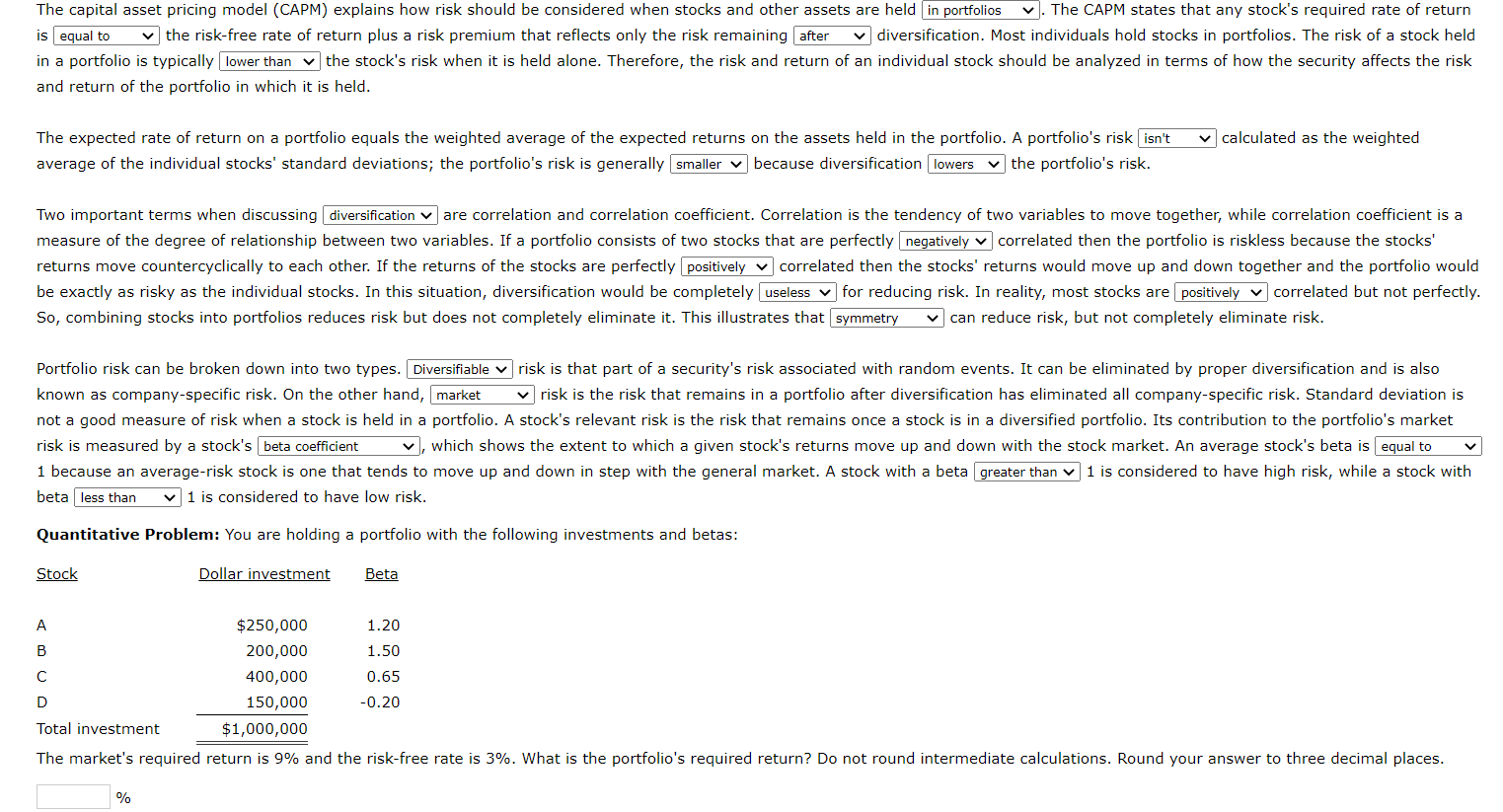

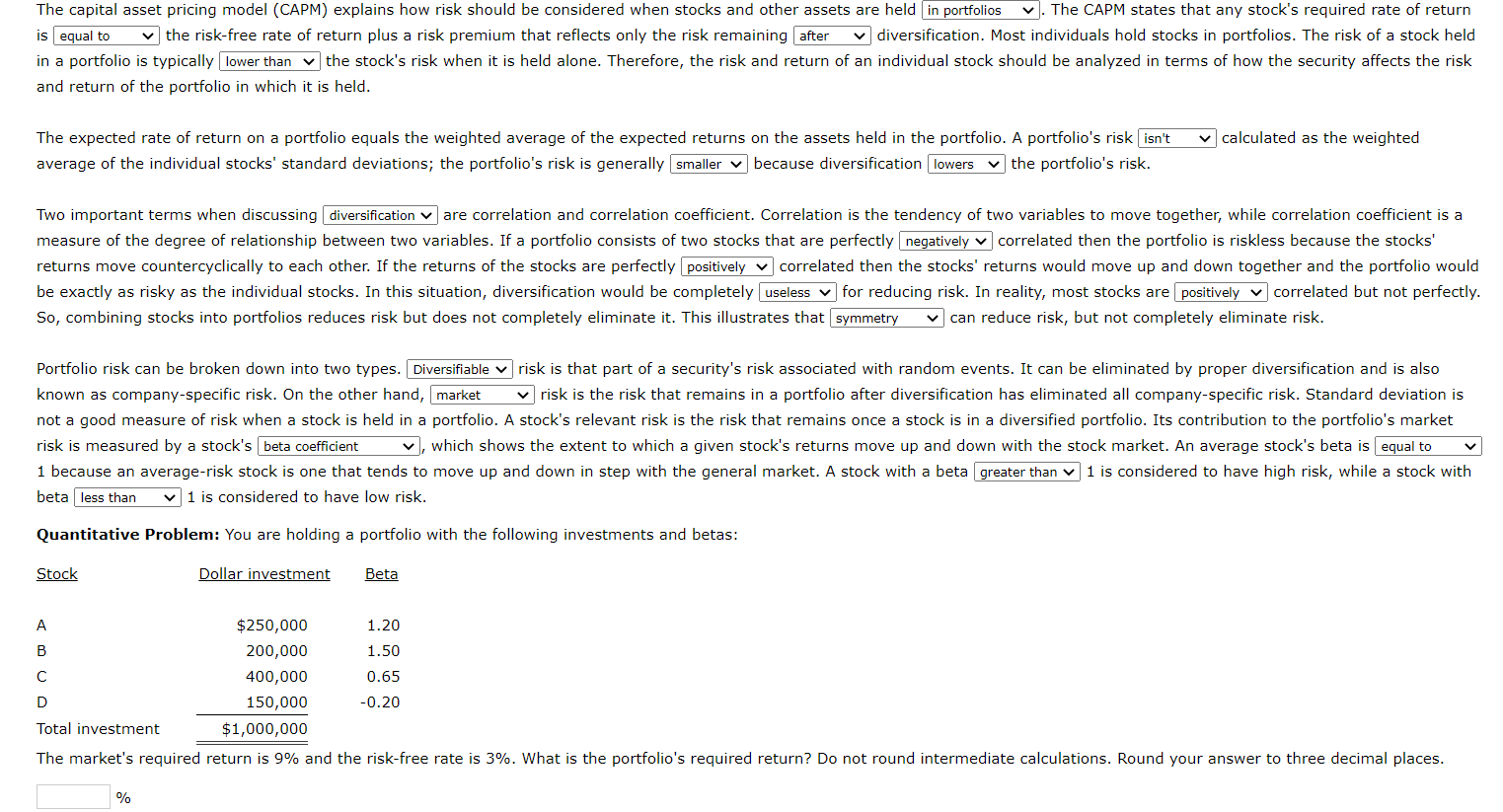

The capital asset pricing model (CAPM) explains how risk should be considered when stocks and other assets are held in portfolios v. The CAPM states that any stock's required rate of return is equal to the risk-free rate of return plus a risk premium that reflects only the risk remaining after v diversification. Most individuals hold stocks in portfolios. The risk of a stock held in a portfolio is typically lower than the stock's risk when it is held alone. Therefore, the risk and return of an individual stock should be analyzed in terms of how the security affects the risk and return of the portfolio in which it is held. calculated as the weighted The expected rate of return on a portfolio equals the weighted average of the expected returns on the assets held in the portfolio. A portfolio's risk isn't average of the individual stocks' standard deviations; the portfolio's risk is generally smaller v because diversification lowers v the portfolio's risk. Two important terms when discussing diversification are correlation and correlation coefficient. Correlation is the tendency of two variables to move together, while correlation coefficient is a measure of the degree of relationship between two variables. If a portfolio consists of two stocks that are perfectly negatively correlated then the portfolio is riskless because the stocks' returns move countercyclically to each other. If the returns of the stocks are perfectly positively correlated then the stocks' returns would move up and down together and the portfolio would be exactly as risky as the individual stocks. In this situation, diversification would be completely useless v for reducing risk. In reality, most stocks are positively correlated but not perfectly. So, combining stocks into portfolios reduces risk but does not completely eliminate it. This illustrates that symmetry can reduce risk, but not completely eliminate risk. Portfolio risk can be broken down into two types. Diversifiable risk is that part of a security's risk associated with random events. It can be eliminated by proper diversification and is also known as company-specific risk. On the other hand, market v risk is the risk that remains in a portfolio after diversification has eliminated all company-specific risk. Standard deviation is not a good measure of risk when a stock is held in a portfolio. A stock's relevant risk is the risk that remains once a stock is in a diversified portfolio. Its contribution to the portfolio's market risk is measured by a stock's beta coefficient V, which shows the extent to which a given stock's returns move up and down with the stock market. An average stock's beta is equal to 1 because an average-risk stock is one that tends to move up and down in step with the general market. A stock with a beta greater than 1 is considered to have high risk, while a stock with beta less than 1 is considered to have low risk. Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $250,000 1.20 B 200,000 1.50 400,000 0.65 D 150,000 -0.20 Total investment $1,000,000 The market's required return is 9% and the risk-free rate is 3%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places. %