Question

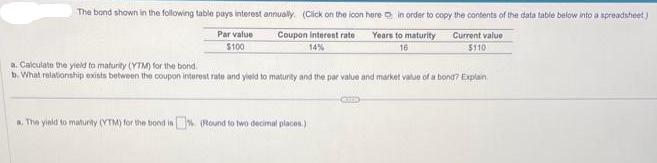

The bond shown in the following table pays interest annually. (Click on the icon here in order to copy the contents of the data

The bond shown in the following table pays interest annually. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Par value $100 Coupon Interest rate 14% Years to maturity 16 Current value $110 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain a. The yield to maturity (VTM) for the bood is (Round to two decimal places)

Step by Step Solution

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the yield to maturity YTM for the bond we need to use the following formula PV C1r C1r2 C1rn F1rn Where PV Present value of the bond Current value C Annual coupon payment r Yie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

14th Edition

0135175216, 978-0135175217

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App