Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers

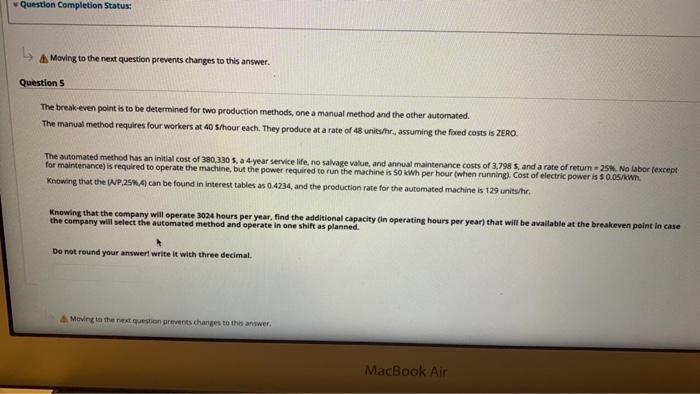

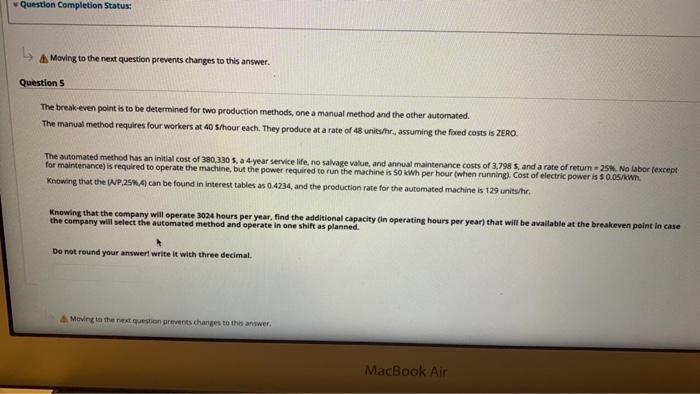

The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers at 40 s/hour each. They produce at a rate of 48 unitshr, assuming the fixed costs is ZERO. The automated method has an initial cost of 380,330 5. a 4-year service life, no salvage value, and annual maintenance costs of 3.798 S. and a rate of return = 25. No labor (except for maintenance) is required to operate the machine, but the power required to run the machine is 50 kWh per hour (when running) Cost of electric power is $0.05/kWh. Knowing that the WP,259.4) can be found in interest tables as 0.4234, and the production rate for the automated machine is 129 units/hr. Knowing that the company will operate 8024 hours per year, find the additional capacity (in operating hours per year that will be available at the breakeven point in case the company will select the automated method and operate in one shift as planned  find the additional capacity Question Completion Status: A Moving to the next question prevents changes to this answer. Questions The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers at 40 s/hour each. They produce at a rate of 48 unitshr, assuming the fixed costs is ZERO. The automated method has an initial cost of 380,330 5. a 4-year service life, no salvage value, and annual maintenance costs of 3.798 S. and a rate of return = 25. No labor (except for maintenance) is required to operate the machine, but the power required to run the machine is 50 kWh per hour (when running) Cost of electric power is $0.05/kWh. Knowing that the WP,259.4) can be found in interest tables as 0.4234, and the production rate for the automated machine is 129 units/hr. Knowing that the company will operate 8024 hours per year, find the additional capacity (in operating hours per year that will be available at the breakeven point in case the company will select the automated method and operate in one shift as planned Do not round your answert write it with three decimal. Moving to the next question prevents changes to this answer. MacBook Air Question Completion Status: A Moving to the next question prevents changes to this answer. Questions The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers at 40 s/hour each. They produce at a rate of 48 unitshr, assuming the fixed costs is ZERO. The automated method has an initial cost of 380,330 5. a 4-year service life, no salvage value, and annual maintenance costs of 3.798 S. and a rate of return = 25. No labor (except for maintenance) is required to operate the machine, but the power required to run the machine is 50 kWh per hour (when running) Cost of electric power is $0.05/kWh. Knowing that the WP,259.4) can be found in interest tables as 0.4234, and the production rate for the automated machine is 129 units/hr. Knowing that the company will operate 8024 hours per year, find the additional capacity (in operating hours per year that will be available at the breakeven point in case the company will select the automated method and operate in one shift as planned Do not round your answert write it with three decimal. Moving to the next question prevents changes to this answer. MacBook Air

find the additional capacity Question Completion Status: A Moving to the next question prevents changes to this answer. Questions The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers at 40 s/hour each. They produce at a rate of 48 unitshr, assuming the fixed costs is ZERO. The automated method has an initial cost of 380,330 5. a 4-year service life, no salvage value, and annual maintenance costs of 3.798 S. and a rate of return = 25. No labor (except for maintenance) is required to operate the machine, but the power required to run the machine is 50 kWh per hour (when running) Cost of electric power is $0.05/kWh. Knowing that the WP,259.4) can be found in interest tables as 0.4234, and the production rate for the automated machine is 129 units/hr. Knowing that the company will operate 8024 hours per year, find the additional capacity (in operating hours per year that will be available at the breakeven point in case the company will select the automated method and operate in one shift as planned Do not round your answert write it with three decimal. Moving to the next question prevents changes to this answer. MacBook Air Question Completion Status: A Moving to the next question prevents changes to this answer. Questions The break-even point is to be determined for two production methods, one a manual method and the other automated. The manual method requires four workers at 40 s/hour each. They produce at a rate of 48 unitshr, assuming the fixed costs is ZERO. The automated method has an initial cost of 380,330 5. a 4-year service life, no salvage value, and annual maintenance costs of 3.798 S. and a rate of return = 25. No labor (except for maintenance) is required to operate the machine, but the power required to run the machine is 50 kWh per hour (when running) Cost of electric power is $0.05/kWh. Knowing that the WP,259.4) can be found in interest tables as 0.4234, and the production rate for the automated machine is 129 units/hr. Knowing that the company will operate 8024 hours per year, find the additional capacity (in operating hours per year that will be available at the breakeven point in case the company will select the automated method and operate in one shift as planned Do not round your answert write it with three decimal. Moving to the next question prevents changes to this answer. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started