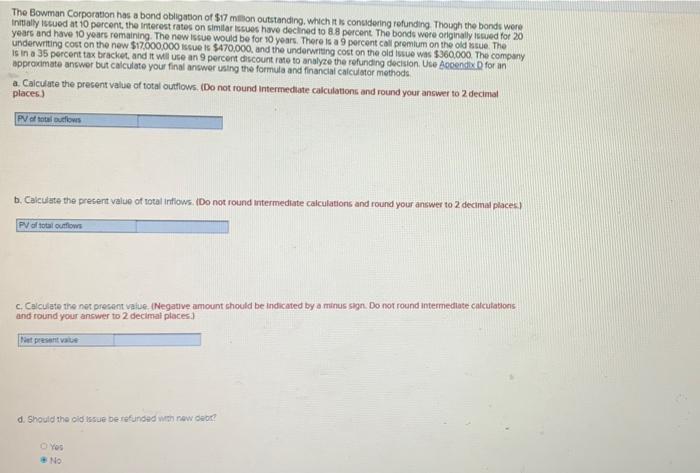

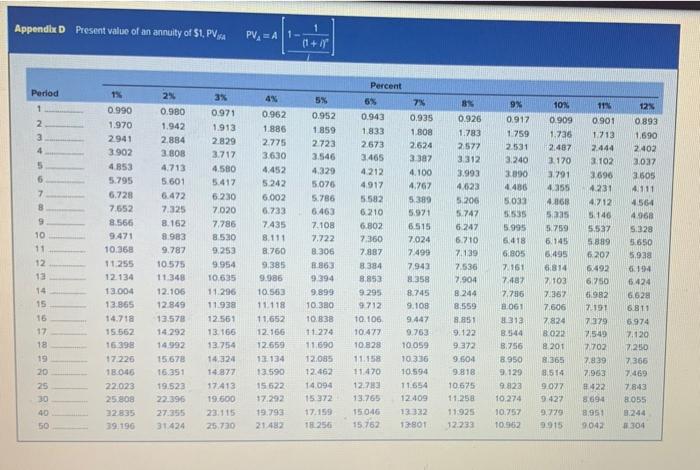

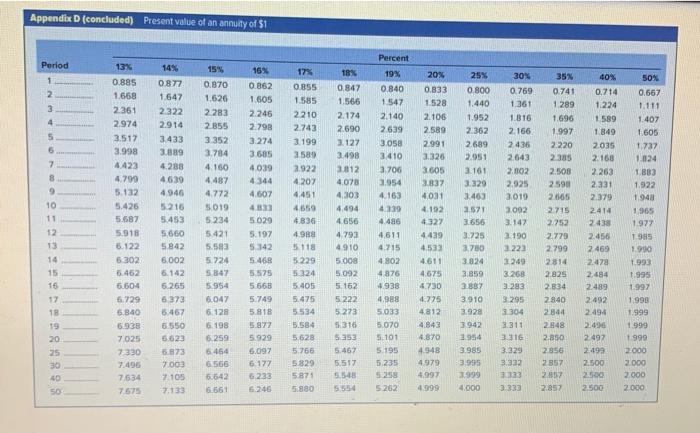

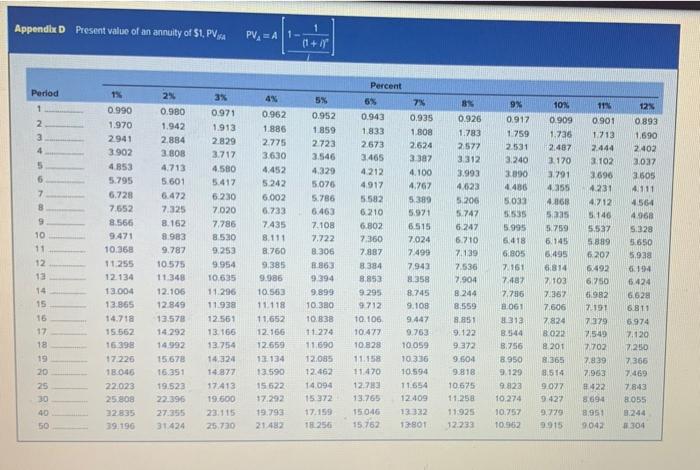

The Bowman Corporation has a bond obligation of $17 million outstanding, which it is considering rounding. Though the bonds were Initially issued at 10 percent, the Interest rates on similar issues have declined to 8.8 percent The bonds were originally issued for 20 years and have 10 years remaining. The new issue would be for 10 years. There is a 9 percent call premium on the old stue. The underwriting cost on the new $17000,000 issue is $470,000, and the underwriting cost on the old issue was $360,000. The company is in a 35 percent tax bracket, and it will use an 9 percent discount rate to analyze the refunding decision. Use Accendix D for an approximate answer but calculate your final answer using the formula and financial Calculator methods a. Calculate the present value of total outflows. (Do not round Intermediate calculations and round your answer to 2 decimal places) PV of total udflows b. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places) PV of total outflows C.Calculate the nat precarit value (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places: at presente d. Should the old scue be refunded with new deod Yos NO Appendix D Present value of an annuity of $1, PVisa PV = A1- Percent Period 1% 2% 5% 5% 7 BS 9% 1 10% 11% 0.990 12% 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 2 0.909 0.901 0.893 1.970 1.942 1.886 1859 1.833 1.808 1.783 1.759 3 1.736 1.713 1,690 2.884 2941 3.902 1.913 2.829 3.717 2.775 2723 2673 2577 2531 4 2.487 2.624 3.387 2.444 2402 3.808 3630 3.546 3.465 3.312 3.240 3.170 3.102 3.037 5 4.853 4.713 4.452 4212 4.580 5.417 4.100 3.993 3.791 6 4.329 5076 3.505 5.795 5.601 5.242 3090 4.486 4917 3696 4231 4,767 4/23 4355 4.111 7 6.472 6.002 5.786 6.728 7.652 5.230 7020 5.582 5389 5.200 5033 4.16 4.712 4564 8 7.325 6.733 6.463 6.210 5.971 51535 5.25 5.140 9 8566 8.162 7.785 5.747 6 247 7108 6.802 7435 8.111 6515 5.995 5759 5.537 4.960 5.328 5.650 10 9.471 8.983 8.530 7.722 7.360 7024 6.710 6.418 6.145 5.889 11 10.368 9.787 9.253 8.750 8.306 7.887 7/499 7139 6805 6.495 6.207 5,928 12 11.255 10.575 9.954 9.385 8.863 8384 7.943 7.536 7151 0194 12 12.134 11.348 10635 9.986 5814 7103 9.394 8.853 1358 6,492 6.750 7.904 7.487 65.424 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.362 6.982 6,628 15 13.865 12.849 11.938 11.118 10.380 9712 9,108 8.559 8.061 7.606 7.191 6811 16 13.578 122561 11,652 10.838 10.106 9447 8.851 312 7824 7379 6974 14.71 151567 17 14.292 13.166 12.166 11.274 10.477 9.763 9.122 B.544 B022 7549 7.120 18 16.398 14.992 13.754 12.659 11.690 10828 10.059 9372 3.756 8201 2702 7200 19 17226 15.678 14,324 1134 12.085 11.158 10336 9504 8.950 81365 7.839 7.365 20 18046 16.351 14.877 13.590 12462 11470 10.594 9818 9 129 8514 7.963 7.469 25 22.023 19.523 17,413 15 522 14094 12.78 11 554 10.675 9123 9077 422 7.8.43 30 25.808 222396 19.600 17.292 15372 13.765 12.409 11.250 10:274 9422 8694 8055 40 22835 27.355 23.115 19.793 17.159 13332 11925 10.757 9.779 8.051 3244 15046 15.762 50 39.196 31424 25.730 21482 1256 13-801 12.233 10.562 9.915 9042 304 Appendix D (concluded) Present value of an annuity of $1 Percent Period 13% 14% 15%, 16% 17% 18% 19% 20% 25% 30% 35% 1 40% 50% 0.885 0.877 1.647 0.870 1.626 0.840 0.862 1.605 2 0.800 0.855 1.585 0.769 1.668 0.847 1.566 0.741 0.714 0.667 0.833 1.528 1547 1.440 1.361 1.289 3 1.224 1.111 2361 2322 2283 2.246 2210 2.174 2.140 2.105 1.952 1.816 1589 4 1407 2.974 2914 2855 2.798 2.743 2690 1.696 1.997 2639 2.589 2362 2.166 1.849 1.605 5 3.517 3.433 3.274 3.199 3.127 3 352 3.784 3.05 2.991 2689 2436 2.220 2035 1.737 6 3.998 3.889 3.685 3580 3498 3410 2.951 2.643 2385 2. 160 1.824 7 4.423 4.288 4.160 3.326 3605 4039 2.922 1812 3.700 3.161 2002 2.508 2.263 1.883 8 4639 4487 4344 4207 4.078 4.799 5.132 21.954 3.837 2.925 2.590 2.331 1.922 9 4946 4.772 4.607 3.329 3.463 4.451 4,303 4.163 4,031 3.019 2665 2.379 1.943 10 5.426 5.216 4833 4659 4.494 4.239 4.192 2571 2002 2.715 5019 5.234 2.414 1.965 5.687 5.453 5029 4.836 4.656 4.486 4322 3.656 3.147 2.752 2438 1977 12 5.918 5660 5.421 5.197 4.988 4.793 4611 4439 3.725 3.190 2779 2.456 1985 13 5.122 5.842 5.583 5142 5118 4910 4.715 4.533 3.780 2222 2.799 2469 1.900 14 6302 6.002 5724 5229 5.000 4.611 3.824 1249 2814 2.478 1.993 15 5.462 6.142 5.575 5324 5.092 4 802 14876 4938 4.675 3.859 3.268 2.825 2.484 1.995 16 6,604 6.265 5.954 5.668 5.405 5.162 4.730 3887 3.283 2834 2489 1.997 17 6729 6 37 6.047 5.749 5.475 5.222 4.988 4.725 3.910 3.295 2840 2492 1.990 18 5.840 5.467 6128 5 818 5534 5.273 5.033 4.812 3.928 3304 2844 2494 1.999 19 6.938 5.550 6.198 5.872 5.584 5.316 5.070 4843 3.942 1.311 2848 2.496 1.999 20 7025 5.623 6.259 5.929 5.628 5353 5.101 4870 2954 3.316 2.850 2492 1990 25 7320 6873 6.454 5.766 5.467 5.195 4.948 3.985 3.329 2.856 2493 22.000 6.097 6177 30 7496 7003 6.566 5.517 5.235 4979 3.995 3.332 2857 2.500 5.829 587 2000 2.000 7634 7105 6.642 6233 40 5.548 4.997 5258 1999 1133 2017 2.500 50 7.133 6.661 6245 5.880 4.999 5.262 7675 4.000 3333 2.857 2.500 2000