Question

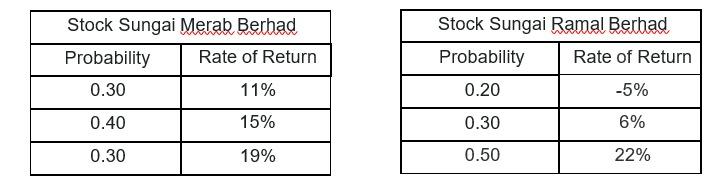

The Bukit Berhad (TBB) has prepared the following information regarding two common stocks under consideration: From the above information you are required to answer below

The Bukit Berhad (TBB) has prepared the following information regarding two common stocks under consideration:

From the above information you are required to answer below questions.

a. Calculate the expected rate of return of each stock.

b. Calculate the standard deviation of each stock. (4 Marks) (4 Marks)

c. From your answer in part (a) and (b) which stock should TBB invest in? Explain your answer. (4 Marks)

d. Now let's assume that TBB would create a portfolio consisting of 60% investment in Stock Sungai Merab and 40% in Stock Sungai Ramal.

Determine the expected rate of return on the portfolio. What is the standard deviation of this portfolio? (4 Marks)

e. Discuss whether the standard deviation of a portfolio is, or is not, a weighted average of the standard deviation of the assets in the portfolio. Fully explain your answer. (4 Marks)

(Total: 20 Marks)

Stock Sungai Merab Berhad Stock Sungai Ramal Berhad Probability Rate of Return Probability Rate of Return 0.30 11% 0.20 -5% 0.40 15% 0.30 6% 0.30 19% 0.50 22%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started