Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cap Company is considering the replacement of Machine A with Machine B that will cost P150,000 and will result in annual savings of

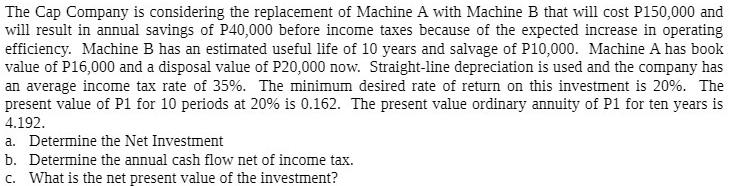

The Cap Company is considering the replacement of Machine A with Machine B that will cost P150,000 and will result in annual savings of P40,000 before income taxes because of the expected increase in operating efficiency. Machine B has an estimated useful life of 10 years and salvage of P10,000. Machine A has book value of P16,000 and a disposal value of P20,000 now. Straight-line depreciation is used and the company has an average income tax rate of 35%. The minimum desired rate of return on this investment is 20%. The present value of P1 for 10 periods at 20% is 0.162. The present value ordinary annuity of P1 for ten years is 4.192. a. Determine the Net Investment b. Determine the annual cash flow net of income tax. What is the net present value of the investment? c.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Determination of Net Investment Net Investment refers to the amount of money required for a company to purchase a new asset including the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started