Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cairo Whet Supply Company a client of yours informs you that they recently lost several employees in their accounting department they are struggling to

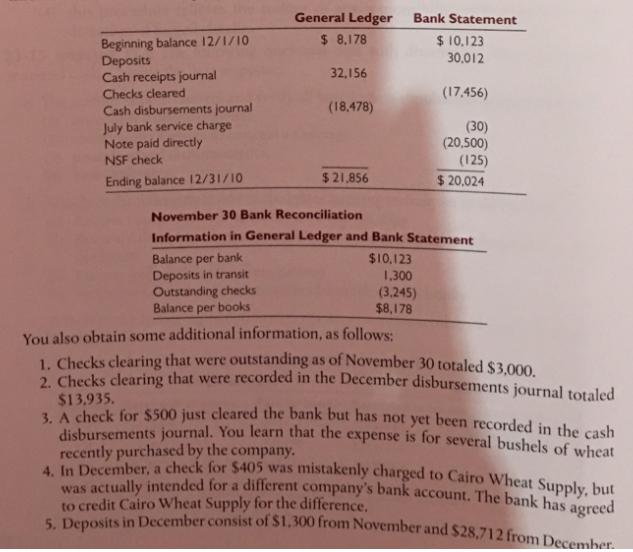

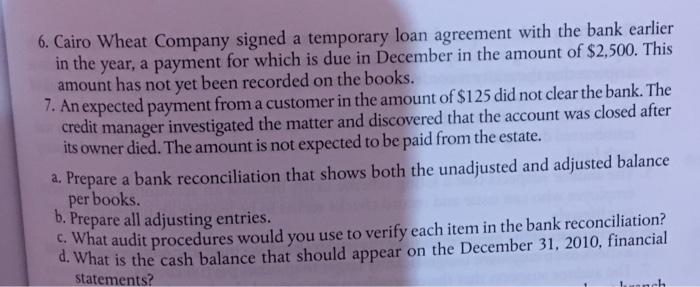

The Cairo Whet Supply Company a client of yours informs you that they recently lost several employees in their accounting department they are struggling to prepare for their yearly audit, so they have asked you to assist with their bank reconciliation for the year ended December 31, 2010. You obtain the following financial information from the company:

General Ledger Bank Statement $ 8,178 Beginning balance 12/1/10 Deposits Cash receipts journal Checks cleared Cash disbursements journal July bank service charge Note paid directly NSF check $ 10,123 30.012 32,156 (17,456) (18.478) (30) (20.500) (125) Ending balance 12/31/10 $21,856 $ 20,024 November 30 Bank Reconciliation Information in General Ledger and Bank Statement Balance per bank Deposits in transit Outstanding checks Balance per books $10.123 1,300 (3.245) $8,178 You also obtain some additional information, as follows: 1. Checks clearing that were outstanding as of November 30 totaled $3.000 2 Checks clearing that were recorded in the December disbursements journal totaled $13.935. LA check for $500 just cleared the bank but has not yet been recorded in the cash disbursements journal. You learn that the expense is for several bushels of wheat recently purchased by the company. in December, a check for $405 was mistakenly charged to Cairo Wheat Supply but was actually intended for a different company's bank account. The bank h . Du to credit Cairo Wheat Supply for the difference, S Deposits in December consist of $1,300 from November and $28,712 from December

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started