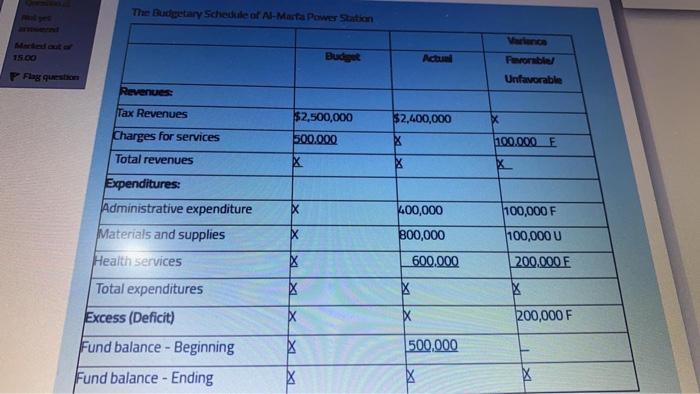

The Budgetary Schedule of Al-Marta Power Station 15.00 Budget Actu Perorable Unfavorable P Flag question Revenues Tax Revenues $2,400,000 $2,500,000 500.000 Charges for services 100.000 Total revenues X X 100,000 Expenditures: Administrative expenditure Materials and supplies Health services 300,000 100,000 F 100,000 U 200.000 F X 600.000 A X Total expenditures Excess (Deficit) Fund balance - Beginning K 200,000 F 500.000 Fund balance - Ending X 500,000 Fund balance - Ending X Required: (1) From the budget, actual, and variance columns above, you are required to: i. Compute the missing amounts that are marked by (x) and indicate whether the variance is favorable or not. (8.5 marks) il. Journalize the budgetary (estimated) transactions. 12.5 marks) (2) Explain the basis of recognizing revenues and expenditure of the general funds. (2 marks) lenovo (1) From the budget, achsal, and variance columns above, you are required to Compute the missing amounts that are marked by Do and indicate whether the variances favorable or not. (8.5 marks) il. Journalize the budgetary (estimated) transactions. 12.5 marks (2) Explain the basis of recognizing revenues and expenditure of the general funds. marks) 12 (3) Explain the bases on which assets and liabilities are reported in the government-wide financial statements. 12 marks) The Budgetary Schedule of Al-Marta Power Station 15.00 Budget Actu Perorable Unfavorable P Flag question Revenues Tax Revenues $2,400,000 $2,500,000 500.000 Charges for services 100.000 Total revenues X X 100,000 Expenditures: Administrative expenditure Materials and supplies Health services 300,000 100,000 F 100,000 U 200.000 F X 600.000 A X Total expenditures Excess (Deficit) Fund balance - Beginning K 200,000 F 500.000 Fund balance - Ending X 500,000 Fund balance - Ending X Required: (1) From the budget, actual, and variance columns above, you are required to: i. Compute the missing amounts that are marked by (x) and indicate whether the variance is favorable or not. (8.5 marks) il. Journalize the budgetary (estimated) transactions. 12.5 marks) (2) Explain the basis of recognizing revenues and expenditure of the general funds. (2 marks) lenovo (1) From the budget, achsal, and variance columns above, you are required to Compute the missing amounts that are marked by Do and indicate whether the variances favorable or not. (8.5 marks) il. Journalize the budgetary (estimated) transactions. 12.5 marks (2) Explain the basis of recognizing revenues and expenditure of the general funds. marks) 12 (3) Explain the bases on which assets and liabilities are reported in the government-wide financial statements. 12 marks)