Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead, I don't have time. You have been

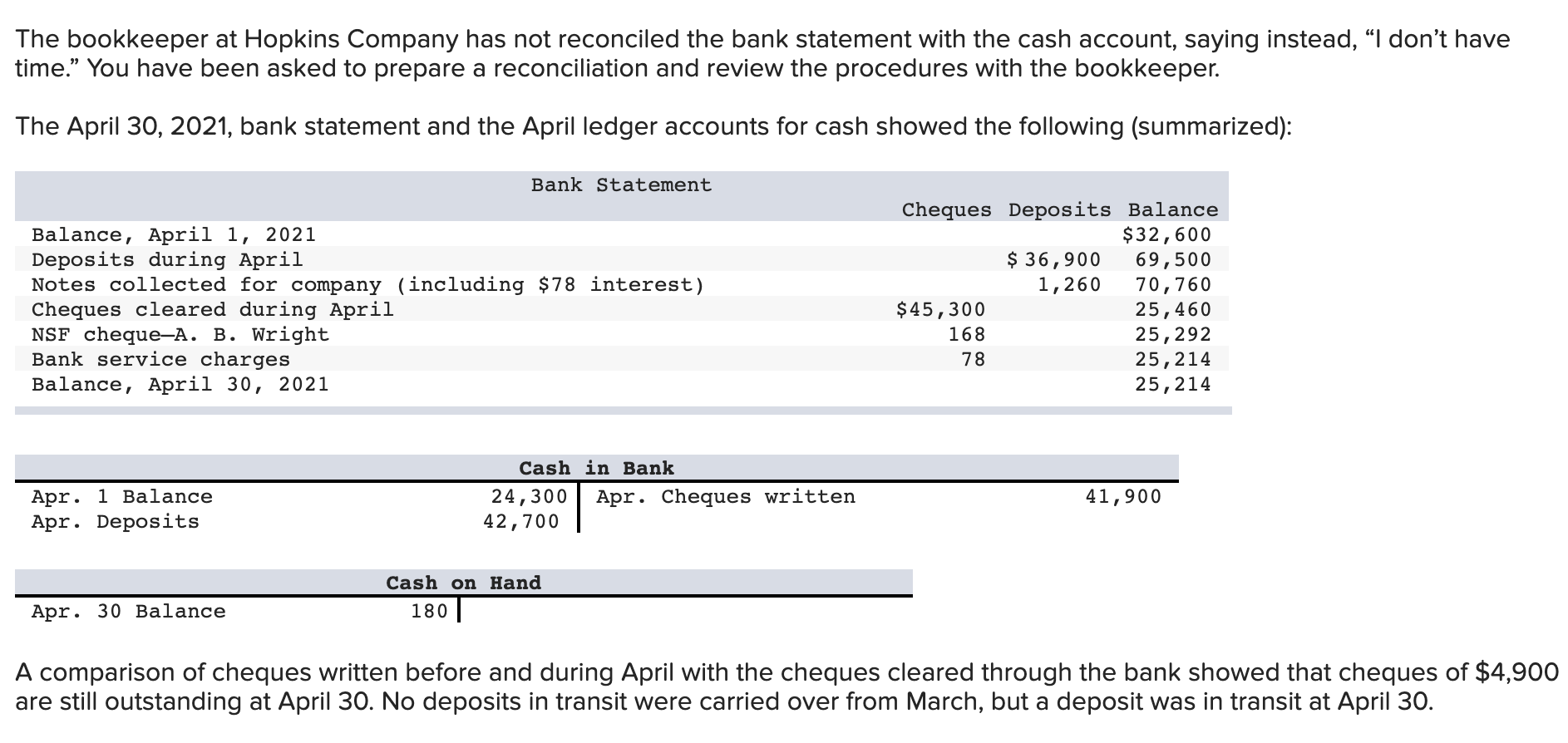

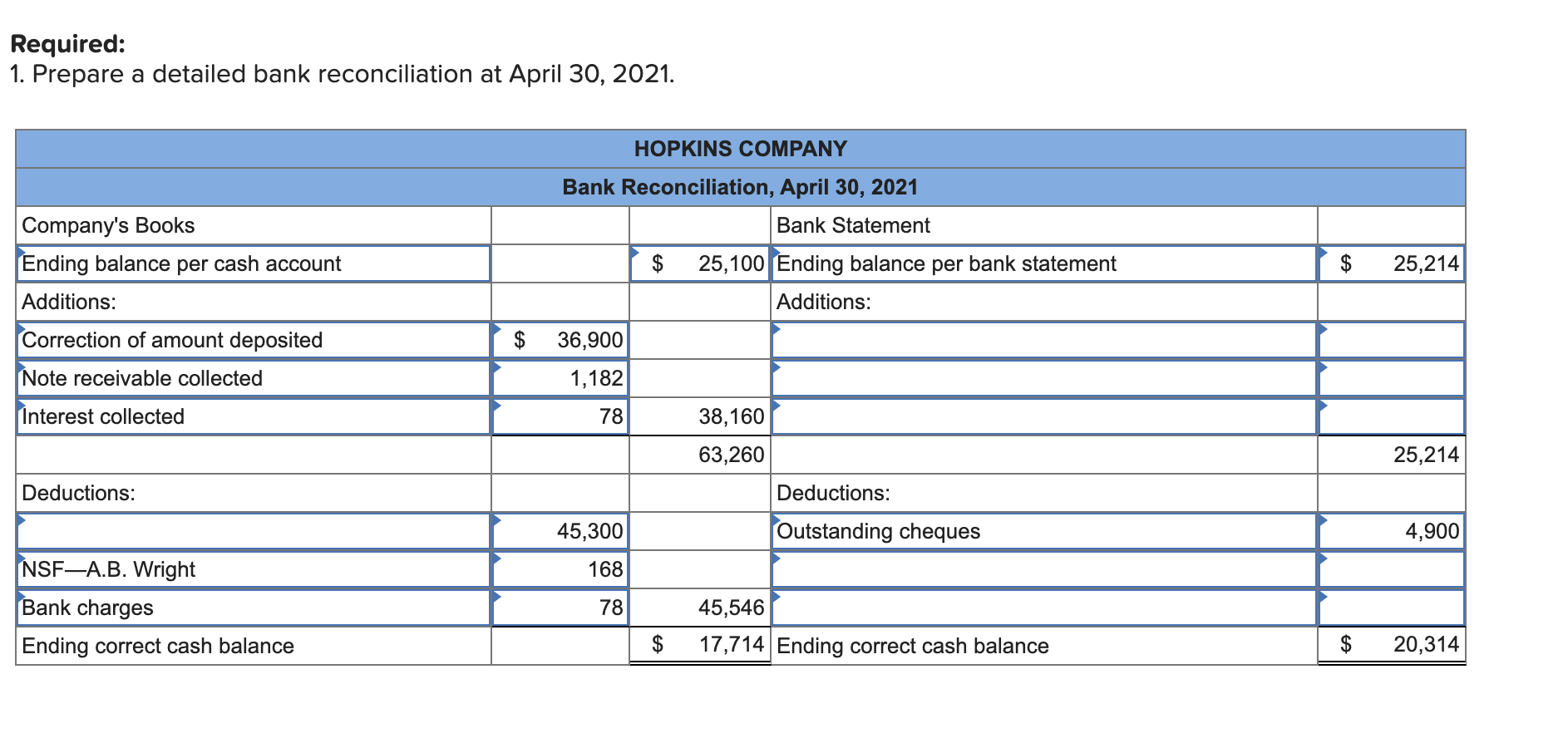

The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead, I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, 2021, bank statement and the April ledger accounts for cash showed the following (summarized): Bank Statement Cheques Deposits Balance Balance, April 1, 2021 $32,600 Deposits during April $ 36,900 69,500 Notes collected for company (including $78 interest) 1,260 70,760 Cheques cleared during April NSF cheque-A. B. Wright $45,300 168 25,460 25,292 Bank service charges Balance, April 30, 2021 78 25,214 25,214 Apr. 1 Balance Apr. Deposits Apr. 30 Balance Cash in Bank 24,300 42,700 Apr. Cheques written Cash on Hand 180 || 41,900 A comparison of cheques written before and during April with the cheques cleared through the bank showed that cheques of $4,900 are still outstanding at April 30. No deposits in transit were carried over from March, but a deposit was in transit at April 30. Required: 1. Prepare a detailed bank reconciliation at April 30, 2021. Company's Books Ending balance per cash account Additions: Correction of amount deposited Note receivable collected Interest collected Deductions: HOPKINS COMPANY Bank Reconciliation, April 30, 2021 Bank Statement $ 25,100 Ending balance per bank statement Additions: $ 25,214 $ 36,900 1,182 78 38,160 63,260 Deductions: Outstanding cheques 25,214 45,300 4,900 NSF-A.B. Wright 168 Bank charges 78 45,546 Ending correct cash balance $ 17,714 Ending correct cash balance $ 20,314

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started