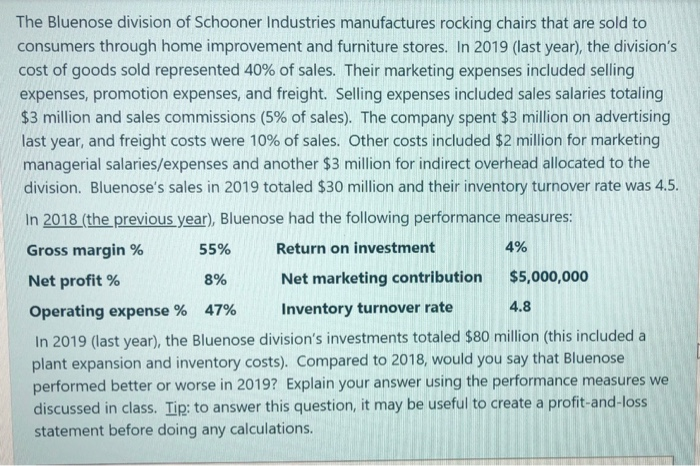

The Bluenose division of Schooner Industries manufactures rocking chairs that are sold to consumers through home improvement and furniture stores. In 2019 (last year), the division's cost of goods sold represented 40% of sales. Their marketing expenses included selling expenses, promotion expenses, and freight. Selling expenses included sales salaries totaling $3 million and sales commissions (5% of sales). The company spent $3 million on advertising last year, and freight costs were 10% of sales. Other costs included $2 million for marketing managerial salaries/expenses and another $3 million for indirect overhead allocated to the division. Bluenose's sales in 2019 totaled $30 million and their inventory turnover rate was 4.5. In 2018 (the previous year), Bluenose had the following performance measures: Gross margin % 55% Return on investment 4% Net profit % 8% Net marketing contribution $5,000,000 Operating expense % 47% Inventory turnover rate In 2019 (last year), the Bluenose division's investments totaled $80 million (this included a plant expansion and inventory costs). Compared to 2018, would you say that Bluenose performed better or worse in 2019? Explain your answer using the performance measures we discussed in class. Tip: to answer this question, it may be useful to create a profit-and-loss statement before doing any calculations. 4.8 The Bluenose division of Schooner Industries manufactures rocking chairs that are sold to consumers through home improvement and furniture stores. In 2019 (last year), the division's cost of goods sold represented 40% of sales. Their marketing expenses included selling expenses, promotion expenses, and freight. Selling expenses included sales salaries totaling $3 million and sales commissions (5% of sales). The company spent $3 million on advertising last year, and freight costs were 10% of sales. Other costs included $2 million for marketing managerial salaries/expenses and another $3 million for indirect overhead allocated to the division. Bluenose's sales in 2019 totaled $30 million and their inventory turnover rate was 4.5. In 2018 (the previous year), Bluenose had the following performance measures: Gross margin % 55% Return on investment 4% Net profit % 8% Net marketing contribution $5,000,000 Operating expense % 47% Inventory turnover rate In 2019 (last year), the Bluenose division's investments totaled $80 million (this included a plant expansion and inventory costs). Compared to 2018, would you say that Bluenose performed better or worse in 2019? Explain your answer using the performance measures we discussed in class. Tip: to answer this question, it may be useful to create a profit-and-loss statement before doing any calculations. 4.8