Answered step by step

Verified Expert Solution

Question

1 Approved Answer

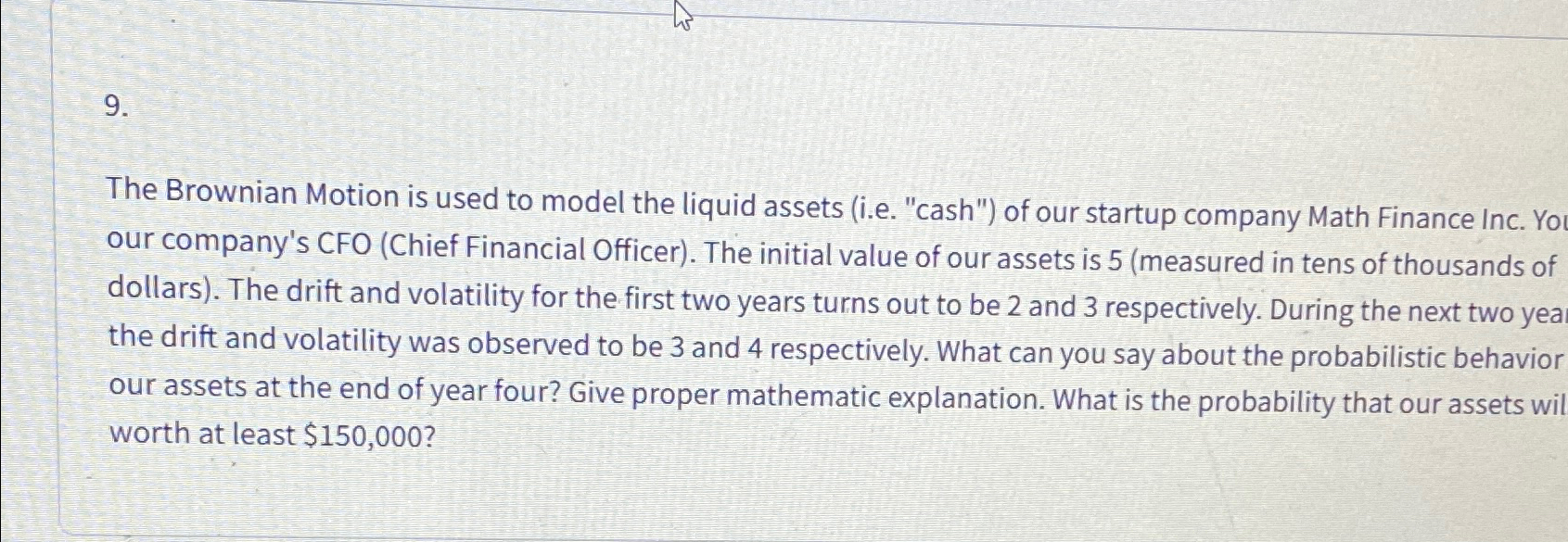

The Brownian Motion is used to model the liquid assets ( i . e . cash ) of our startup company Math Finance Inc. Yo

The Brownian Motion is used to model the liquid assets ie "cash" of our startup company Math Finance Inc. Yo our company's CFO Chief Financial Officer The initial value of our assets is measured in tens of thousands of dollars The drift and volatility for the first two years turns out to be and respectively. During the next two yea the drift and volatility was observed to be and respectively. What can you say about the probabilistic behavior our assets at the end of year four? Give proper mathematic explanation. What is the probability that our assets wil worth at least $

The Brownian Motion is used to model the liquid assets ie "cash" of our startup company Math Finance Inc. Yo our company's CFO Chief Financial Officer The initial value of our assets is measured in tens of thousands of dollars The drift and volatility for the first two years turns out to be and respectively. During the next two yea the drift and volatility was observed to be and respectively. What can you say about the probabilistic behavior our assets at the end of year four? Give proper mathematic explanation. What is the probability that our assets wil worth at least $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started