Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the capital asset pricing model 10. The Capital Asset Pricing Model and the security market line Nick holds a portfolio that invests equally in three

the capital asset pricing model

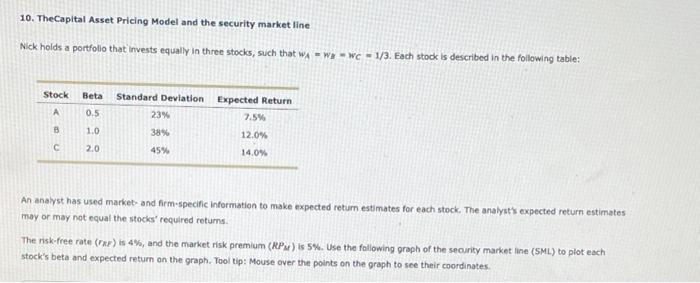

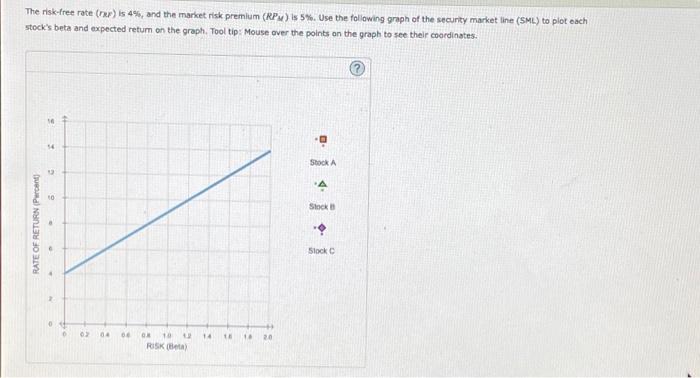

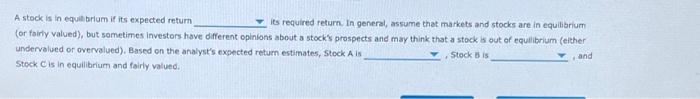

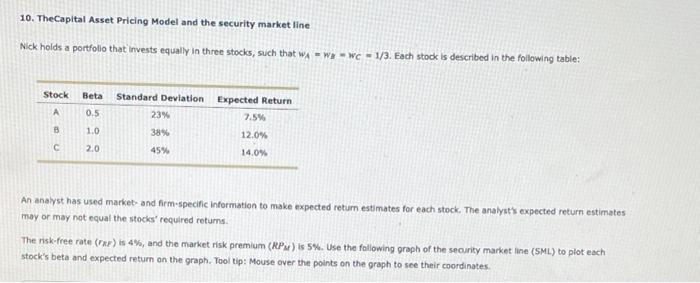

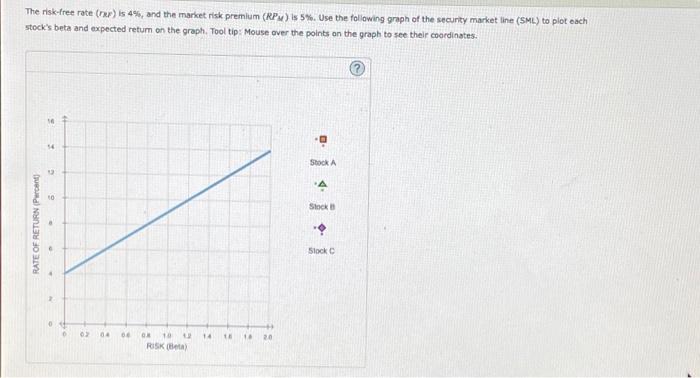

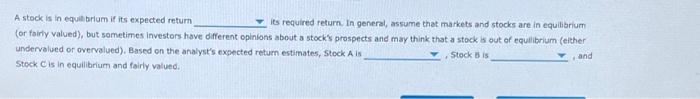

10. The Capital Asset Pricing Model and the security market line Nick holds a portfolio that invests equally in three stocks, such that wx = w-wc = 1/3. Each stock is described in the following table: Stock A Beta 0.5 Standard Deviation Expected Return 23% B 1.0 7.5% 12.0% 38% 45% 2.0 14.0% An analyst has used market and firm-specific information to make expected retum estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns The risk-free rate () is 4%, and the market risk premium (RPM) is 5%. Use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. Tooltip: mouse over the points on the graph to see their coordinates. The risk-free rate (p) is 4%, and the market risk premium (RPM) is 5%. Use the following graph of the security market line (SML) to pior each stock's beta and expected return on the graph. Tooltip: Mouse over the points on the graph to see their coordinates. 14 Stock 10 Stock RATE OF RETURN(Percent) Stock 0 04 06 14 TE 10 RISK) 120 A stock is in equilibrium if its expected return les required return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stocks out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, Stock Als Stock Bis Stock is in equilibrium and fairly valued and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started