Question

The Cabinet Shoppe is considering the addition of a new line of kitchen cabinets to its current product lines. Expected cost and revenue data

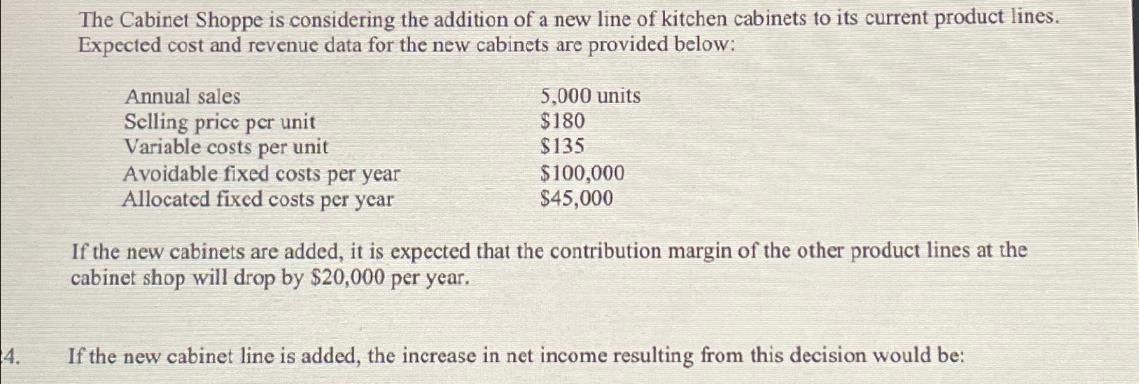

The Cabinet Shoppe is considering the addition of a new line of kitchen cabinets to its current product lines. Expected cost and revenue data for the new cabinets are provided below: Annual sales Selling price per unit 5,000 units $180 $135 Avoidable fixed costs per year $100,000 $45,000 Variable costs per unit 4. Allocated fixed costs per year If the new cabinets are added, it is expected that the contribution margin of the other product lines at the cabinet shop will drop by $20,000 per year. If the new cabinet line is added, the increase in net income resulting from this decision would be:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the increase in net income resulting from adding the new cabinet line we need to compar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial And Managerial Accounting The Basis For Business Decisions

Authors: Jan Williams, Susan Haka, Mark Bettner

20th Edition

1264445245, 9781264445240

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App