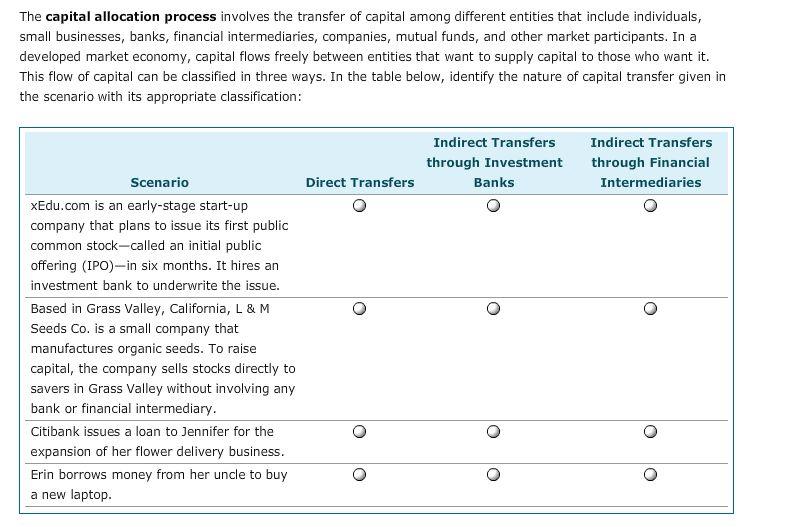

The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and

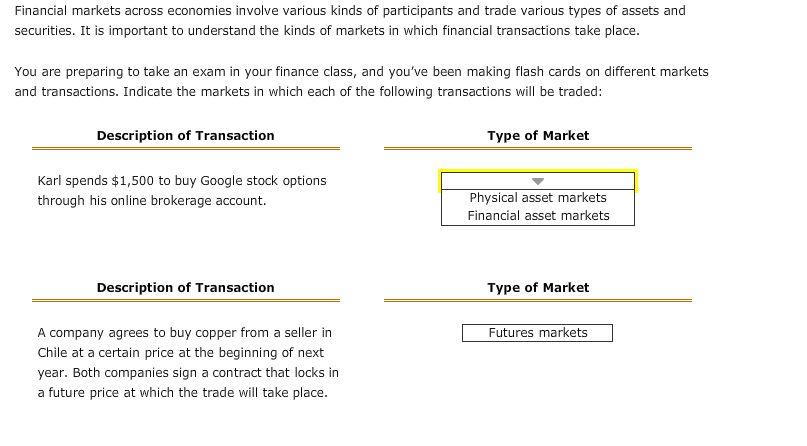

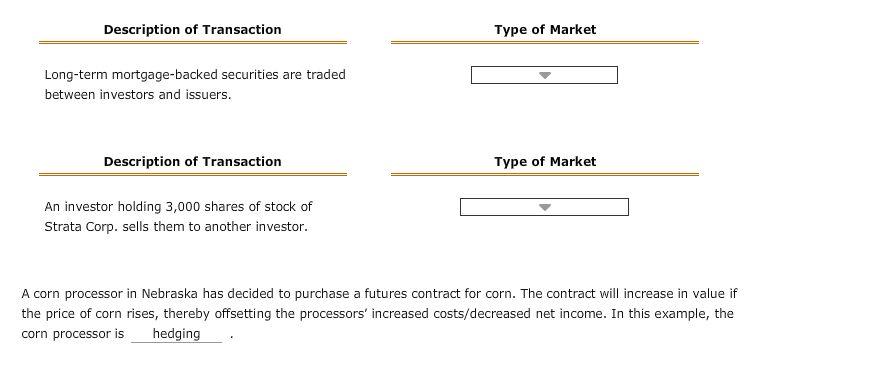

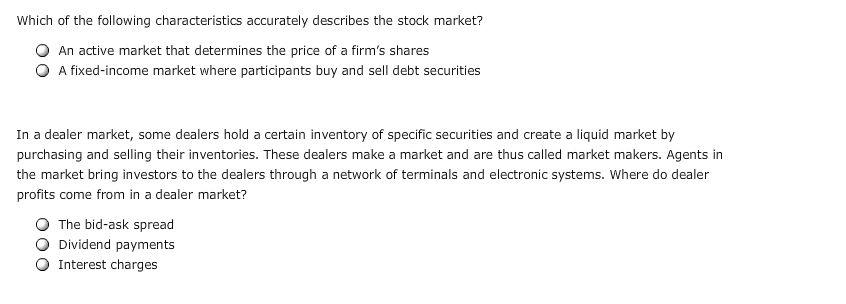

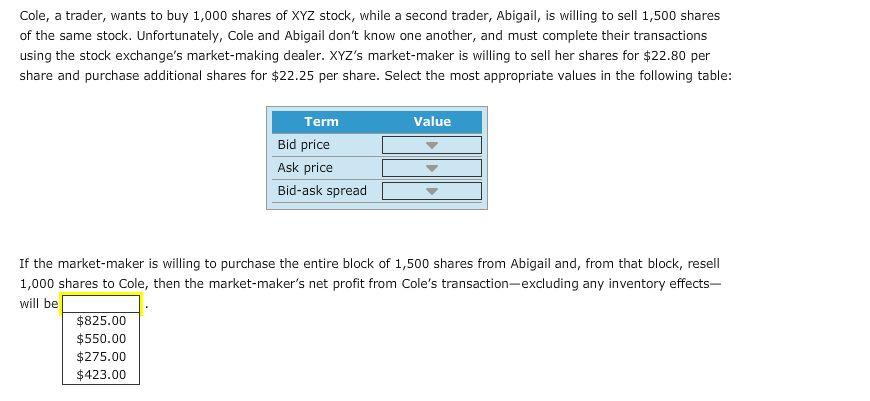

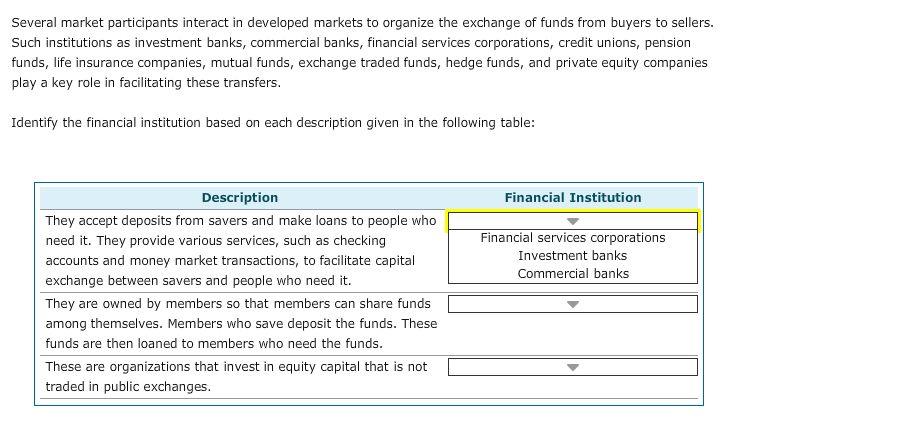

The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Indirect Transfers Indirect Transfers through Investment through Financial Scenario Direct Transfers Banks Intermediaries XEdu.com is an early-stage start-up company that plans to issue its first public common stock-called an initial public offering (IPO)-in six months. It hires an investment bank to underwrite the issue. Based in Grass Valley, California, L & M Seeds Co. is a small company that manufactures organic seeds. To raise capital, the company sells stocks directly to savers in Grass Valley without involving any bank or financial intermediary. Citibank issues a loan to Jennifer for the expansion of her flower delivery business. Erin borrows money from her uncle to buy a new laptop. Financial markets across economies involve various kinds of participants and trade various types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance class, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: Description of Transaction Type of Market Karl spends $1,500 to buy Google stock options Physical asset markets Financial asset markets through his online brokerage account. Description of Transaction Type of Market A company agrees to buy copper from a seller in Futures markets Chile at a certain price at the beginning of next year. Both companies sign a contract that locks in a future price at which the trade will take place. Description of Transaction Type of Market Long-term mortgage-backed securities are traded between investors and issuers. Description of Transaction Type of Market An investor holding 3,000 shares of stock of Strata Corp. sells them to another investor. A corn processor in Nebraska has decided to purchase a futures contract for corn. The contract will increase in value if the price of corn rises, thereby offsetting the processors' increased costs/decreased net income. In this example, the corn processor is hedging Which of the following characteristics accurately describes the stock market? An active market that determines the price of a firm's shares A fixed-income market where participants buy and sell debt securities In a dealer market, some dealers hold a certain inventory of specific securities and create a liquid market by purchasing and selling their inventories. These dealers make a market and are thus called market makers. Agents in the market bring investors to the dealers through a network of terminals and electronic systems. Where do dealer profits come from in a dealer market? The bid-ask spread Dividend payments Interest charges Cole, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Abigail, is willing to sell 1,500 shares of the same stock. Unfortunately, Cole and Abigail don't know one another, and must complete their transactions using the stock exchange's market-making dealer. XYZ's market-maker is willing to sell her shares for $22.80 per share and purchase additional shares for $22.25 per share. Select the most appropriate values in the following table: Term Value Bid price Ask price Bid-ask spread If the market-maker is willing to purchase the entire block of 1,500 shares from Abigail and, from that block, resell 1,000 shares to Cole, then the market-maker's net profit from Cole's transaction-excluding any inventory effects- will be $825.00 $550.00 $275.00 $423.00 Several market participants interact in developed markets to organize the exchange of funds from buyers to sellers. Such institutions as investment banks, commercial banks, financial services corporations, credit unions, pension funds, life insurance companies, mutual funds, exchange traded funds, hedge funds, and private equity companies play a key role in facilitating these transfers. Identify the financial institution based on each description given in the following table: Description Financial Institution They accept deposits from savers and make loans to people who need it. They provide various services, such as checking Financial services corporations Investment banks accounts and money market transactions, to facilitate capital Commercial banks exchange between savers and people who need it. They are owned by members so that members can share funds among themselves. Members who save deposit the funds. These funds are then loaned to members who need the funds. These are organizations that invest in equity capital that is not traded in public exchanges.

Step by Step Solution

3.60 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Part 1 In the capital allocation process when the allocation is done through som...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started