Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Canada Improvement Financial Analysis The Canada Improvement, one of the largest home improvement retailers globally, exhibited strong financial performance in fiscal year 2019,

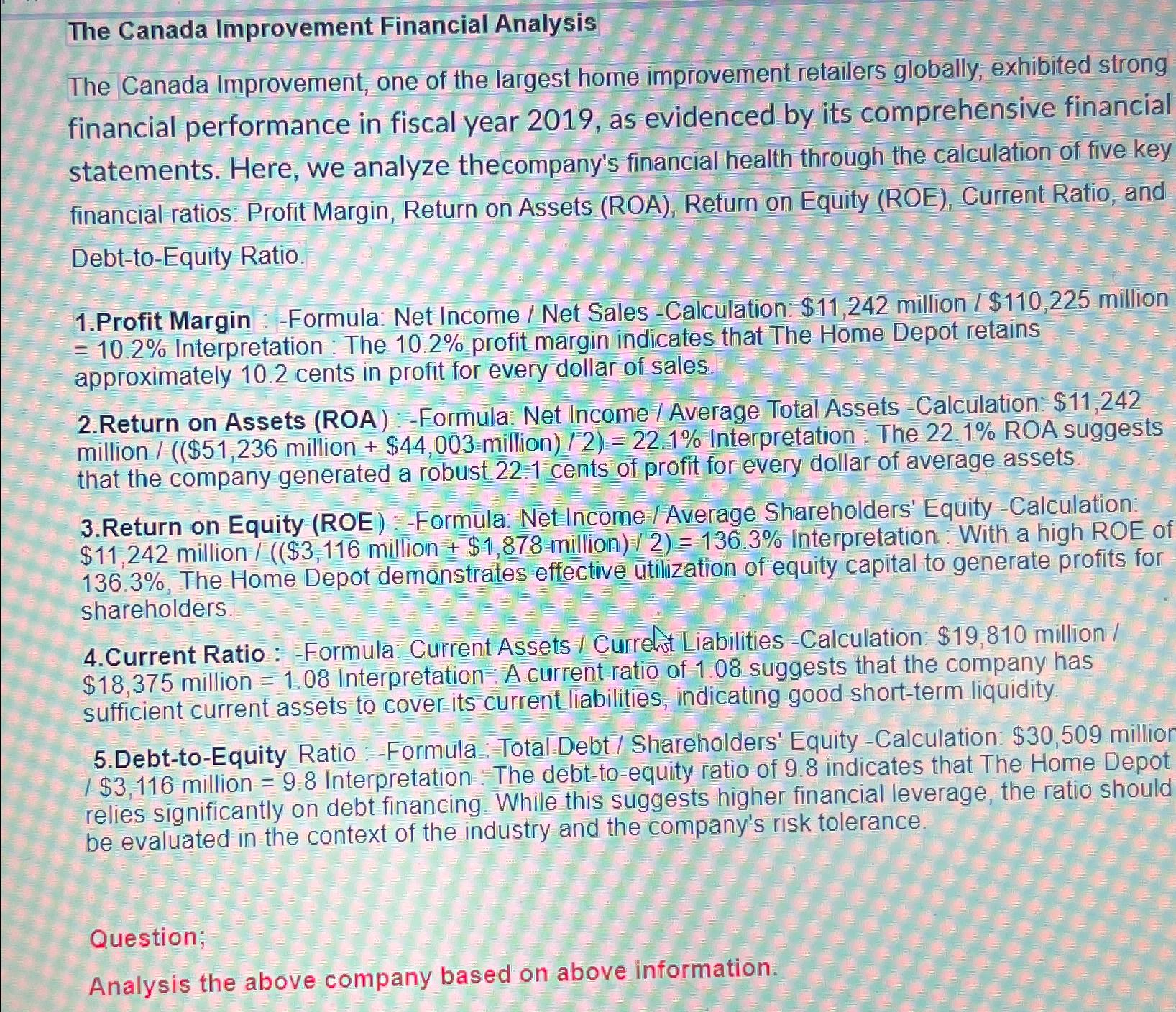

The Canada Improvement Financial Analysis The Canada Improvement, one of the largest home improvement retailers globally, exhibited strong financial performance in fiscal year 2019, as evidenced by its comprehensive financial statements. Here, we analyze the company's financial health through the calculation of five key financial ratios: Profit Margin, Return on Assets (ROA), Return on Equity (ROE), Current Ratio, and Debt-to-Equity Ratio. 1.Profit Margin :-Formula: Net Income / Net Sales -Calculation: $11,242 million / $110,225 million = 10.2% Interpretation: The 10.2% profit margin indicates that The Home Depot retains approximately 10.2 cents in profit for every dollar of sales. 2.Return on Assets (ROA) -Formula: Net Income / Average Total Assets -Calculation: $11,242 million / (($51,236 million + $44,003 million)/2) = 22.1% Interpretation: The 22.1% ROA suggests that the company generated a robust 22.1 cents of profit for every dollar of average assets. 3.Return on Equity (ROE) -Formula: Net Income / Average Shareholders' Equity -Calculation: $11,242 million / (($3,116 million + $1,878 million) / 2) = 136.3% Interpretation: With a high ROE of 136.3%, The Home Depot demonstrates effective utilization of equity capital to generate profits for shareholders. 4.Current Ratio : -Formula: Current Assets / Current Liabilities -Calculation: $19,810 million / $18,375 million = 1.08 Interpretation: A current ratio of 1.08 suggests that the company has sufficient current assets to cover its current liabilities, indicating good short-term liquidity. 5.Debt-to-Equity Ratio -Formula: Total Debt/ Shareholders' Equity -Calculation: $30,509 million / $3,116 million = 9.8 Interpretation: The debt-to-equity ratio of 9.8 indicates that The Home Depot relies significantly on debt financing. While this suggests higher financial leverage, the ratio should be evaluated in the context of the industry and the company's risk tolerance. Question; Analysis the above company based on above information.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided financial ratios and interpretations The Home Depot exhibits strong financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started