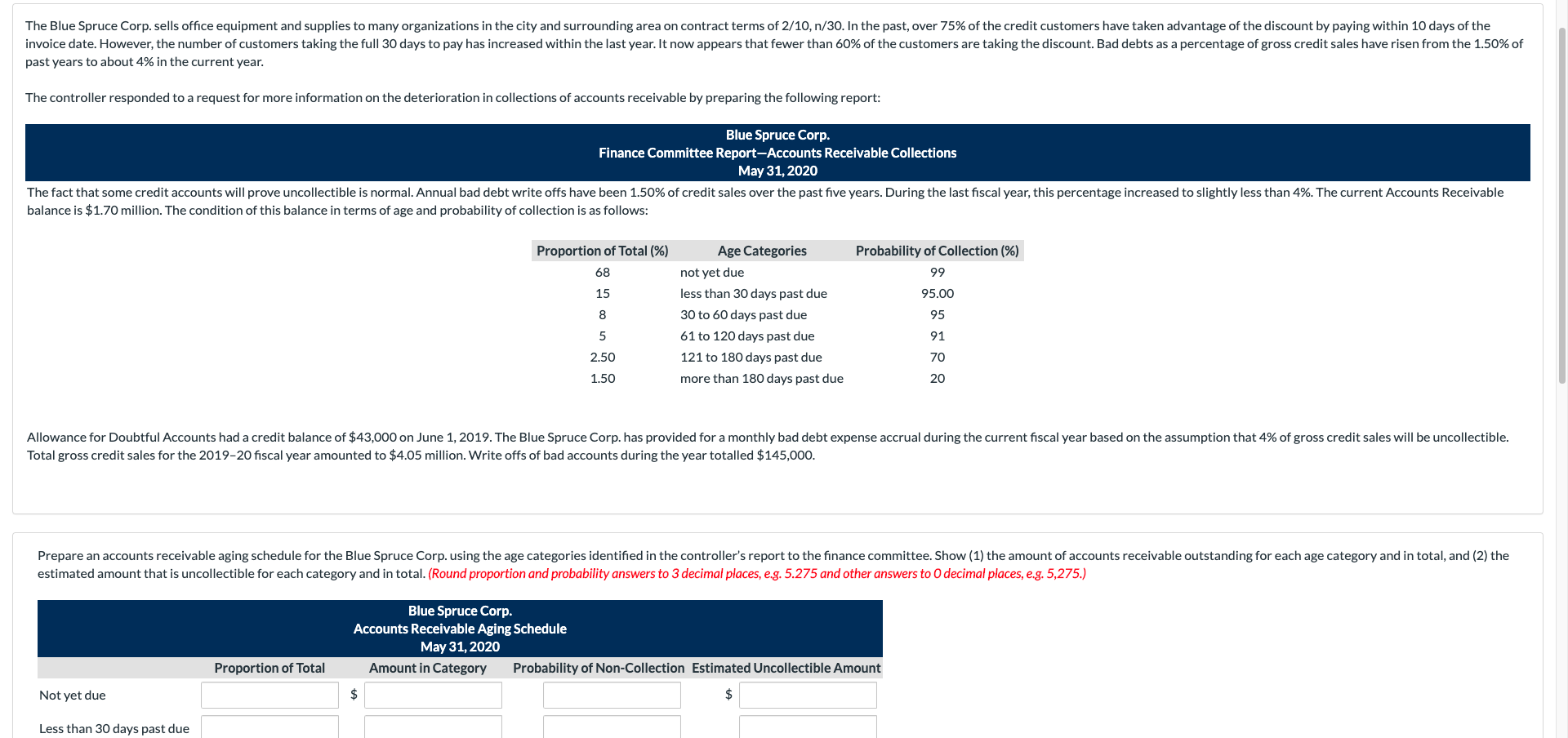

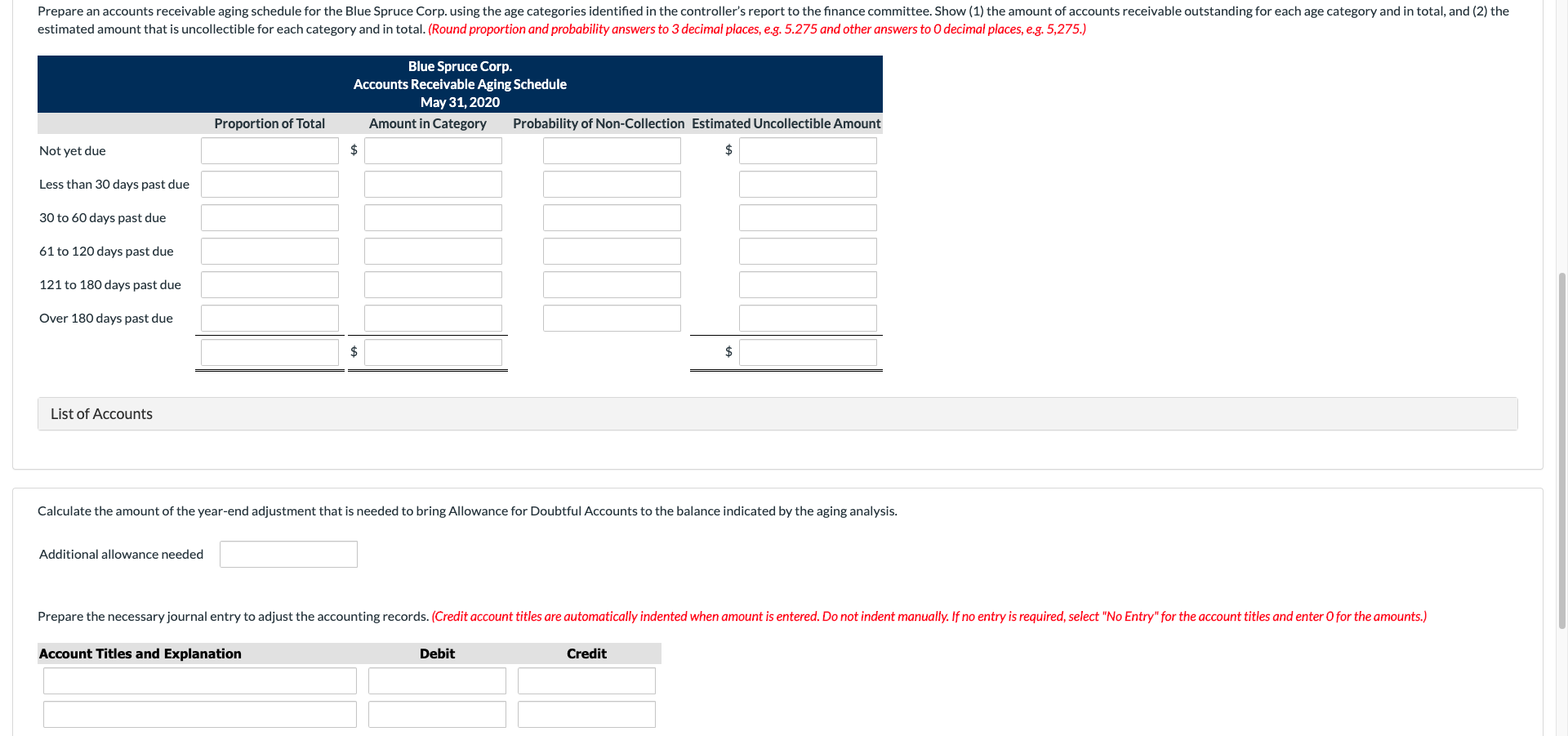

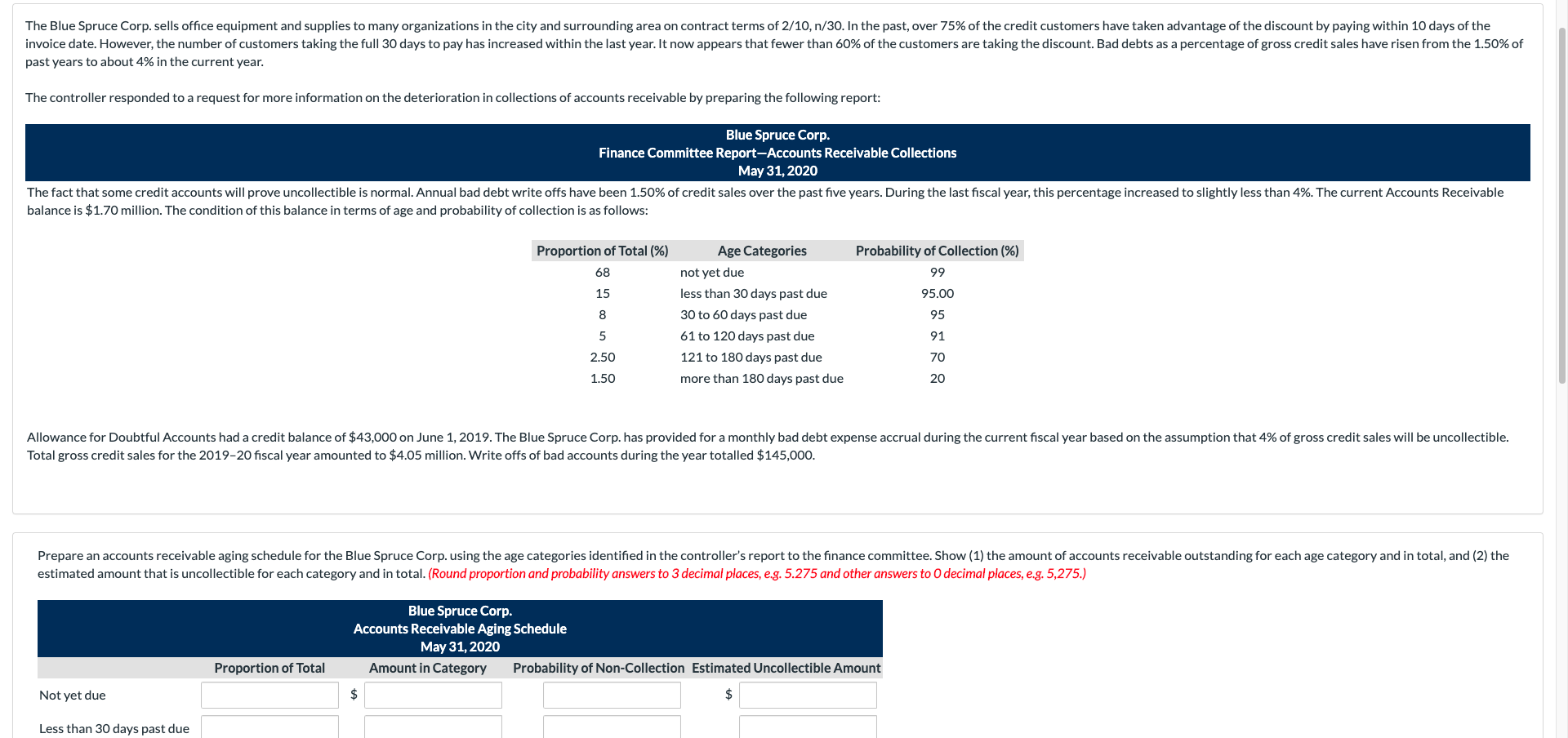

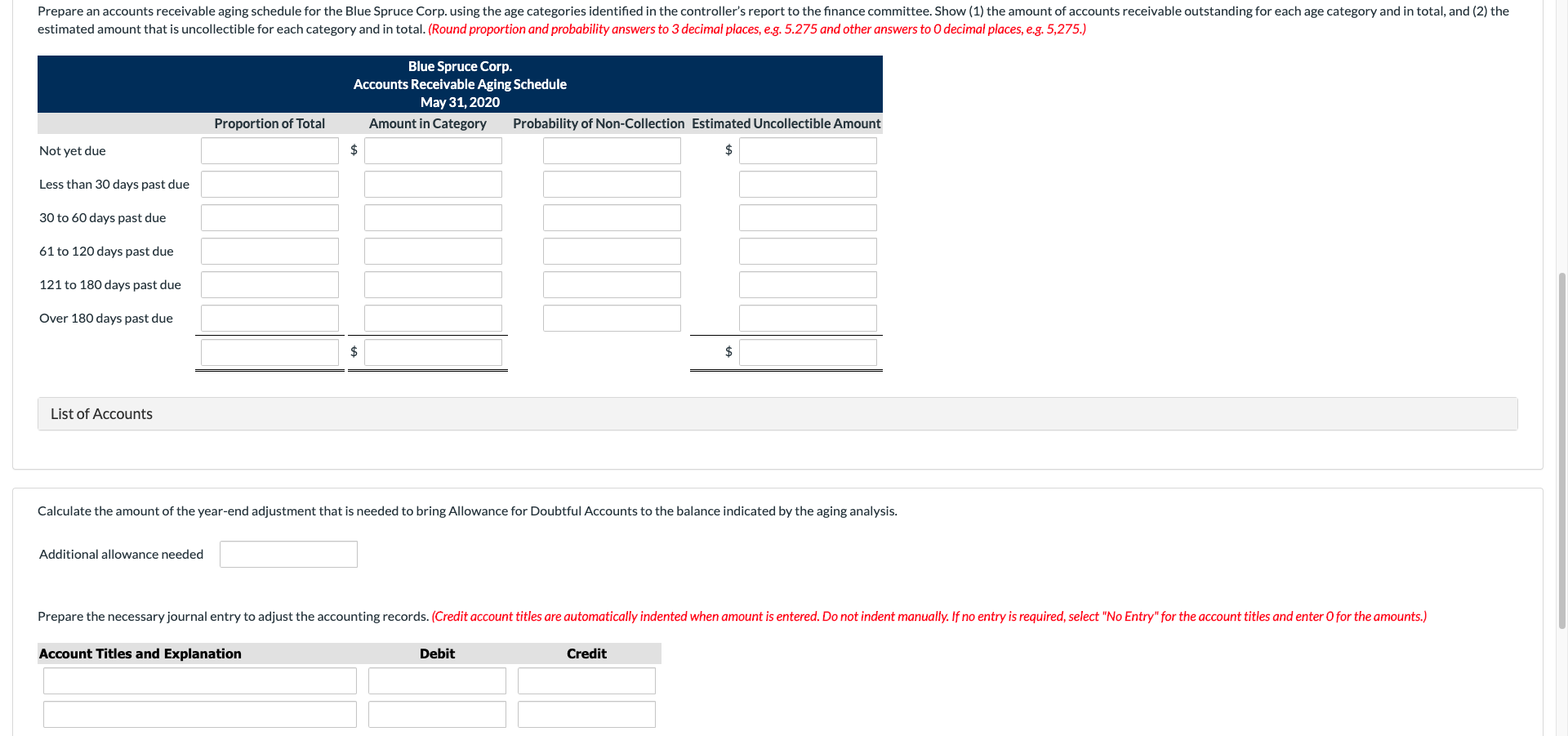

The Blue Spruce Corp. sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10,n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 days of the invoice date. However, the number of customers taking the full 30 days to pay has increased within the last year. It now appears that fewer than 60% of the customers are taking the discount. Bad debts as a percentage of gross credit sales have risen from the 1.50% of past years to about 4% in the current year. The controller responded to a request for more information on the deterioration in collections of accounts receivable by preparing the following report: Blue Spruce Corp. Finance Committee Report-Accounts Receivable Collections May 31, 2020 The fact that some credit accounts will prove uncollectible is normal. Annual bad debt write offs have been 1.50% of credit sales over the past five years. During the last fiscal year, this percentage increased to slightly less than 4%. The current Accounts Receivable balance is $1.70 million. The condition of this balance in terms of age and probability of collection is as follows: Proportion of Total (%) Probability of Collection (%) 68 99 15 95.00 8 Age Categories not yet due less than 30 days past due 30 to 60 days past due 61 to 120 days past due 121 to 180 days past due more than 180 days past due 95 5 91 2.50 70 1.5 Allowance for Doubtful Accounts had a credit balance of $43,000 on June 1, 2019. The Blue Spruce Corp. has provided for a monthly bad debt expense accrual during the current fiscal year based on the assumption that 4% of gross credit sales will be uncollectible. Total gross credit sales for the 2019-20 fiscal year amounted to $4.05 million. Write offs of bad accounts during the year totalled $145,000. Prepare an accounts receivable aging schedule for the Blue Spruce Corp. using the age categories identified in the controller's report to the finance committee. Show (1) the amount of accounts receivable outstanding for each age category and in total, and (2) the estimated amount that is uncollectible for each category and in total. (Round proportion and probability answers to 3 decimal places, e.g. 5.275 and other answers to 0 decimal places, e.g. 5,275.) Blue Spruce Corp. Accounts Receivable Aging Schedule May 31, 2020 Amount in Category Probability of Non-Collection Estimated Uncollectible Amount Proportion of Total Not yet due $ A Less than 30 days past due Prepare an accounts receivable aging schedule for the Blue Spruce Corp. using the age categories identified in the controller's report to the finance committee. Show (1) the amount of accounts receivable outstanding for each age category and in total, and (2) the estimated amount that is uncollectible for each category and in total. (Round proportion and probability answers to 3 decimal places, eg. 5.275 and other answers to 0 decimal places, e.g. 5,275.) Blue Spruce Corp. Accounts Receivable Aging Schedule May 31, 2020 Amount in Category Probability of Non-Collection Estimated Uncollectible Amount Proportion of Total Not yet due $ Less than 30 days past due 30 to 60 days past due 61 to 120 days past due 121 to 180 days past due Over 180 days past due $ $ List of Accounts Calculate the amount of the year-end adjustment that is needed to bring Allowance for Doubtful Accounts to the balance indicated by the aging analysis. Additional allowance needed Prepare the necessary journal entry to adjust the accounting records. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit