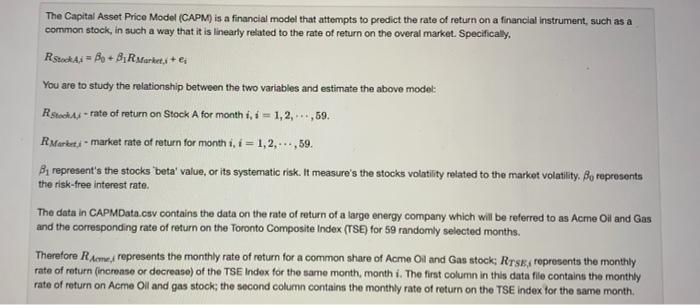

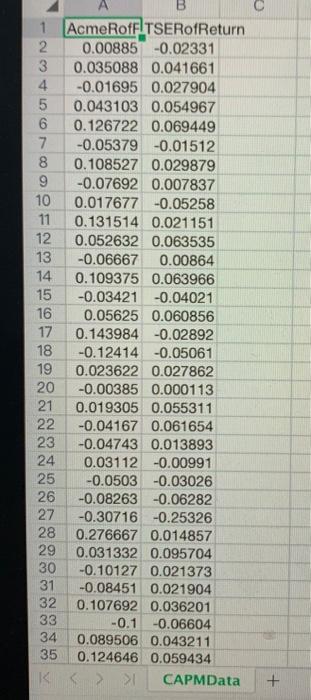

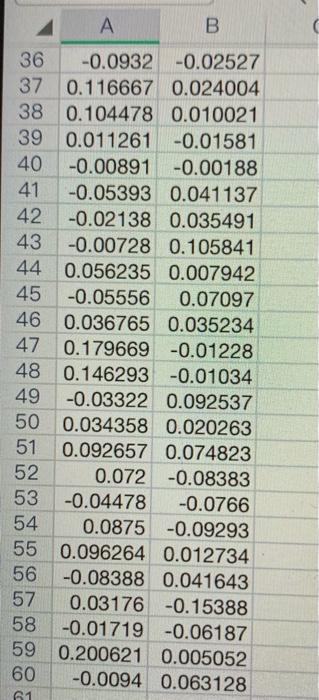

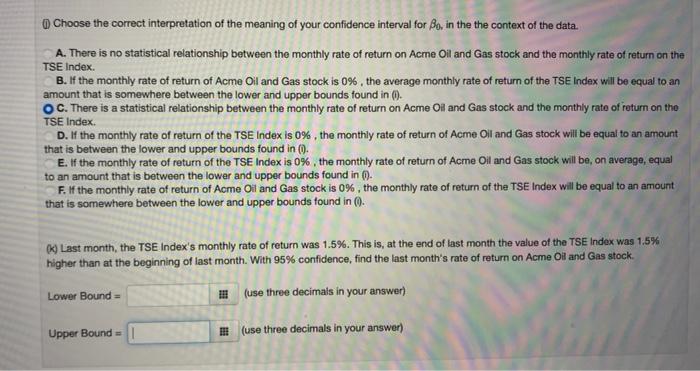

The Capital Asset Price Model (CAPM) is a financial model that attempts to predict the rate of return on a financial instrument, such as a common stock, in such a way that it is linearly related to the rate of return on the overal market. Specifically, Stocks - BoB, R Markety + el You are to study the relationship between the two variables and estimate the above model: RockA - rate of return on Stock A for month 1, 1 = 1, 2,...,59. R Market - market rate of return for month i, i = 1,2,..., 69. Bu represent's the stocks 'beta' value, or its systematic risk. It measure's the stocks volatility related to the market volatility. By represents the risk-free interest rate. The data in CAPMData.csv contains the data on the rate of return of a large energy company which will be referred to as Acme Oil and Gas and the corresponding rate of return on the Toronto Composite Index (TSE) for 59 randomly selected months. Therefore Rome, represents the monthly rate of return for a common share of Acme Oil and Gas stock: Rrse, represents the monthly rate of return (increase or decrease) of the TSE Index for the same month, month i. The first column in this data file contains the monthly rate of return on Acme Oll and gas stock, the second column contains the monthly rate of return on the TSE index for the same month. 1 Acme Roff! TSERofReturn 2. 0.00885 -0.02331 3 0.035088 0.041661 4. -0.01695 0.027904 5 0.043103 0.054967 6 0.126722 0.069449 7 -0.05379 -0.01512 8. 0.108527 0.029879 9 -0.07692 0.007837 10 0.017677 -0.05258 11 0.131514 0.021151 12 0.052632 0.063535 13 -0.06667 0.00864 14 0.109375 0.063966 15 -0.03421 -0.04021 16 0.05625 0.060856 17 0.143984 -0.02892 18 -0.12414 -0.05061 19 0.023622 0.027862 20 -0.00385 0.000113 21 0.019305 0.055311 22 -0.04167 0.061654 23 -0.04743 0.013893 24 0.03112 -0.00991 25 -0.0503 -0.03026 -0.08263 -0.06282 27 -0.30716 -0.25326 28 0.276667 0.014857 29 0.031332 0.095704 -0.10127 0.021373 31 -0.08451 0.021904 32 0.107692 0.036201 33 -0.1 -0.06604 34 0.089506 0.043211 0.124646 0.059434 K >> CAPMData 26 30 35 + 36 -0.0932 -0.02527 37 0.116667 0.024004 38 0.104478 0.010021 39 0.011261 -0.01581 40 -0.00891 -0.00188 41 -0.05393 0.041137 42 -0.02138 0.035491 43 -0.00728 0.105841 44 0.056235 0.007942 45 -0.05556 0.07097 46 0.036765 0.035234 47 0.179669 -0.01228 48 0.146293 -0.01034 49 -0.03322 0.092537 50 0.034358 0.020263 51 0.092657 0.074823 52 0.072 -0.08383 53 -0.04478 -0.0766 54 0.0875 -0.09293 55 0.096264 0.012734 56 -0.08388 0.041643 57 0.03176 -0.15388 58 -0.01719 -0.06187 59 0.200621 0.005052 60 -0.0094 0.063128 61 Choose the correct interpretation of the meaning of your confidence interval for Bo, in the the context of the data. A. There is no statistical relationship between the monthly rate of return on Acmne Oil and Gas stock and the monthly rate of return on the TSE Index. B. If the monthly rate of return of Acme Oil and Gas stock is 0%, the average monthly rate of return of the TSE Index will be equal to an amount that is somewhere between the lower and upper bounds found in (). OC. There is a statistical relationship between the monthly rate of return on Acme Oil and Gas stock and the monthly rate of return on the D. If the monthly rate of return of the TSE Index is 0%, the monthly rate of return of Acme Oil and Gas stock will be equal to an amount that is between the lower and upper bounds found in (). E. If the monthly rate of return of the TSE Index is 0%, the monthly rate of return of Acrne Oil and Gas stock will be on average, equal to an amount that is between the lower and upper bounds found in 0. F. If the monthly rate of return of Acme Oil and Gas stock is 0%, the monthly rate of return of the TSE Index will be equal to an amount that is somewhere between the lower and upper bounds found in 0. TSE Index. (k) Last month, the TSE Index's monthly rate of return was 1.5%. This is at the end of last month the value of the TSE Index was 1.5% higher than at the beginning of last month. With 95% confidence, find the last month's rate of return on Acme Oil and Gas stock Lower Bound 11 (use three decimals in your answer) Upper Bound (use three decimals in your answer) The Capital Asset Price Model (CAPM) is a financial model that attempts to predict the rate of return on a financial instrument, such as a common stock, in such a way that it is linearly related to the rate of return on the overal market. Specifically, Stocks - BoB, R Markety + el You are to study the relationship between the two variables and estimate the above model: RockA - rate of return on Stock A for month 1, 1 = 1, 2,...,59. R Market - market rate of return for month i, i = 1,2,..., 69. Bu represent's the stocks 'beta' value, or its systematic risk. It measure's the stocks volatility related to the market volatility. By represents the risk-free interest rate. The data in CAPMData.csv contains the data on the rate of return of a large energy company which will be referred to as Acme Oil and Gas and the corresponding rate of return on the Toronto Composite Index (TSE) for 59 randomly selected months. Therefore Rome, represents the monthly rate of return for a common share of Acme Oil and Gas stock: Rrse, represents the monthly rate of return (increase or decrease) of the TSE Index for the same month, month i. The first column in this data file contains the monthly rate of return on Acme Oll and gas stock, the second column contains the monthly rate of return on the TSE index for the same month. 1 Acme Roff! TSERofReturn 2. 0.00885 -0.02331 3 0.035088 0.041661 4. -0.01695 0.027904 5 0.043103 0.054967 6 0.126722 0.069449 7 -0.05379 -0.01512 8. 0.108527 0.029879 9 -0.07692 0.007837 10 0.017677 -0.05258 11 0.131514 0.021151 12 0.052632 0.063535 13 -0.06667 0.00864 14 0.109375 0.063966 15 -0.03421 -0.04021 16 0.05625 0.060856 17 0.143984 -0.02892 18 -0.12414 -0.05061 19 0.023622 0.027862 20 -0.00385 0.000113 21 0.019305 0.055311 22 -0.04167 0.061654 23 -0.04743 0.013893 24 0.03112 -0.00991 25 -0.0503 -0.03026 -0.08263 -0.06282 27 -0.30716 -0.25326 28 0.276667 0.014857 29 0.031332 0.095704 -0.10127 0.021373 31 -0.08451 0.021904 32 0.107692 0.036201 33 -0.1 -0.06604 34 0.089506 0.043211 0.124646 0.059434 K >> CAPMData 26 30 35 + 36 -0.0932 -0.02527 37 0.116667 0.024004 38 0.104478 0.010021 39 0.011261 -0.01581 40 -0.00891 -0.00188 41 -0.05393 0.041137 42 -0.02138 0.035491 43 -0.00728 0.105841 44 0.056235 0.007942 45 -0.05556 0.07097 46 0.036765 0.035234 47 0.179669 -0.01228 48 0.146293 -0.01034 49 -0.03322 0.092537 50 0.034358 0.020263 51 0.092657 0.074823 52 0.072 -0.08383 53 -0.04478 -0.0766 54 0.0875 -0.09293 55 0.096264 0.012734 56 -0.08388 0.041643 57 0.03176 -0.15388 58 -0.01719 -0.06187 59 0.200621 0.005052 60 -0.0094 0.063128 61 Choose the correct interpretation of the meaning of your confidence interval for Bo, in the the context of the data. A. There is no statistical relationship between the monthly rate of return on Acmne Oil and Gas stock and the monthly rate of return on the TSE Index. B. If the monthly rate of return of Acme Oil and Gas stock is 0%, the average monthly rate of return of the TSE Index will be equal to an amount that is somewhere between the lower and upper bounds found in (). OC. There is a statistical relationship between the monthly rate of return on Acme Oil and Gas stock and the monthly rate of return on the D. If the monthly rate of return of the TSE Index is 0%, the monthly rate of return of Acme Oil and Gas stock will be equal to an amount that is between the lower and upper bounds found in (). E. If the monthly rate of return of the TSE Index is 0%, the monthly rate of return of Acrne Oil and Gas stock will be on average, equal to an amount that is between the lower and upper bounds found in 0. F. If the monthly rate of return of Acme Oil and Gas stock is 0%, the monthly rate of return of the TSE Index will be equal to an amount that is somewhere between the lower and upper bounds found in 0. TSE Index. (k) Last month, the TSE Index's monthly rate of return was 1.5%. This is at the end of last month the value of the TSE Index was 1.5% higher than at the beginning of last month. With 95% confidence, find the last month's rate of return on Acme Oil and Gas stock Lower Bound 11 (use three decimals in your answer) Upper Bound (use three decimals in your answer)