Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The book balance of Macro, Inc.'s checking account on July 31, 2023 was $5,790. The bank statement balance on that date was $8,500. Not

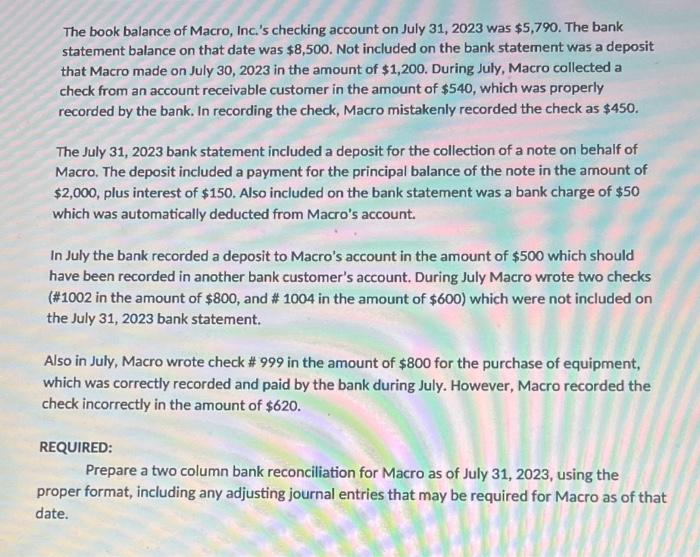

The book balance of Macro, Inc.'s checking account on July 31, 2023 was $5,790. The bank statement balance on that date was $8,500. Not included on the bank statement was a deposit that Macro made on July 30, 2023 in the amount of $1,200. During July, Macro collected a check from an account receivable customer in the amount of $540, which was properly recorded by the bank. In recording the check, Macro mistakenly recorded the check as $450. The July 31, 2023 bank statement included a deposit for the collection of a note on behalf of Macro. The deposit included a payment for the principal balance of the note in the amount of $2,000, plus interest of $150. Also included on the bank statement was a bank charge of $50 which was automatically deducted from Macro's account. In July the bank recorded a deposit to Macro's account in the amount of $500 which should have been recorded in another bank customer's account. During July Macro wrote two checks (#1002 in the amount of $800, and # 1004 in the amount of $600) which were not included on the July 31, 2023 bank statement. Also in July, Macro wrote check # 999 in the amount of $800 for the purchase of equipment, which was correctly recorded and paid by the bank during July. However, Macro recorded the check incorrectly in the amount of $620. REQUIRED: Prepare a two column bank reconciliation for Macro as of July 31, 2023, using the proper format, including any adjusting journal entries that may be required for Macro as of that date. The book balance of Macro, Inc.'s checking account on July 31, 2023 was $5,790. The bank statement balance on that date was $8,500. Not included on the bank statement was a deposit that Macro made on July 30, 2023 in the amount of $1,200. During July, Macro collected a check from an account receivable customer in the amount of $540, which was properly recorded by the bank. In recording the check, Macro mistakenly recorded the check as $450. The July 31, 2023 bank statement included a deposit for the collection of a note on behalf of Macro. The deposit included a payment for the principal balance of the note in the amount of $2,000, plus interest of $150. Also included on the bank statement was a bank charge of $50 which was automatically deducted from Macro's account. In July the bank recorded a deposit to Macro's account in the amount of $500 which should have been recorded in another bank customer's account. During July Macro wrote two checks (#1002 in the amount of $800, and # 1004 in the amount of $600) which were not included on the July 31, 2023 bank statement. Also in July, Macro wrote check # 999 in the amount of $800 for the purchase of equipment, which was correctly recorded and paid by the bank during July. However, Macro recorded the check incorrectly in the amount of $620. REQUIRED: Prepare a two column bank reconciliation for Macro as of July 31, 2023, using the proper format, including any adjusting journal entries that may be required for Macro as of that date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a bank reconciliation for Macro as of July 31 2023 we need to adjust the book balance and the bank balance based on the information provided to calculate the adjusted cash balance Heres a s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started