Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Board is asking you to produce a detailed analysis of the characteristics of the new portfolio to be constructed according to this Strategic

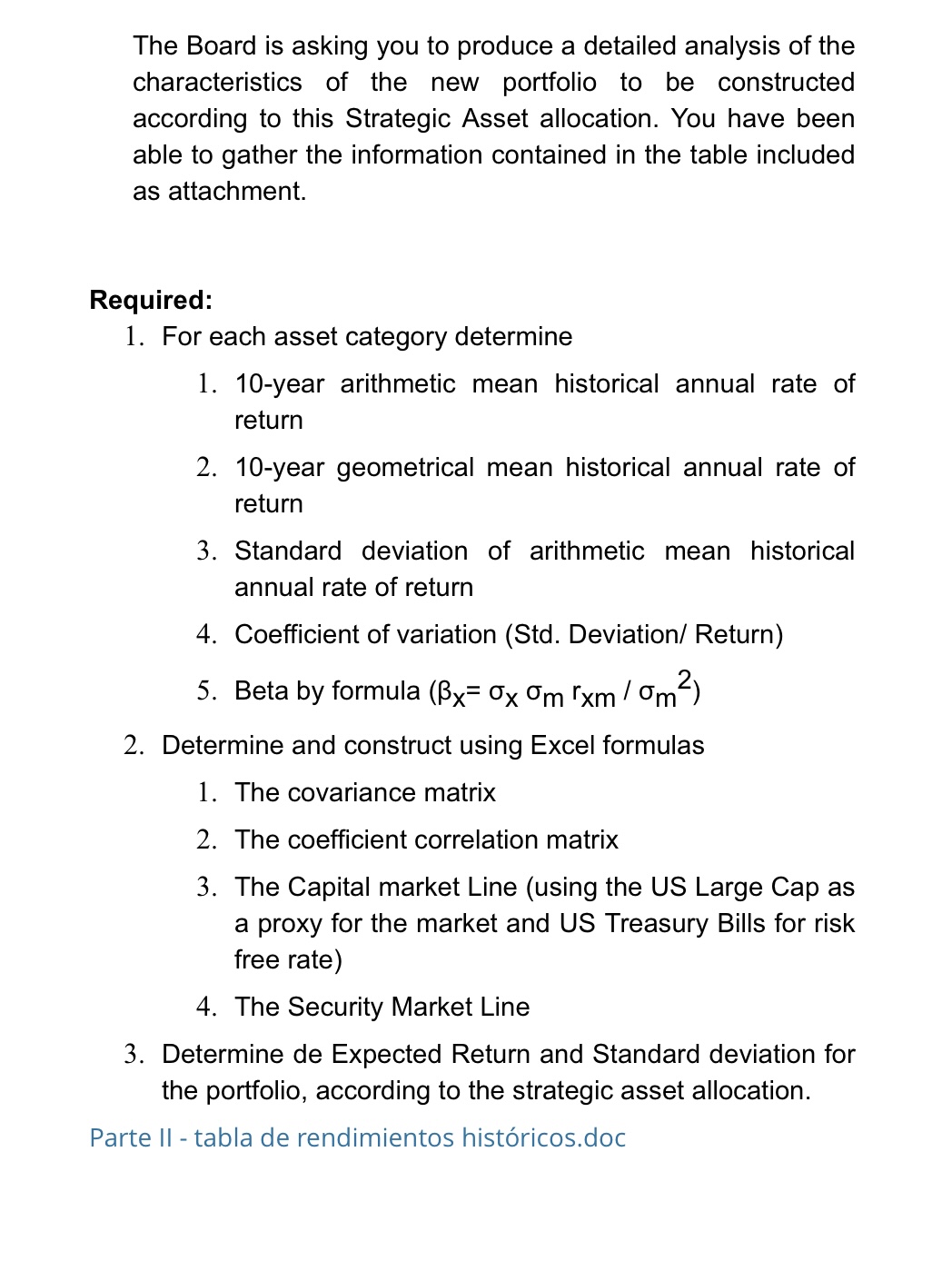

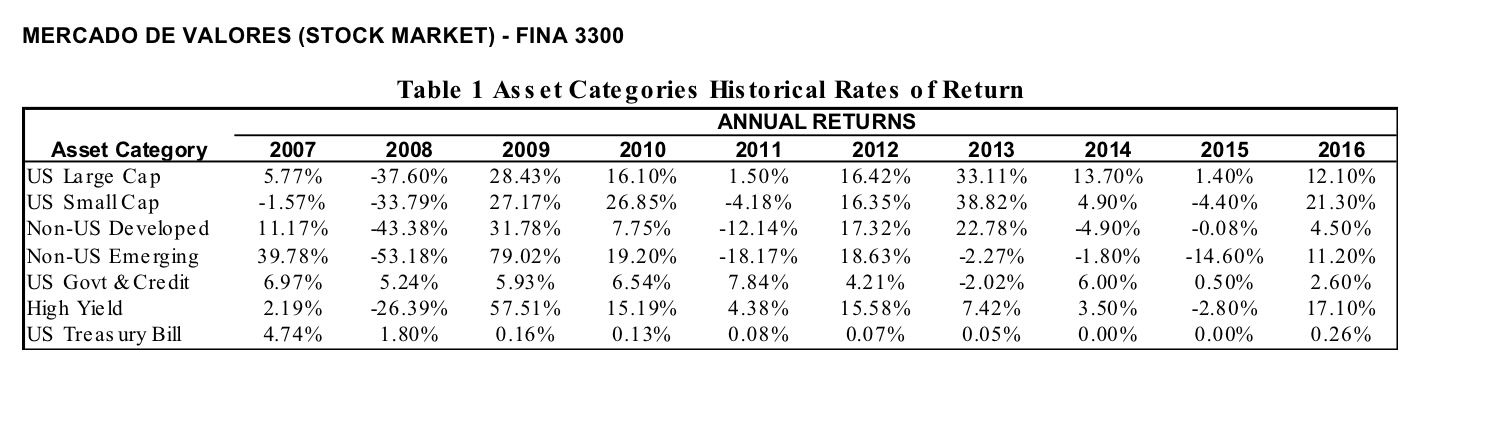

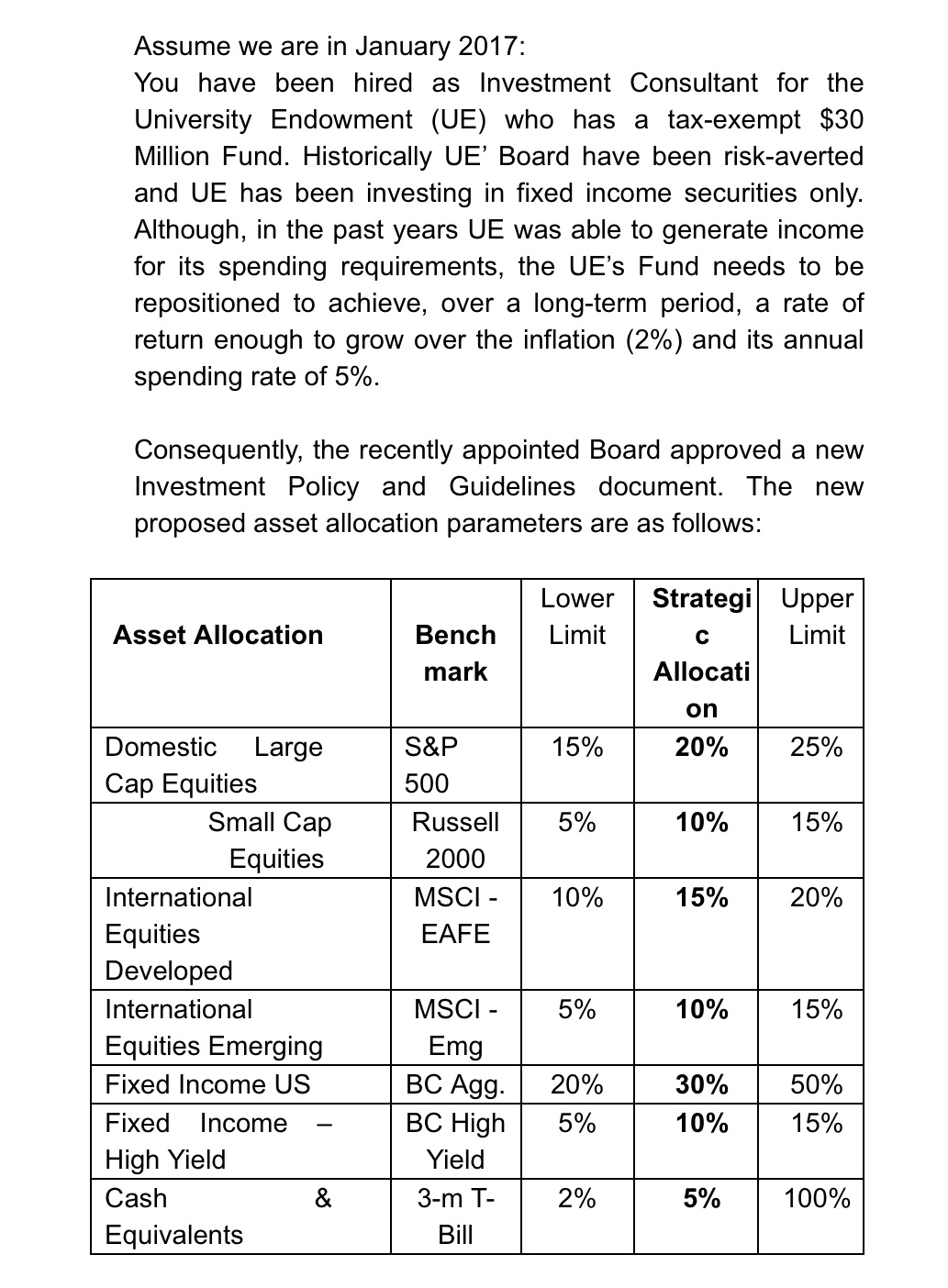

The Board is asking you to produce a detailed analysis of the characteristics of the new portfolio to be constructed according to this Strategic Asset allocation. You have been able to gather the information contained in the table included as attachment. Required: 1. For each asset category determine 1. 10-year arithmetic mean historical annual rate of return 2. 10-year geometrical mean historical annual rate of return 3. Standard deviation of arithmetic mean historical annual rate of return 4. Coefficient of variation (Std. Deviation/ Return) 5. Beta by formula (x= x m 'xm / m) 2. Determine and construct using Excel formulas 1. The covariance matrix 2. The coefficient correlation matrix 3. The Capital market Line (using the US Large Cap as a proxy for the market and US Treasury Bills for risk free rate) 4. The Security Market Line 3. Determine de Expected Return and Standard deviation for the portfolio, according to the strategic asset allocation. Parte II - tabla de rendimientos histricos.doc MERCADO DE VALORES (STOCK MARKET)-FINA 3300 Table 1 Asset Categories Historical Rates of Return ANNUAL RETURNS Asset Category US Large Cap 2007 5.77% US Small Cap -1.57% 2008 2009 -37.60% 28.43% -33.79% 27.17% 2010 16.10% 2011 2012 2013 2014 2015 2016 1.50% 16.42% 33.11% 13.70% 1.40% 12.10% 26.85% -4.18% 16.35% 38.82% 4.90% -4.40% 21.30% Non-US Developed 11.17% -43.38% 31.78% 7.75% -12.14% 17.32% 22.78% -4.90% -0.08% 4.50% Non-US Emerging 39.78% -53.18% 79.02% 19.20% -18.17% 18.63% -2.27% -1.80% -14.60% 11.20% US Govt & Credit 6.97% 5.24% 5.93% 6.54% 7.84% 4.21% -2.02% 6.00% 0.50% 2.60% High Yield 2.19% -26.39% 57.51% 15.19% 4.38% 15.58% 7.42% 3.50% -2.80% 17.10% US Treasury Bill 4.74% 1.80% 0.16% 0.13% 0.08% 0.07% 0.05% 0.00% 0.00% 0.26% Assume we are in January 2017: You have been hired as Investment Consultant for the University Endowment (UE) who has a tax-exempt $30 Million Fund. Historically UE' Board have been risk-averted and UE has been investing in fixed income securities only. Although, in the past years UE was able to generate income for its spending requirements, the UE's Fund needs to be repositioned to achieve, over a long-term period, a rate of return enough to grow over the inflation (2%) and its annual spending rate of 5%. Consequently, the recently appointed Board approved a new Investment Policy and Guidelines document. The new proposed asset allocation parameters are as follows: Lower Strategi Upper Asset Allocation Bench Limit C Limit mark Allocati on Domestic Large S&P 15% 20% 25% Cap Equities 500 Small Cap Russell 5% 10% 15% Equities 2000 International MSCI - 10% 15% 20% Equities EAFE Developed International MSCI - 5% 10% 15% Equities Emerging Emg Fixed Income US BC Agg. 20% 30% 50% Fixed Income BC High 5% 10% 15% High Yield Yield Cash & 3-m T- 2% 5% 100% Equivalents Bill

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started