Answered step by step

Verified Expert Solution

Question

1 Approved Answer

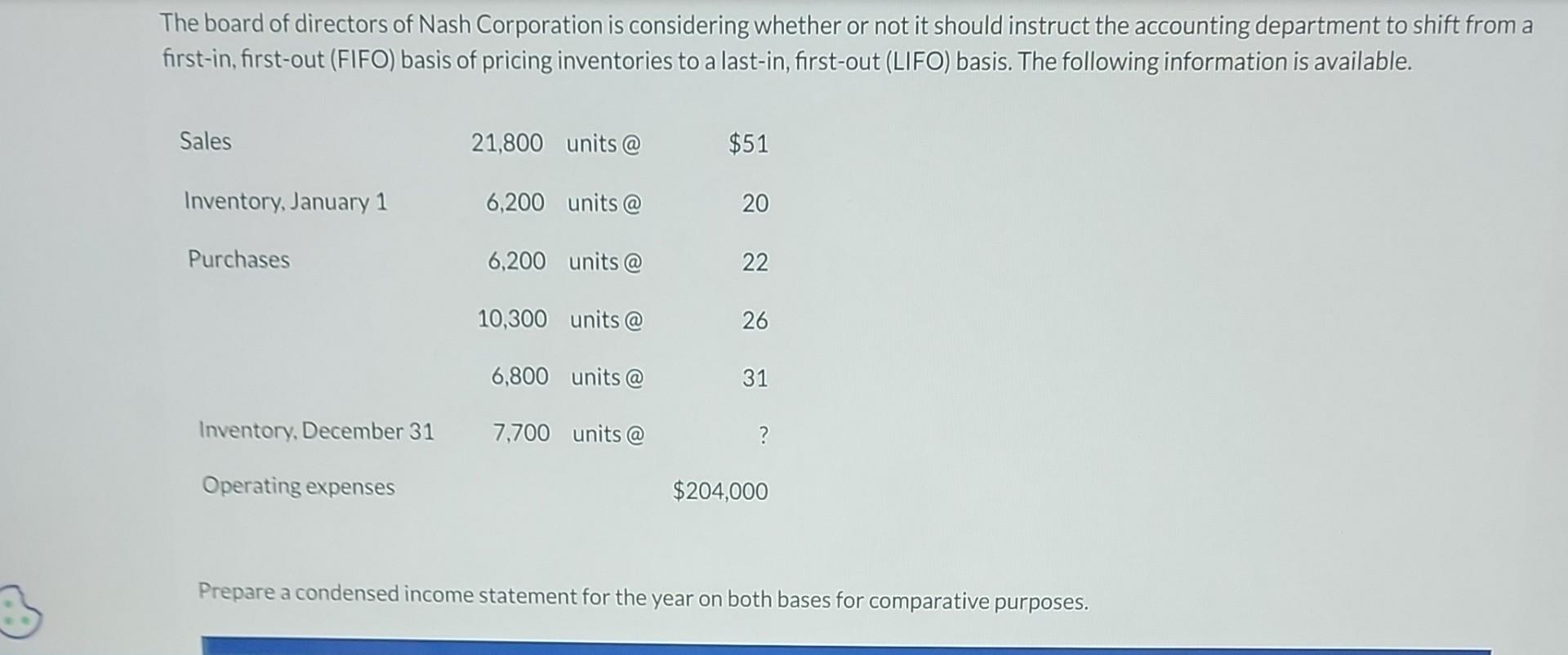

The board of directors of Nash Corporation is considering whether or not it should instruct the accounting department to shift from a first-in, first-out (FIFO)

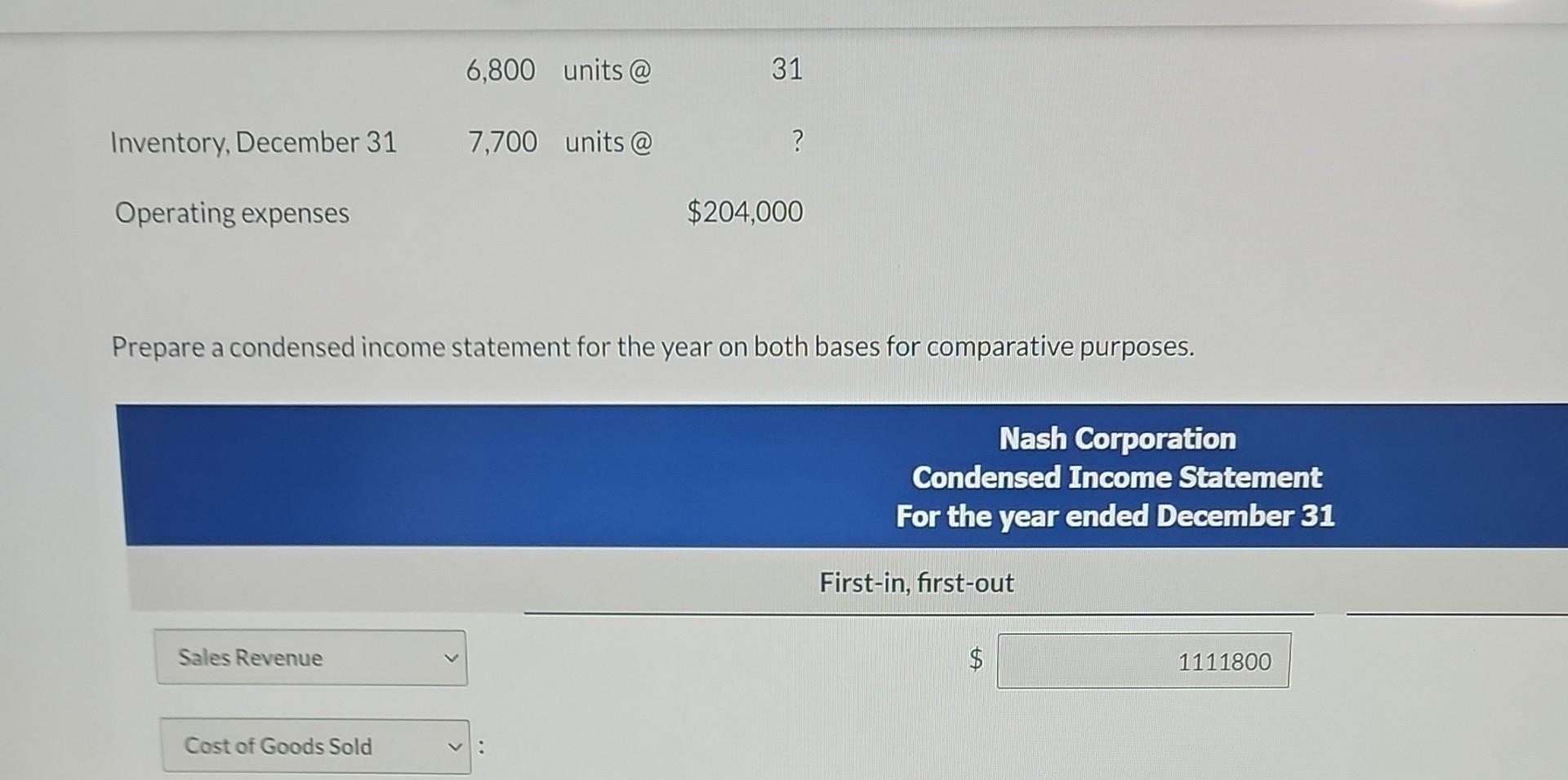

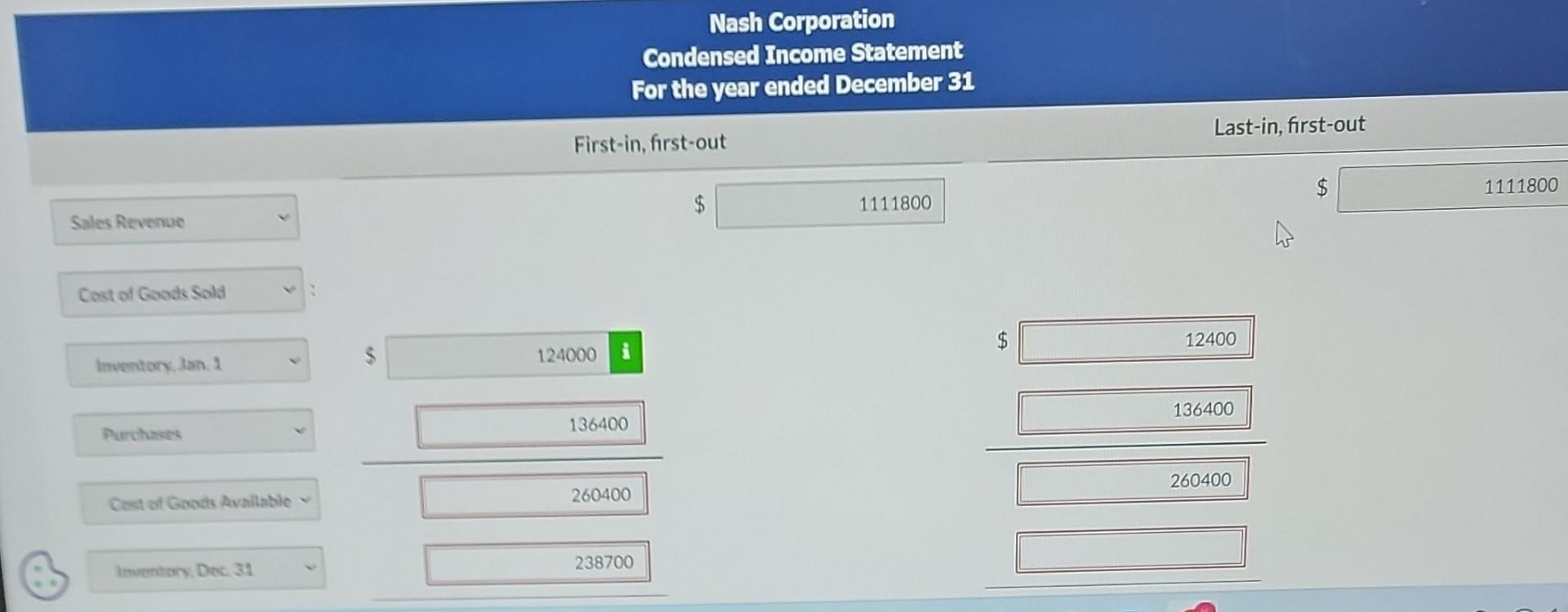

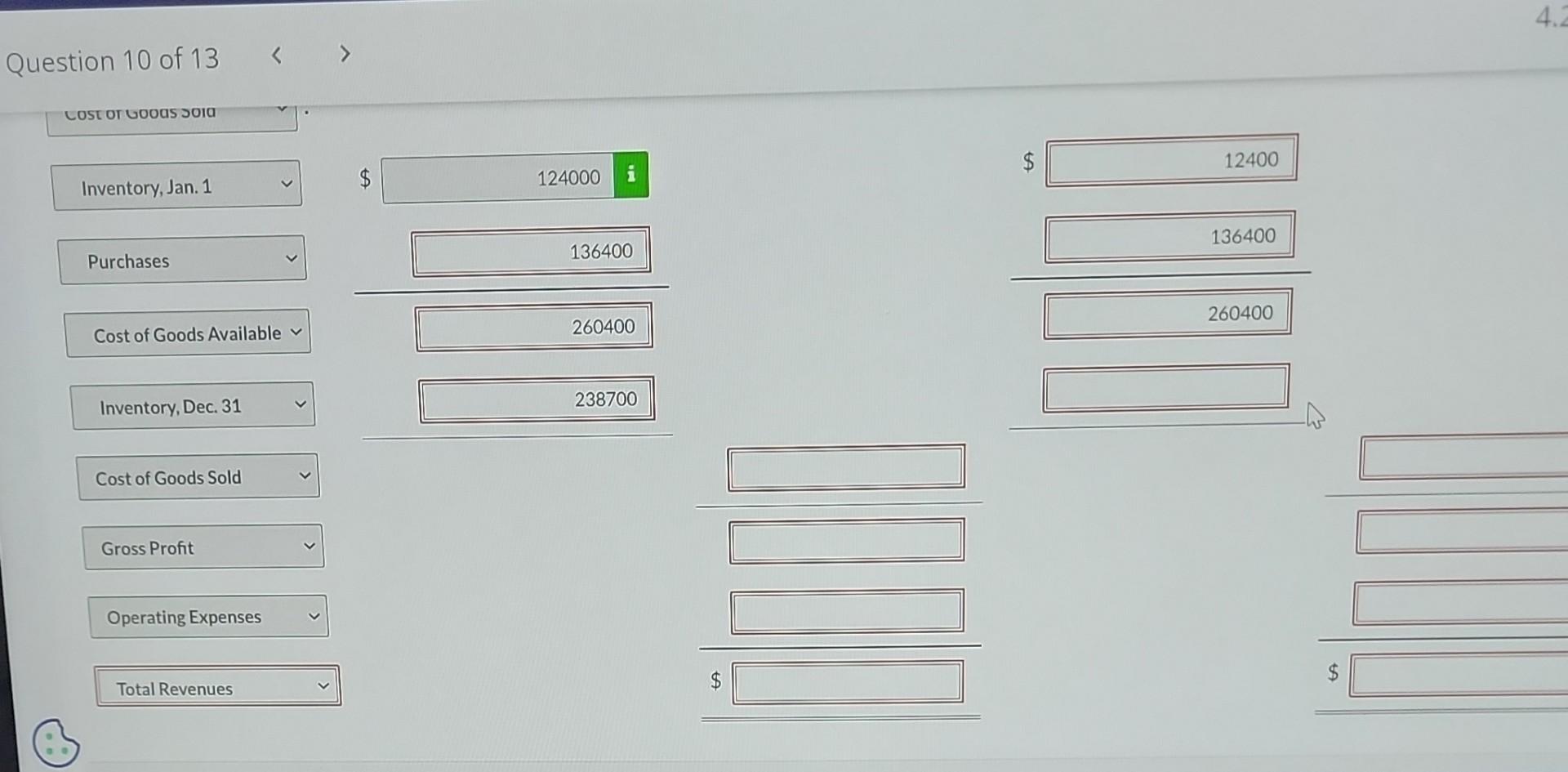

The board of directors of Nash Corporation is considering whether or not it should instruct the accounting department to shift from a first-in, first-out (FIFO) basis of pricing inventories to a last-in, first-out (LIFO) basis. The following information is available. Prepare a condensed income statement for the year on both bases for comparative purposes. Prepare a condensed income statement for the year on both bases for comparative purposes. Nash Corporation Condensed Income Statement For the year ended December 31 First-in, first-out Last-in, first-out Sales Revenue $111800 $ 5124000 i $12400 Purchases Question 10 of 13 cost ot uouds soid Inventory, Jan. 1 Cost of Goods Available Inventory, Dec. 31 238700 Cost of Goods Sold Gross Profit Operating Expenses Total Revenues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started