Question

The bond payable footnote for Ruby Tuesday, Inc. is shown below. Using this information answer the following questions. 1. The bond payable shown is unsecured.

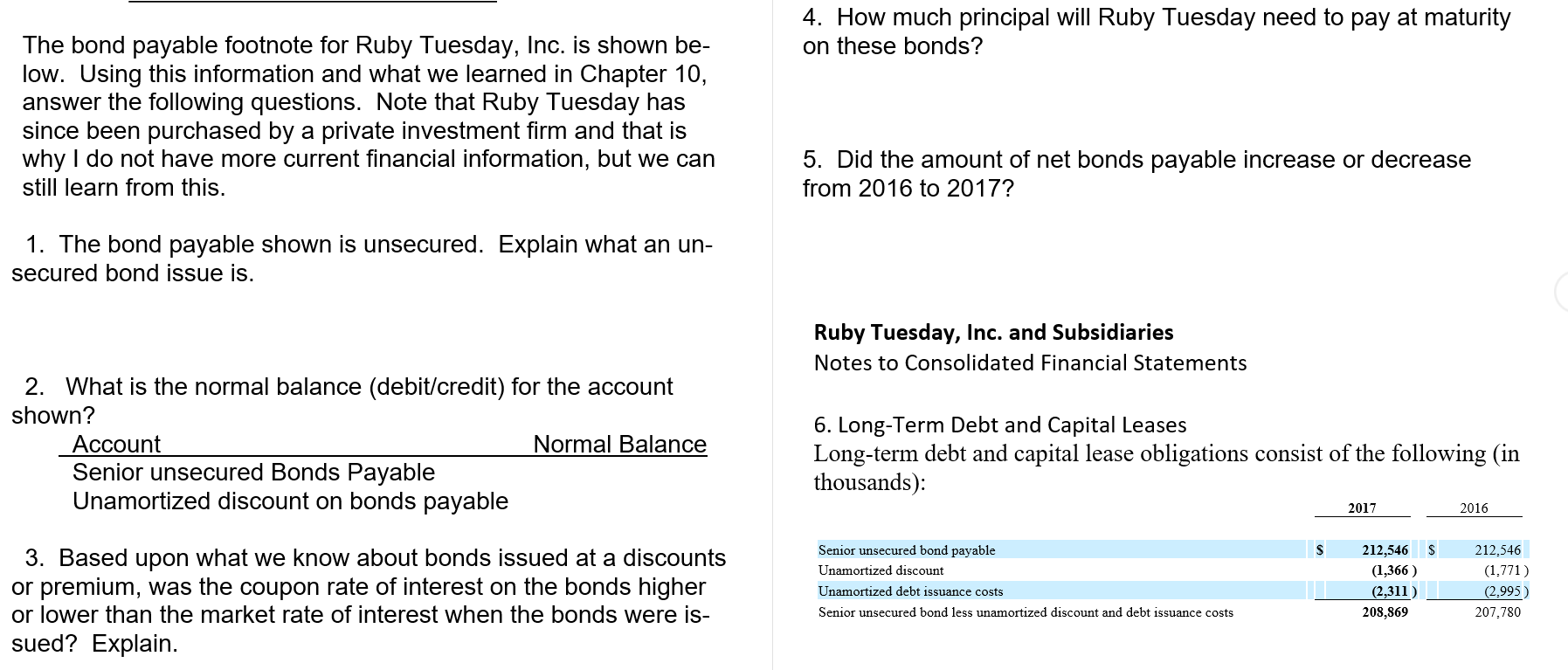

The bond payable footnote for Ruby Tuesday, Inc. is shown below. Using this information answer the following questions.

1. The bond payable shown is unsecured. Explain what an unsecured bond issue is.

2. What is the normal balance (debit/credit) for the account shown?

3. Based upon what we know about bonds issued at a discounts or premium, was the coupon rate of interest on the bonds higher or lower than the market rate of interest when the bonds were issued? Explain.

4. How much principal will Ruby Tuesday need to pay at maturity on these bonds?

5. Did the amount of net bonds payable increase or decrease from 2016 to 2017?

4. How much principal will Ruby Tuesday need to pay at maturity on these bonds? The bond payable footnote for Ruby Tuesday, Inc. is shown be- low. Using this information and what we learned in Chapter 10, answer the following questions. Note that Ruby Tuesday has since been purchased by a private investment firm and that is why I do not have more current financial information, but we can still learn from this. 5. Did the amount of net bonds payable increase or decrease from 2016 to 2017? 1. The bond payable shown is unsecured. Explain what an un- secured bond issue is. Ruby Tuesday, Inc. and Subsidiaries Notes to Consolidated Financial Statements 2. What is the normal balance (debit/credit) for the account shown? Account Normal Balance Senior unsecured Bonds Payable Unamortized discount on bonds payable 6. Long-Term Debt and Capital Leases Long-term debt and capital lease obligations consist of the following (in thousands): 2017 2016 3. Based upon what we know about bonds issued at a discounts or premium, was the coupon rate of interest on the bonds higher or lower than the market rate of interest when the bonds were is- sued? Explain. Senior unsecured bond payable Unamortized discount Unamortized debt issuance costs Senior unsecured bond less unamortized discount and debt issuance costs 212,546 (1,366 ) (2,311 ) 208,869 212,546 (1,771) (2,995) 207,780Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started