Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Boeing 7E7 case illustrates the concept and estimation process of the weighted average cost of capital (WACC). Boeing has two divisions: commercial and

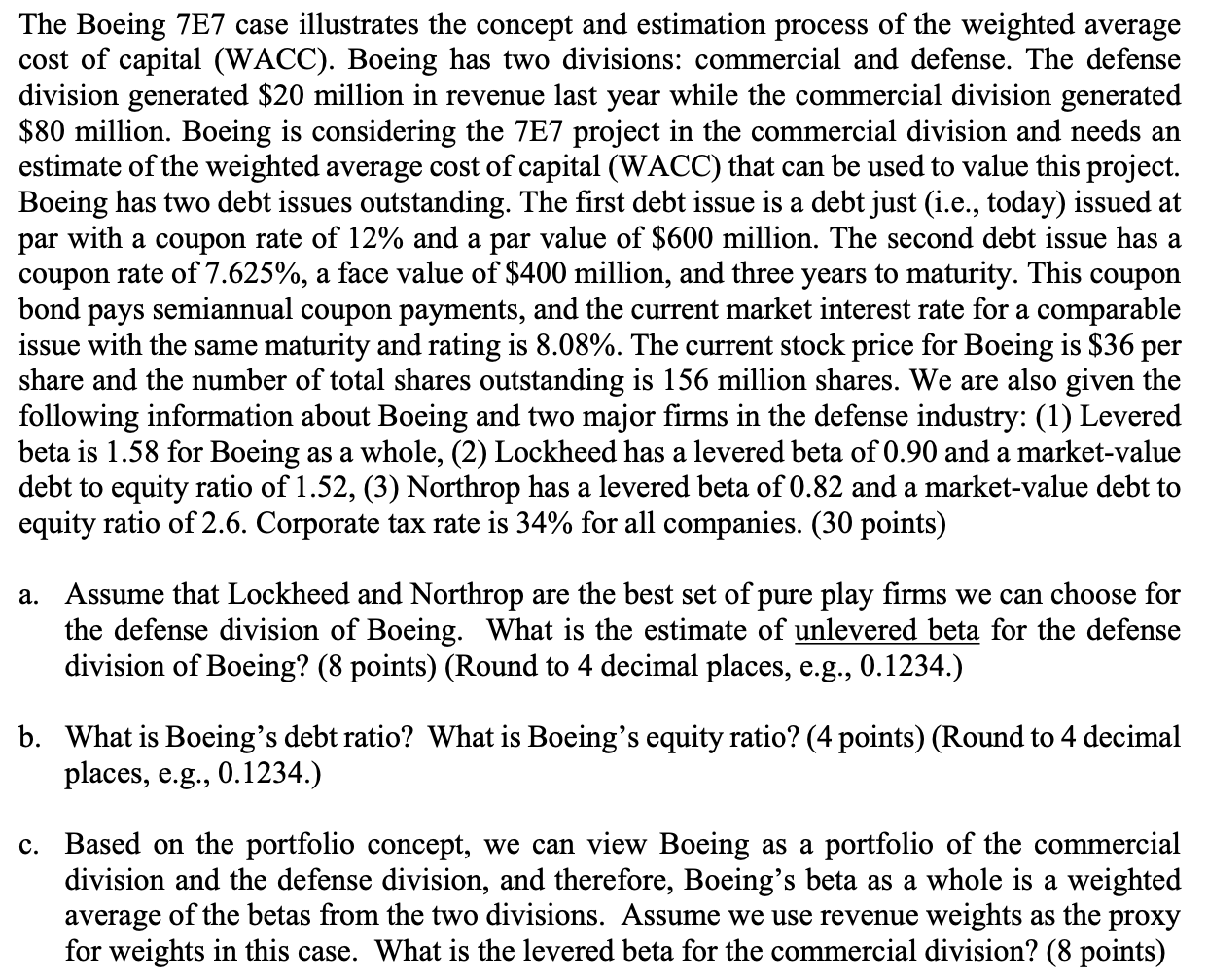

The Boeing 7E7 case illustrates the concept and estimation process of the weighted average cost of capital (WACC). Boeing has two divisions: commercial and defense. The defense division generated $20 million in revenue last year while the commercial division generated $80 million. Boeing is considering the 7E7 project in the commercial division and needs an estimate of the weighted average cost of capital (WACC) that can be used to value this project. Boeing has two debt issues outstanding. The first debt issue is a debt just (i.e., today) issued at par with a coupon rate of 12% and a par value of $600 million. The second debt issue has a coupon rate of 7.625%, a face value of $400 million, and three years to maturity. This coupon bond pays semiannual coupon payments, and the current market interest rate for a comparable issue with the same maturity and rating is 8.08%. The current stock price for Boeing is $36 per share and the number of total shares outstanding is 156 million shares. We are also given the following information about Boeing and two major firms in the defense industry: (1) Levered beta is 1.58 for Boeing as a whole, (2) Lockheed has a levered beta of 0.90 and a market-value debt to equity ratio of 1.52, (3) Northrop has a levered beta of 0.82 and a market-value debt to equity ratio of 2.6. Corporate tax rate is 34% for all companies. (30 points) a. Assume that Lockheed and Northrop are the best set of pure play firms we can choose for the defense division of Boeing. What is the estimate of unlevered beta for the defense division of Boeing? (8 points) (Round to 4 decimal places, e.g., 0.1234.) b. What is Boeing's debt ratio? What is Boeing's equity ratio? (4 points) (Round to 4 decimal places, e.g., 0.1234.) c. Based on the portfolio concept, we can view Boeing as a portfolio of the commercial division and the defense division, and therefore, Boeing's beta as a whole is a weighted average of the betas from the two divisions. Assume we use revenue weights as the proxy for weights in this case. What is the levered beta for the commercial division? (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started