Answered step by step

Verified Expert Solution

Question

1 Approved Answer

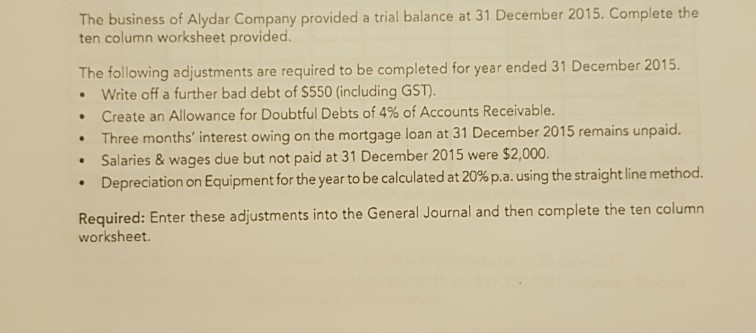

The business of Alydar Company provided a trial balance at 31 December 2015. Complete the ten column worksheet provided. The following adjustments are required to

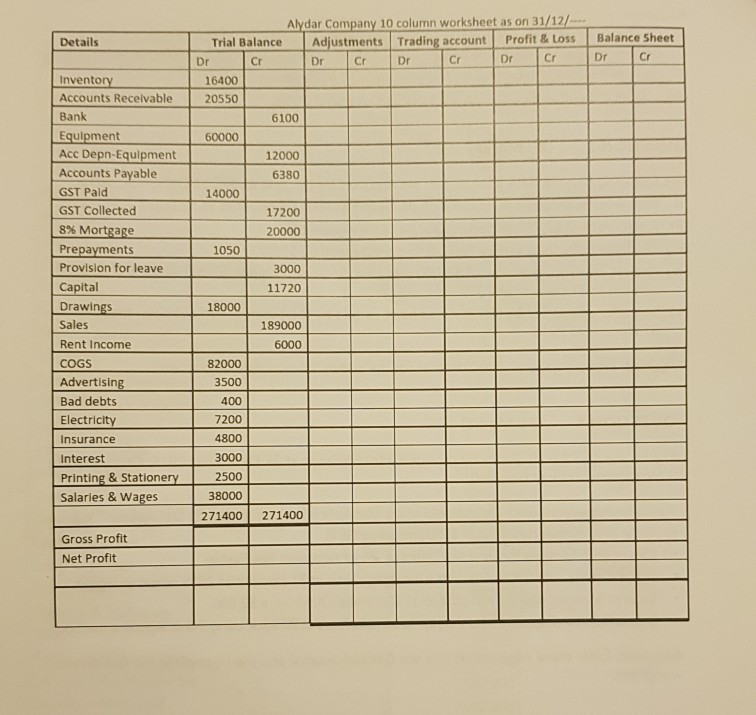

The business of Alydar Company provided a trial balance at 31 December 2015. Complete the ten column worksheet provided. The following adjustments are required to be completed for year ended 31 December 2015. Write off a further bad debt of $550 (including GST). Create an Allowance for Doubtful Debts of 4% of Accounts Receivable. Three months' interest owing on the mortgage loan at 31 December 2015 remains unpaid. Salaries&wages due but not paid at 31 December 2015 were $2,000. Depreciation on Equipment for the year to be calculated at 20%pausing the straight line method. . Required: Enter these adjustments into the General Journal and then complete the ten column worksheet. Alydar Company 10 column worksheet as on 31/12/ Trial BalanceAdjustments Dr Profit & Loss Dr Balance Sheet Dr Details Trading account Cr Dr Cr Dr Cr Cr Cr 16400 Accounts Recelvable Bank 20550 6100 Acc Depn-Equipment Accounts Payable GST Pald GST Collected 8% Mortgage 12000 6380 14000 17200 20000 1050 Provision for leave Capital Drawings Sales Rent Income COGS Advertising Bad debts Electricity Insurance Interest Printing & Stationery Salaries & Wages 3000 11720 18000 189000 6000 82000 3500 400 7200 4800 3000 2500 38000 271400 271400 Gross Profit Net Profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started