Question

The Cane Growers Enterprise (CGE) is a government owned enterprise which is legislated to generate its own income which it uses to cover capital and

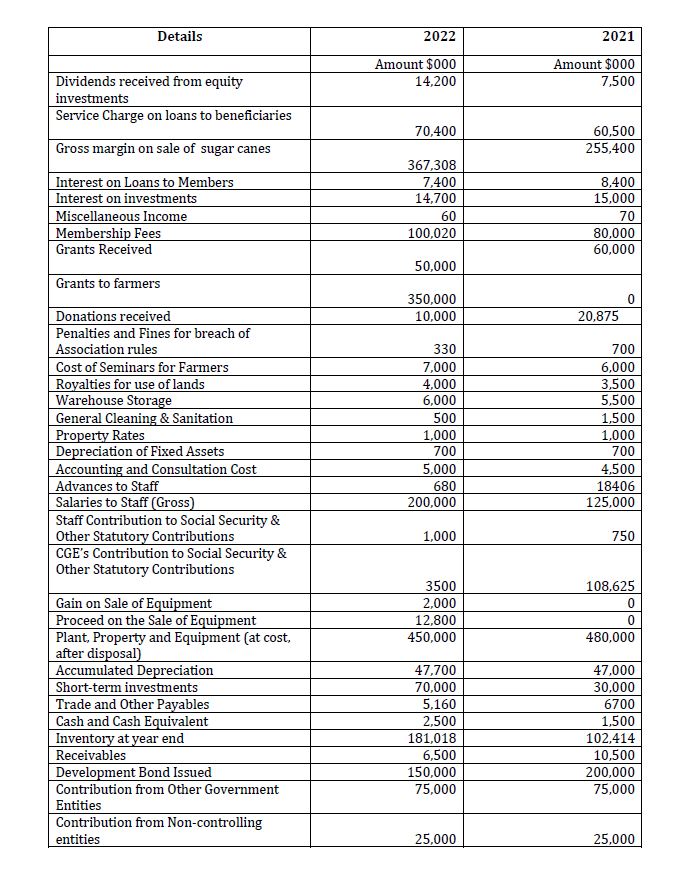

The Cane Growers Enterprise (CGE) is a government owned enterprise which is legislated to generate its own income which it uses to cover capital and recurrent expenditures. CGE is an agent of the National Agriculture Association. The Young Famers association controls 25% of CGE. Outside of these powers, its government also provides CGE with monthly subventions to cover its recurrent expenditures based on CGE budgetary demands and the legal allocations by the government. CGE uses ISPAP to prepare its financial statements. You were asked by to government to assist CGE with its accounting processes, which involved the recording, generation and preparation of accounting transactions and final accounts as stipulated by the IPSASs. Collaborating with a team of qualified and experienced accountants, you were able to prepare the following accounting information of GCE for the year ended December 2022.

Notes 1. Dividend receivable as at 31 December 2021 was $5,000,000 and Dividend receivable as at 31 December 2022 was $2,000,000.

2. CGE receives an annual transfer of $30,000,000 from the National Agricultural Association for the operating of the industry.

3.Service Charge Outstanding as at 31 December 2022 was $500,000.

4.Interest outstanding from Loans to Members as of 31 December 2021 was $2,000,000. Interest receivable at 31 December 2022 was $6,000,000.

5.All membership fees were paid in full. In 2022, twenty (20) members prepaid their membership for eight ( 8) months at $15,000 per month.

6.Twenty percent (20%) of the grants were not received at the end of each year.

7.To secure adequate storage in 2022, payments of $3,000,000 were made in advance.

8.Bond issued in 2021 was issued for $200,000,000. There was a repayment of $50,000 in 2022.

9.All statutory contributions were paid at year end.

Required: Prepare the Statement of Financial Performance, Statement of Financial Position and Cash flow for 2022 in line with ISAPS. Expenses should be classified by nature. No comparative data required for the Cashflow.

\begin{tabular}{|c|c|c|} \hline Details & 2022 & 2021 \\ \hline & Amount $000 & Amount $000 \\ \hline \begin{tabular}{l} Dividends received from equity \\ investments \end{tabular} & 14,200 & 7,500 \\ \hline Service Charge on loans to beneficiaries & 70,400 & 60,500 \\ \hline Gross margin on sale of sugar canes & 367,308 & 255,400 \\ \hline Interest on Loans to Members & 7,400 & 8,400 \\ \hline Interest on investments & 14,700 & 15,000 \\ \hline Miscellaneous Income & 60 & 70 \\ \hline Membership Fees & 100,020 & 80,000 \\ \hline Grants Received & 50,000 & 60,000 \\ \hline Grants to farmers & 350,000 & 0 \\ \hline Donations received & 10,000 & 20,875 \\ \hline \begin{tabular}{l} Penalties and Fines for breach of \\ Association rules \end{tabular} & 330 & 700 \\ \hline Cost of Seminars for Farmers & 7,000 & 6,000 \\ \hline Royalties for use of lands & 4,000 & 3,500 \\ \hline Warehouse Storage & 6,000 & 5,500 \\ \hline General Cleaning \& Sanitation & 500 & 1,500 \\ \hline Property Rates & 1,000 & 1,000 \\ \hline Depreciation of Fixed Assets & 700 & 700 \\ \hline Accounting and Consultation Cost & 5,000 & 4,500 \\ \hline Advances to Staff & 680 & 18406 \\ \hline Salaries to Staff (Gross) & 200,000 & 125,000 \\ \hline \begin{tabular}{l} Staff Contribution to Social Security \& \\ Other Statutory Contributions \end{tabular} & 1,000 & 750 \\ \hline \begin{tabular}{l} CGE's Contribution to Social Security \& \\ Other Statutory Contributions \end{tabular} & 3500 & 108,625 \\ \hline Gain on Sale of Equipment & 2,000 & 0 \\ \hline Proceed on the Sale of Equipment & 12,800 & 0 \\ \hline \begin{tabular}{l} Plant, Property and Equipment (at cost, \\ after disposal) \end{tabular} & 450,000 & 480,000 \\ \hline Accumulated Depreciation & 47,700 & 47,000 \\ \hline Short-term investments & 70,000 & 30,000 \\ \hline Trade and Other Payables & 5,160 & 6700 \\ \hline Cash and Cash Equivalent & 2,500 & 1,500 \\ \hline Inventory at year end & 181,018 & 102,414 \\ \hline Receivables & 6,500 & 10,500 \\ \hline Development Bond Issued & 150,000 & 200,000 \\ \hline \begin{tabular}{l} Contribution from Other Government \\ Entities \end{tabular} & 75,000 & 75,000 \\ \hline \begin{tabular}{l} Contribution from Non-controlling \\ entities \end{tabular} & 25,000 & 25,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started