Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martin Ltd's, bookkeeper comes to you with a problem. She tells you first of all that the business is non-GST registered, then proceeds with

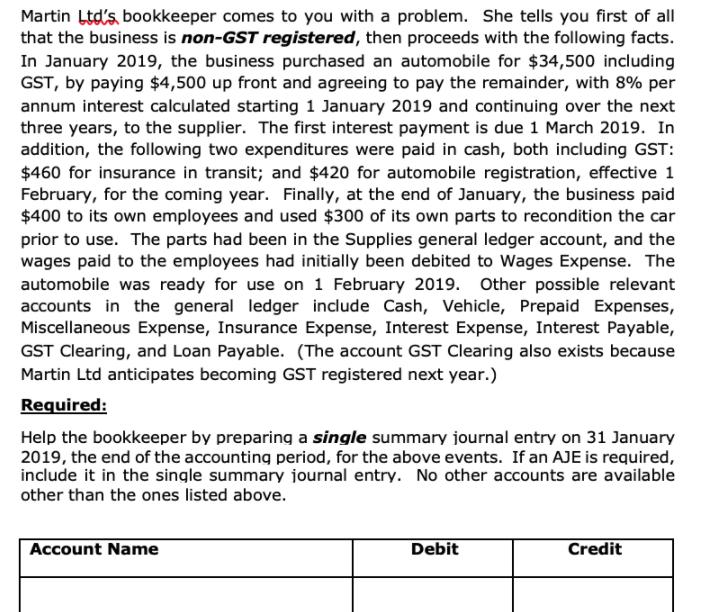

Martin Ltd's, bookkeeper comes to you with a problem. She tells you first of all that the business is non-GST registered, then proceeds with the following facts. In January 2019, the business purchased an automobile for $34,500 including GST, by paying $4,500 up front and agreeing to pay the remainder, with 8% per annum interest calculated starting 1 January 2019 and continuing over the next three years, to the supplier. The first interest payment is due 1 March 2019. In addition, the following two expenditures were paid in cash, both including GST: $460 for insurance in transit; and $420 for automobile registration, effective 1 February, for the coming year. Finally, at the end of January, the business paid $400 to its own employees and used $300 of its own parts to recondition the car prior to use. The parts had been in the Supplies general ledger account, and the wages paid to the employees had initially been debited to Wages Expense. The automobile was ready for use on 1 February 2019. Other possible relevant accounts in the general ledger include Cash, Vehicle, Prepaid Expenses, Miscellaneous Expense, Insurance Expense, Interest Expense, Interest Payable, GST Clearing, and Loan Payable. (The account GST Clearing also exists because Martin Ltd anticipates becoming GST registered next year.) Required: Help the bookkeeper by preparing a single summary journal entry on 31 January 2019, the end of the accounting period, for the above events. If an AJE is required, include it in the single summary journal entry. No other accounts are available other than the ones listed above. Account Name Debit Credit

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Workings for interest payable for Jan 2019 As the annuity pmt Towards the loan amt of 3450045...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started