Answered step by step

Verified Expert Solution

Question

1 Approved Answer

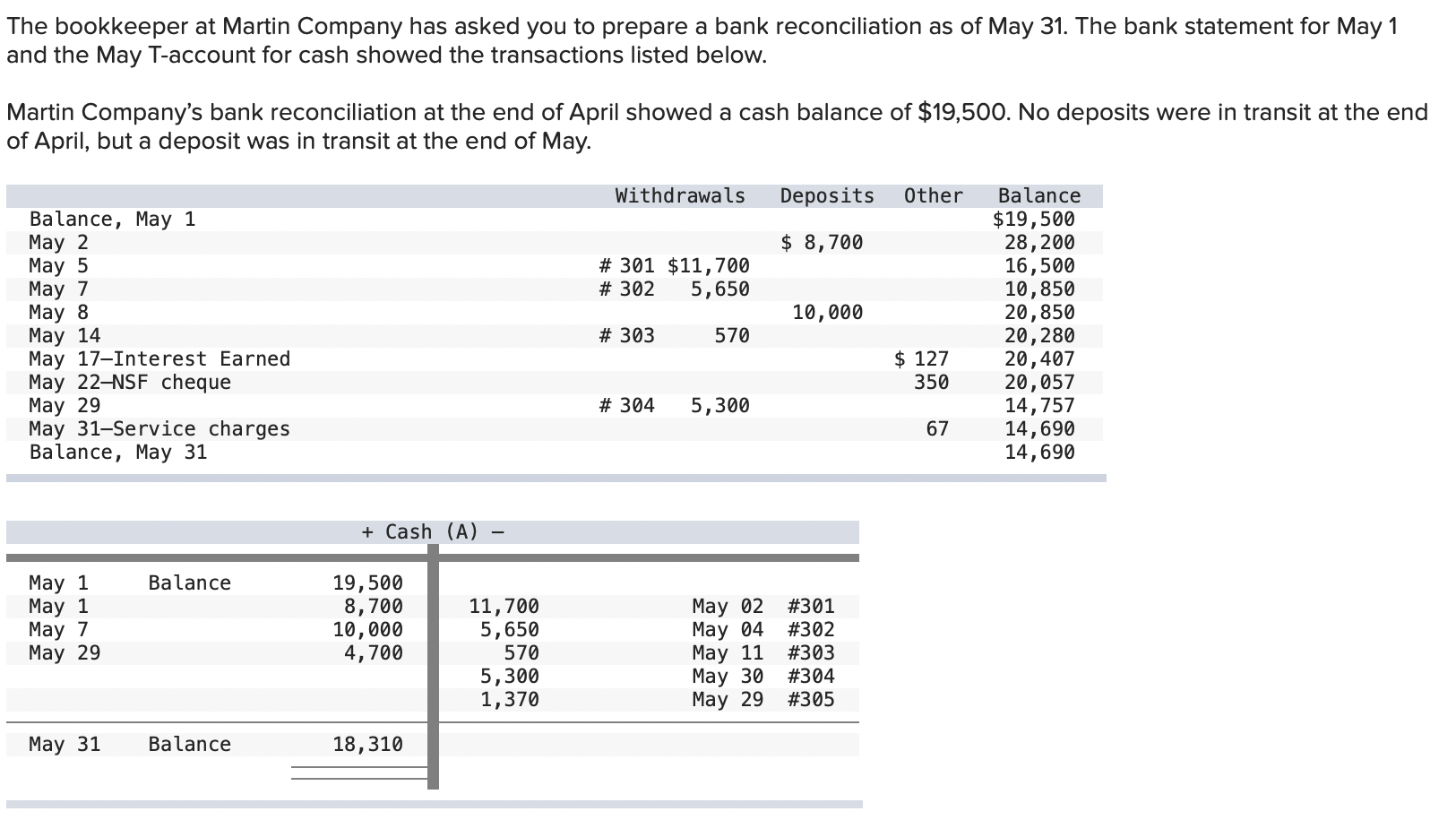

The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The bank statement for May 1 and

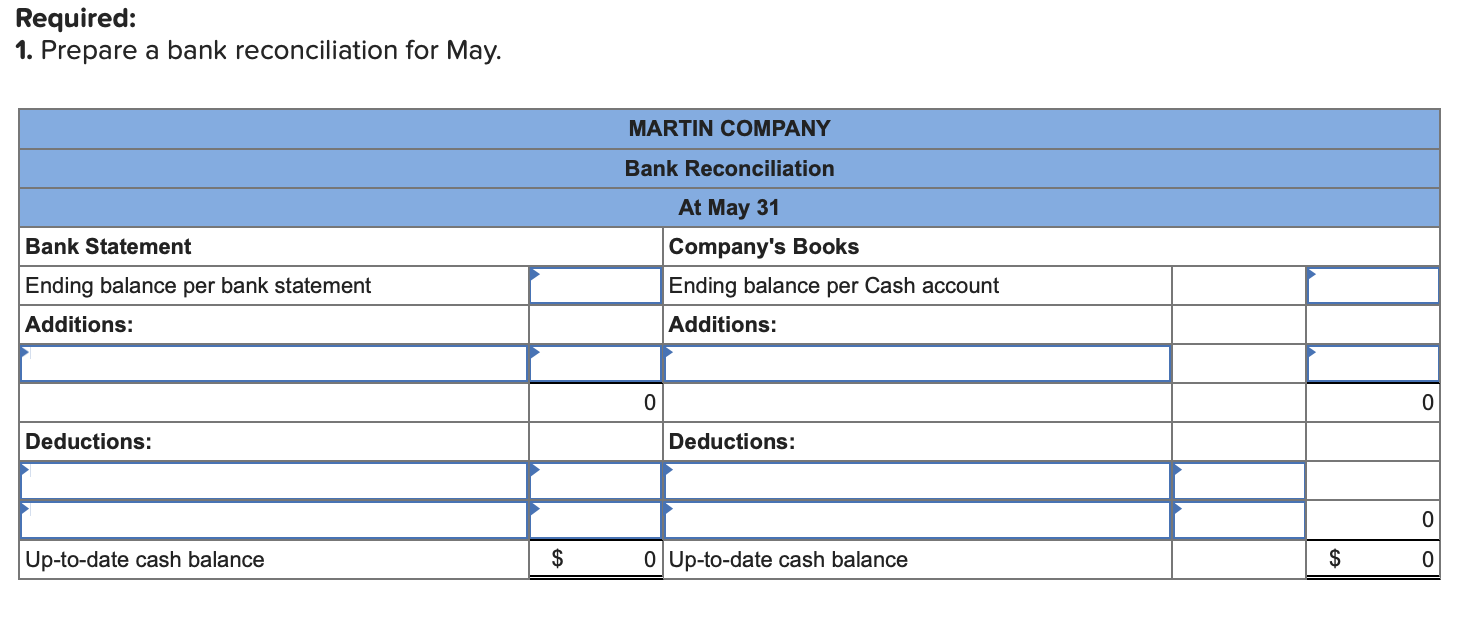

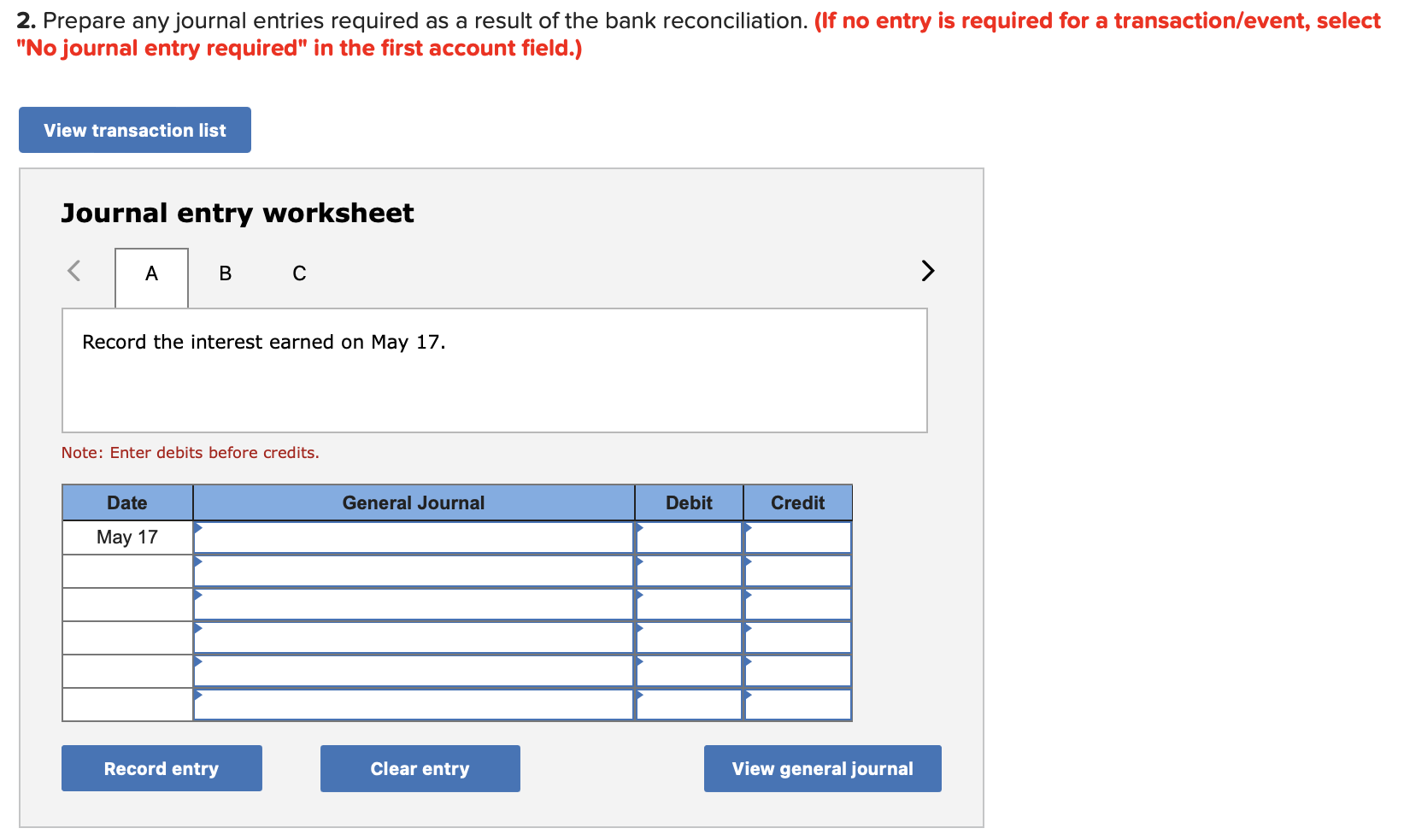

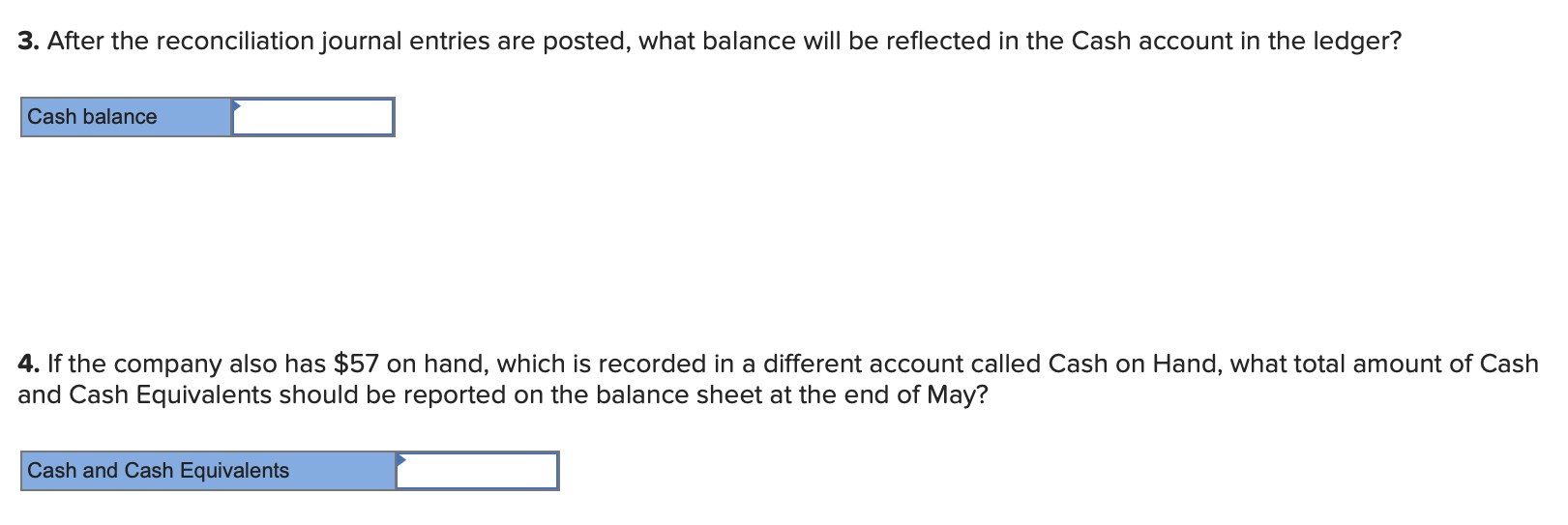

The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The bank statement for May 1 and the May T-account for cash showed the transactions listed below. Martin Company's bank reconciliation at the end of April showed a cash balance of $19,500. No deposits were in transit at the end of April, but a deposit was in transit at the end of May. Withdrawals Deposits Other Balance Balance, May 1 $19,500 May 2 $ 8,700 28,200 May 5 May 7 # 301 $11,700 # 302 5,650 16,500 10,850 May 8 10,000 20,850 May 14 # 303 570 20,280 May 17-Interest Earned $ 127 20,407 May 22-NSF cheque 350 20,057 May 29 # 304 5,300 14,757 May 31-Service charges 67 14,690 Balance, May 31 14,690 + Cash (A) May 1 Balance 19,500 May 1 8,700 11,700 May 02 #301 May 7 10,000 5,650 May 04 #302 May 29 4,700 570 May 11 #303 5,300 May 30 #304 1,370 May 29 #305 May 31 Balance 18,310 Required: 1. Prepare a bank reconciliation for May. Bank Statement Ending balance per bank statement Additions: Deductions: MARTIN COMPANY Bank Reconciliation At May 31 Company's Books Ending balance per Cash account Additions: 0 Deductions: 0 0 Up-to-date cash balance $ 0 Up-to-date cash balance $ 0 2. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet A B C Record the interest earned on May 17. Note: Enter debits before credits. Date May 17 General Journal Debit Credit View general journal Record entry Clear entry 3. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? Cash balance 4. If the company also has $57 on hand, which is recorded in a different account called Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the balance sheet at the end of May? Cash and Cash Equivalents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the bank reconciliation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started