Answered step by step

Verified Expert Solution

Question

1 Approved Answer

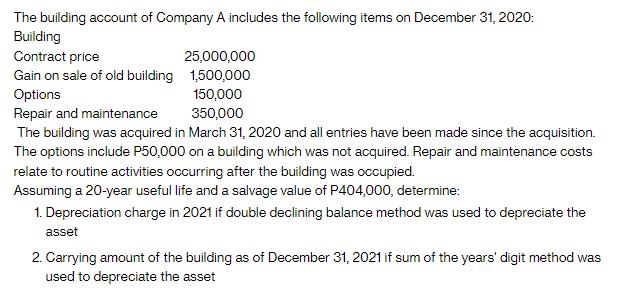

The building account of Company A includes the following items on December 31, 2020: Building Contract price 25,000,000 1,500,000 150,000 350,000 Gain on sale

The building account of Company A includes the following items on December 31, 2020: Building Contract price 25,000,000 1,500,000 150,000 350,000 Gain on sale of old building Options Repair and maintenance The building was acquired in March 31, 2020 and all entries have been made since the acquisition. The options include P50,000 on a building which was not acquired. Repair and maintenance costs relate to routine activities occurring after the building was occupied. Assuming a 20-year useful life and a salvage value of P404,000, determine: 1. Depreciation charge in 2021 if double declining balance method was used to depreciate the asset 2. Carrying amount of the building as of December 31, 2021 if sum of the years' digit method was used to depreciate the asset

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine the depreciation charge in 2021 using the double declining balance method we need to calculate the annual depreciation rate Step 1 Calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started