Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The bond portfolio has seven bonds: - A $20,000 par value bond from 3M Co. with a coupon of 3.00%. The bond is a senior

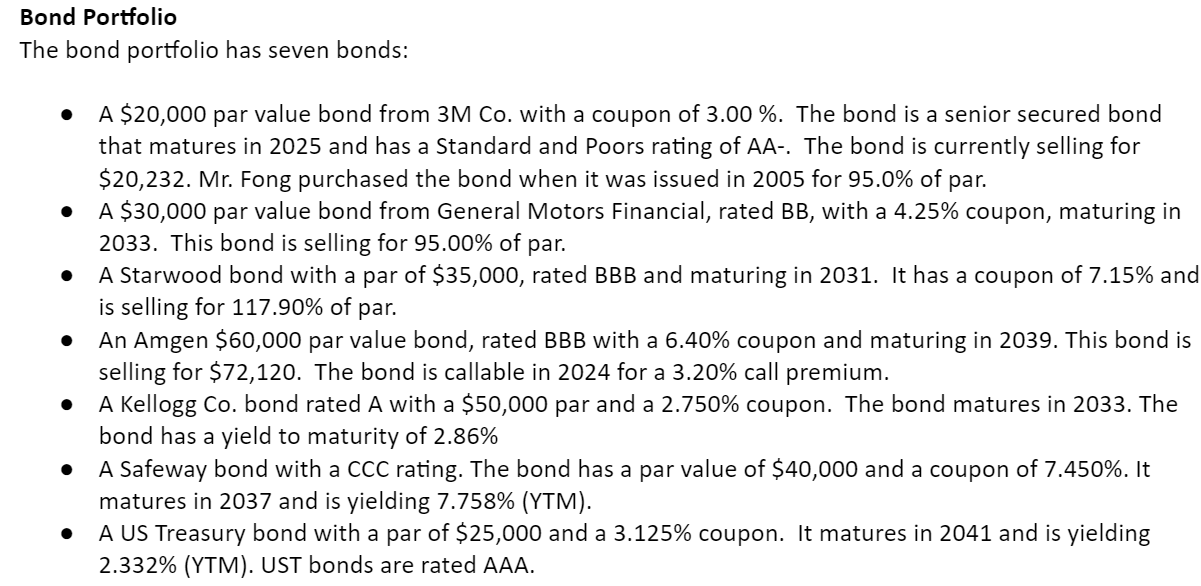

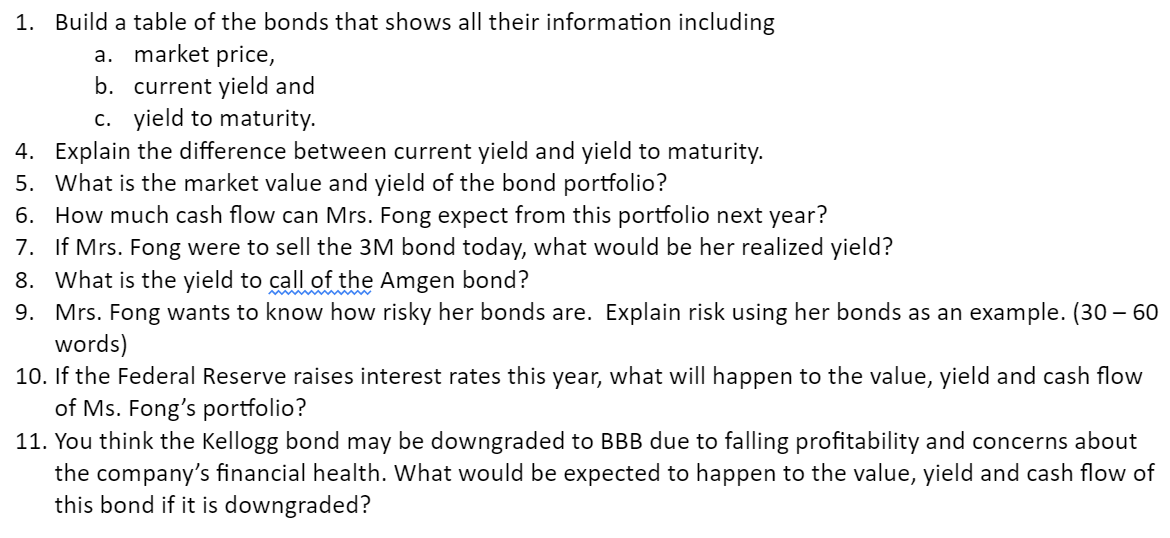

The bond portfolio has seven bonds: - A $20,000 par value bond from 3M Co. with a coupon of 3.00%. The bond is a senior secured bond that matures in 2025 and has a Standard and Poors rating of AA-. The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. - A $30,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2033. This bond is selling for 95.00% of par. - A Starwood bond with a par of $35,000, rated BBB and maturing in 2031 . It has a coupon of 7.15% ano is selling for 117.90% of par. - An Amgen $60,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039 . This bond is selling for $72,120. The bond is callable in 2024 for a 3.20% call premium. - A Kellogg Co. bond rated A with a $50,000 par and a 2.750% coupon. The bond matures in 2033 . The bond has a yield to maturity of 2.86% - A Safeway bond with a CCC rating. The bond has a par value of $40,000 and a coupon of 7.450%. It matures in 2037 and is yielding 7.758\% (YTM). - A US Treasury bond with a par of $25,000 and a 3.125% coupon. It matures in 2041 and is yielding 2.332% (YTM). UST bonds are rated AAA. 1. Build a table of the bonds that shows all their information including a. market price, b. current yield and c. yield to maturity. 4. Explain the difference between current yield and yield to maturity. 5. What is the market value and yield of the bond portfolio? 6. How much cash flow can Mrs. Fong expect from this portfolio next year? 7. If Mrs. Fong were to sell the 3M bond today, what would be her realized yield? 8. What is the yield to call of the Amgen bond? 9. Mrs. Fong wants to know how risky her bonds are. Explain risk using her bonds as an example. ( 3060 words) 10. If the Federal Reserve raises interest rates this year, what will happen to the value, yield and cash flow of Ms. Fong's portfolio? 11. You think the Kellogg bond may be downgraded to BBB due to falling profitability and concerns about the company's financial health. What would be expected to happen to the value, yield and cash flow of this bond if it is downgraded

The bond portfolio has seven bonds: - A $20,000 par value bond from 3M Co. with a coupon of 3.00%. The bond is a senior secured bond that matures in 2025 and has a Standard and Poors rating of AA-. The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. - A $30,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2033. This bond is selling for 95.00% of par. - A Starwood bond with a par of $35,000, rated BBB and maturing in 2031 . It has a coupon of 7.15% ano is selling for 117.90% of par. - An Amgen $60,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039 . This bond is selling for $72,120. The bond is callable in 2024 for a 3.20% call premium. - A Kellogg Co. bond rated A with a $50,000 par and a 2.750% coupon. The bond matures in 2033 . The bond has a yield to maturity of 2.86% - A Safeway bond with a CCC rating. The bond has a par value of $40,000 and a coupon of 7.450%. It matures in 2037 and is yielding 7.758\% (YTM). - A US Treasury bond with a par of $25,000 and a 3.125% coupon. It matures in 2041 and is yielding 2.332% (YTM). UST bonds are rated AAA. 1. Build a table of the bonds that shows all their information including a. market price, b. current yield and c. yield to maturity. 4. Explain the difference between current yield and yield to maturity. 5. What is the market value and yield of the bond portfolio? 6. How much cash flow can Mrs. Fong expect from this portfolio next year? 7. If Mrs. Fong were to sell the 3M bond today, what would be her realized yield? 8. What is the yield to call of the Amgen bond? 9. Mrs. Fong wants to know how risky her bonds are. Explain risk using her bonds as an example. ( 3060 words) 10. If the Federal Reserve raises interest rates this year, what will happen to the value, yield and cash flow of Ms. Fong's portfolio? 11. You think the Kellogg bond may be downgraded to BBB due to falling profitability and concerns about the company's financial health. What would be expected to happen to the value, yield and cash flow of this bond if it is downgraded Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started